|

I was born shortly after World War II.

I’ve paid close attention to presidential debates since President Nixon and President Kennedy sparred on Sept. 26, 1960, exactly two days and 60 years ago.

I’ve studied the grandiose promises and dreams of every candidate.

And I can tell you flatly:

Despite all their attacks and all their defences, there’s one thing the candidates have in common: On Inauguration Day, the next president must face the same harsh realities.

But never in my lifetime has that reality been harsher than it will be on January 20, 2021!

Consider the facts …

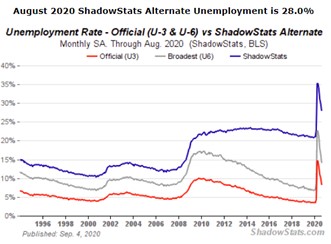

1. Severe unemployment. In August, the official unemployment rate was 8.4%, and the expectation is that when the September number is released on Friday, it will still be at the deep-recession level of 8.2% or more.

But that number doesn’t include folks who are making do with low-paying, part-time jobs or have given up looking for employment altogether.

According to the U.S. Labor Department, when you include those jobless categories, the actual, all-in unemployment rate (U-6) is 14.2%.

And based largely on government metrics that were used during much of the 20th Century, a widely respected research organization, Shadow Government Statistics, estimates the actual U.S. unemployment rate in August was 28%.

2. Massive deficit. The nonpartisan U.S. Congressional Budget Office (CBO) estimates a federal budget deficit of $3.3 trillion for fiscal 2020, more than triple the shortfall recorded in 2019.

That’s 16% of GDP, the worst since 1945. (And in that year, the government’s wartime spending hit a peak of nearly two-fifths of the entire economy.)

If the next president cuts a deal with Congress for another stimulus package, the deficit could surge to $5 trillion. And the economy could sink again under the weight of a resurging pandemic, gutting tax revenues and bloating the deficit even further.

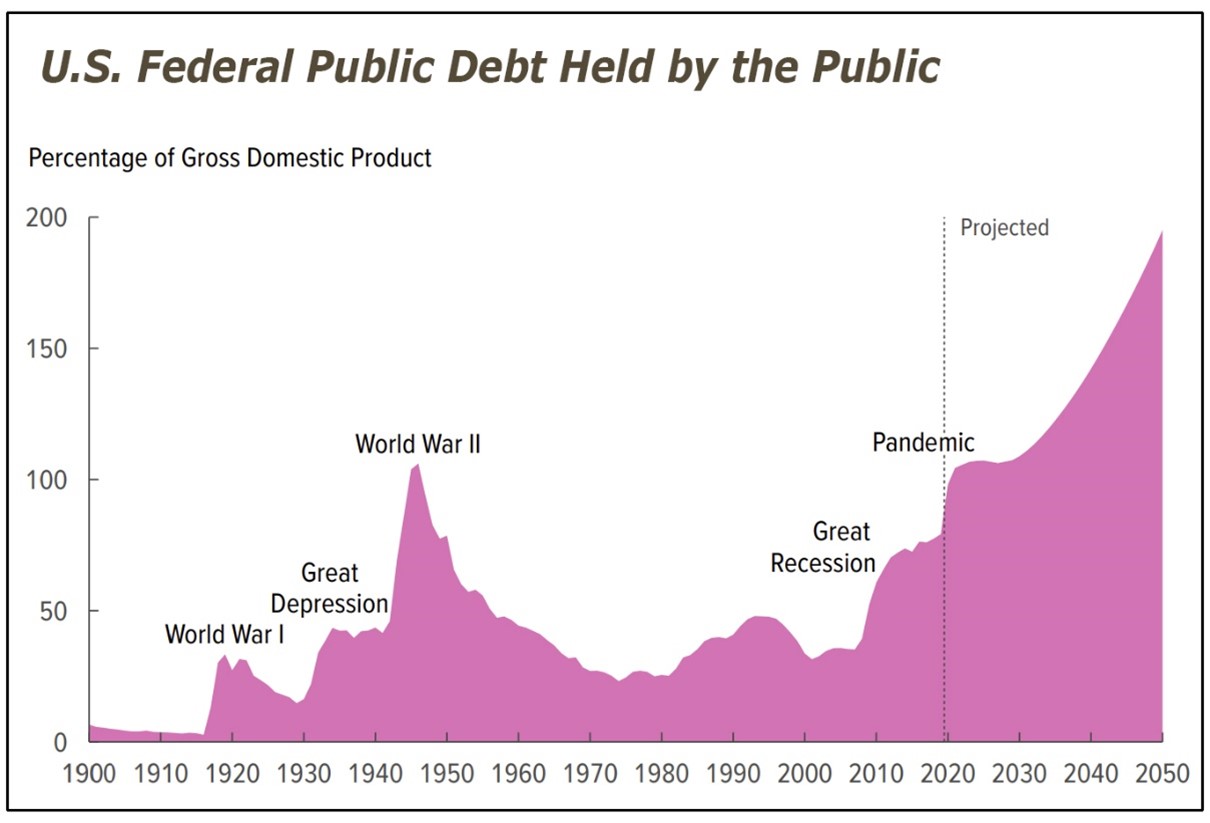

3. Unprecedented public debt. The bigger this problem gets, the less people in Washington or on Wall Street want to talk about it.

But that doesn’t make it go away. The fact remains that in the wake of the pandemic, the federal debt held by the public (as a percent of GDP) is now approaching peak World War II levels.

But that’s not the half of it.

According to the official CBO projection, it will be nearly TWICE in the future.

And by the way, that does not include the trillions in U.S. government debts that are held by the U.S. Federal Reserve.

Why is this a problem? Just ask the CBO itself. Like I said, they’re nonpartisan. And they don’t hesitate to tell it like it is:

High and rising federal debt increases the likelihood of a fiscal crisis. Such a crisis can occur as investors’ confidence in the U.S. government’s fiscal position erodes, undermining the value of Treasury securities and driving up interest rates on federal debt because investors would demand higher yields to purchase those securities.

Concerns about the government’s fiscal position could lead to a sudden and potentially spiralling increase in people’s expectations of inflation, a large drop in the value of the dollar, or a loss of confidence in the government’s ability or commitment to repay its debt in full.

4. Social unrest. No matter who wins the presidential election, or how it’s decided, millions of Americans on the losing side will forever believe that it was stolen, that the man occupying the Oval Office is a usurper, and that the only recourse is protest, civil disobedience, or worse.

The country will often be ungovernable, and that could be the next president’s biggest challenge of all.

Our recommendation: If you haven’t done so already, move a portion of your money to gold and silver-related investments.

In this amazing presentation, Sean shows you how to do so with up to 100 times the potential profits you could make in bullion alone.

So, be sure to watch it now before he takes it offline tomorrow.

Good luck and God bless!

Martin