|

Several states have relaxed their restrictions on business operations. However, opening a business is one thing; filling it with customers is quite another.

One of the key tell-tale signs of a recovering America will be the success (or lack thereof) of shopping malls. If consumers flock to malls and spend lots of money, our economy may enjoy a quick rebound.

Here’s the results of freshly opened shopping malls in several different cities.

A local paper said in Greenwood, Ind. reported that customers who entered the newly reopened mall came right back out, complaining that many of the stores inside still hadn’t lifted their gates.

One couple said, “We turned around and walked away. A little bit shocked. I thought they’d be prepared to be open.”

Well, that’s just one mall, right? Wrong!

Five Atlanta-area malls — Lenox Square, Phipps Plaza, The Mall of Georgia, Sugarloaf Mills and Town Center at Cobb — opened over the weekend and they were deader than a doornail.

|

The Atlanta Journal Constitution reported:

“At Lenox, just a handful of cars sat in the parking decks and lots Monday afternoon. Few customers were inside, and security guards were stationed at entrances to hand out gloves and masks.”

In Charlotte, N.C., three area malls were greeted with “hundreds” of shoppers. Patrons at the most upscale of the three, SouthPark Mall, found that 71% of the stores were still closed.

“About 40 of the mall’s 140 stores, kiosks and carts opened Saturday,” according to a story in the Charlotte Observer.

Look, a couple hundred shoppers with 70% of the stores closed is so far from normal. So, whoever owns that mall should realize what the store owners did: They will probably lose more money from opening than by staying closed.

Yanick Almeida works as a jeweler at a kiosk in Atlanta’s Barton Creek Mall and was interviewed by a local newspaper. He said the business usually takes in several thousand dollars on a typical Friday. “That was before corona,” he said. Around noon, he hadn’t made a single sale. “If we don’t make any money, we’re going to have to shut down.”

Conclusion? Things may get better ... eventually. But the U.S. is a consumer-driven economy, and very few Americans are in a consuming mood.

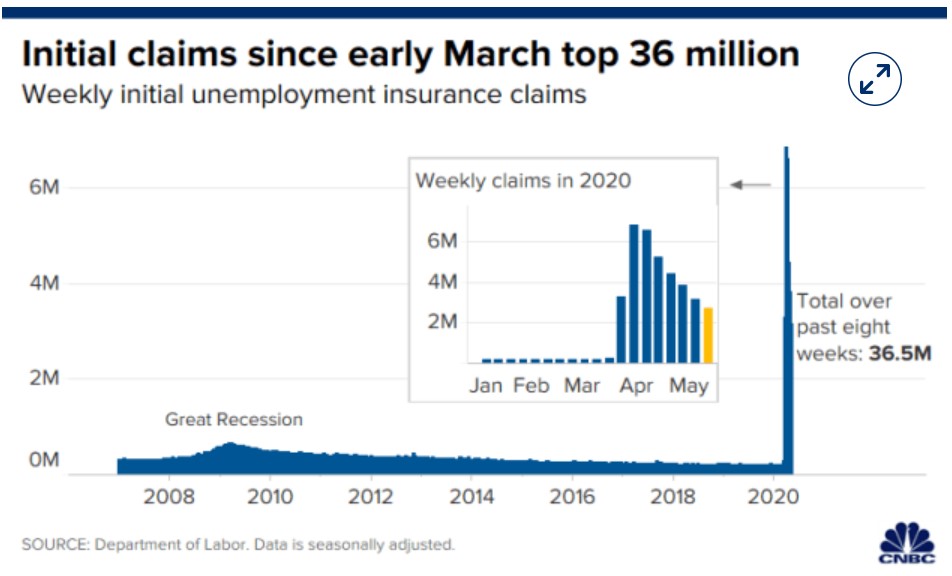

With just over 36 million Americans having filed for unemployment, there isn’t a lot of pocket change to spend freely on consumer goods. This economic crush is making the average spender more tight-fisted than they might have been previously.

|

Add to this the hesitation by a third of Americans to shop in public right now — according to a Washington Post poll — and you’ve got a recipe for revenue loss for brick-and-mortar stores.

The Wall Street crowd is expecting a fast, “V”-shaped recovery. You might be, too.

I think that’s nuts.

But you don’t have to take my word for it. Here is what Mary Daly, the president of the San Francisco Federal Reserve said last week: "It won’t be quick; in my opinion, it won’t be ‘V’-shaped, it will be gradual.”

By the way, one publicly traded company owns every one of the malls discussed above: Simon Property Group (NYSC: SPG).

Simon Property owns more indoor shopping malls than anybody in the United States. Meaning now, it’s the owner of a national network of largely empty buildings.

Overall, this serves as a prime example of the real state of the economy. Sturdy looking on the outside, hollow on the inside. Despite hopes of a “V”-shaped economic recovery, it probably won’t happen.

So, what does that mean for you?

It means you should be diligent. It means looking for ways to profit as company shares plummet. You can look to buying options or, if you want to do a little less research, you can invest in an inverse ETF, which increases in value as the markets decrease in value.

Investing in traditional safe haven assets is one way to keep your money out of the markets. Gold and Treasuries come to mind, as both have been pushed higher by the Fed’s response to the pandemic.

No matter what you chose, though, remember: Timing is everything.

Best wishes,

Tony Sagami