The stock market has been on a roller coaster ride, and that makes it more important than ever to pay careful attention to fundamentals.

One of the most important fundamentals that I follow is GDP growth -- not just for the U.S., but all around the world. And one part of the developed world that is growing faster than the U.S. (believe it or not) is Europe.

As a matter of fact, in 2017, the S&P 500 was up an impressive 19%. But did you know that the MSCI Europe index was up 22%? More importantly, the 2018 economic outlook for Europe is even better.

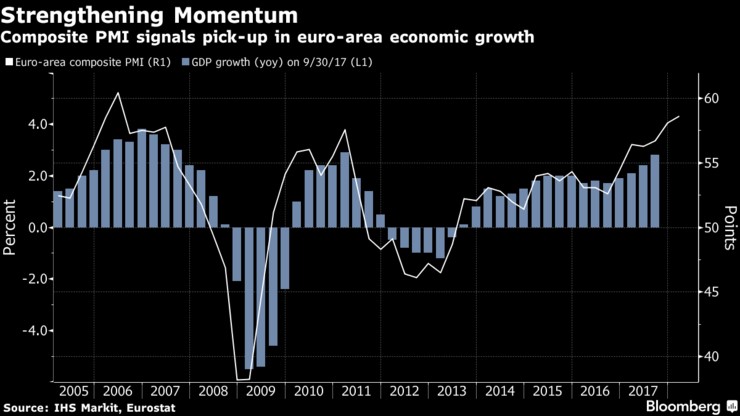

It confirms that the European economy is on a roll. The Eurozone Purchasing Managers’ Index, or PMI, rose from 58.1 in December to 58.6 in January. That was higher than economists were expecting and the highest reading since 2006!

Manufacturing is especially strong. The index for manufacturing activity rose to 61.1, with factory output showing the biggest increase since 2000.

Moreover, employment is really picking up a strong head of steam. The eurozone jobless rate has dropped to 8.7%, the lowest since 2009.

And don’t forget about the gargantuan amount of monetary steroids that the European Central Bank has been injecting into the European economy. The ECB is spending 30 billion euros a month on its quantitative easing program in order to goose the European economy and support financial markets.

European Stocks Are Cheaper than U.S. Stocks

Not only did the European stock market outperform the S&P 500 in 2017, but European stocks are substantially cheaper than U.S. stocks today.

The S&P 500 recently traded at 18 times forward earnings (the highest since 2002), while the European Stoxx 600 (the European equivalent to our S&P 500) traded at 15 times forward earnings (below its 2015 peak).

European stocks look even cheaper on a price-to-book basis. The Stoxx 600 trades at two times book value, while the S&P 500 is at 3.4 times book value, the highest level since 2002.

Moreover, the spread between those two indexes is the widest since 2002. That’s why you should be looking at adding some European exposure to your portfolio.

The good news? Investing in Europe is easier than you may think. You can buy ...

European Stocks listed on the NYSE: There are hundreds of European stocks trading right here in the U.S., including many with BUY grades from our Weiss Ratings system. They include ASML Holding (ASML, Rated “B+”) and Unilever (UN, Rated “B”) of the Netherlands ... Total (TOT, Rated “B”) and LVMH Moet Hennessy Louis Vuitton (LVMUY, Rated “B+”) of France ... Fresenius Medical Care (FMS, Rated “B”) and SAP (SAP, Rated “B”) of Germany ... and more.

European ETFs: There are also scores of Europe-focused ETFs. The most popular ones (with the largest amount of assets under management) are Vanguard FTSE Europe (VGK, Rated “C+”) with $27.5 billion, iShares MSCI Eurozone ETF (EZU, Rated “C+”) with $16.9 billion, and the WisdomTree Europe Hedged Equity Fund (HEDJ, Rated “C+”) with $7.3 billion.

With so many choices, I’d suggest using the Weiss Ratings screening tools to focus on the best of the best. To help get you started, I created this Best Performing European ETFs Screener using the tools available to Weiss Platinum subscribers (You can call 877-934-7778 to get signed up at a special rate).

Specifically, I used the “European Stock” prospectus objective field to zero in on ETFs that specialize in that strategy. Then I cut out any ETFs with Weiss Ratings of “D+” or lower (SELL), and with negative returns over the past year. This is what the resulting list looked like recently once I sorted it in descending order by Rating:

Data Date: 2/13/2018

I’m not suggesting that you rush out and buy any of these ETFs today. As always, timing is everything -- so I suggest that you wait until they go on sale or you get a buy signal from me.

However, these are the cream of the European ETF crop and a great list from which to pick. The combination of stronger performance and cheaper valuation is a compelling combination that you shouldn’t ignore.

Best wishes,

Tony Sagami