This Is Monetary Madness on Steroids. Here’s What to do for Safety and Profit

|

Right now, even as you read these words, we are witnessing the most radical — and most dangerous — money printing in the history of civilization.

But the danger is not limited to the economy or financial markets. It also impacts virtually every aspect of what we do and how we live.

Plus, it creates enormous profit opportunities — like the investment I’ve been writing you about that has surged from $34.53 on July 18 to more than $42,000 this weekend. (For more on this, be sure to watch my presentation before it goes offline for good tonight.)

To give you some perspective on how urgent this really is, let me take you back in time to when I first began writing about the Fed.

It was early 1965. I was 19 years old. And I was helping my father write his biweekly newsletter, Money and Credit Report.

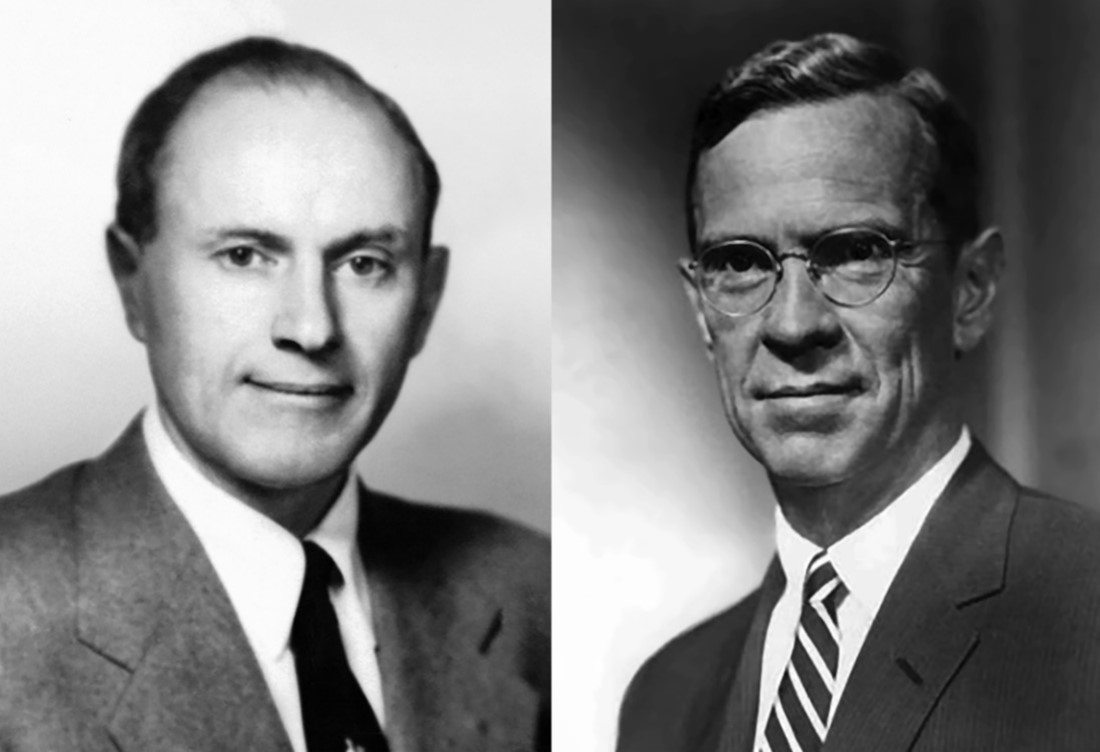

While we were discussing the next issue, Dad received a call from Fed Chairman William McChesney Martin, and I listened in.

Six years earlier, Martin had supported my father’s Sound Dollar Committee, which organized a nationwide grassroots campaign to balance the federal budget.

So now, the Fed Chairman Martin was asking my father to return the favor.

I got close enough to hear the Fed Chairman’s voice pretty clearly …

“President Johnson is leaning on me pretty damn heavily to cut the discount rate by a quarter point,” he said. “Kennedy used to do the same thing, but that was minor in comparison to the pressure from Johnson. This is dangerous as hell. Is there anything your Sound Dollar Committee can do to help make the public more aware of the consequences, to help get him off my back?”

There was no need to discuss why the discount rate was so important. They already knew that.

Like the Fed funds rate today, the discount rate was the key rate the Fed controlled, directly impacting the rates banks charged, which, in turn, drove nearly all interest rates up or down.

But the U.S. economy was already growing by over 6% per year, and the discount rate was still only 3.5%. So, Martin felt the rate was already way too low, and, in fact, he was planning a series of rate hikes — not cuts.

There was also no need to discuss why the political pressure from President Johnson was so dangerous. They had talked about that before, too. So as soon as the call ended, I queried my father for clarification.

“Future inflation is the most obvious danger,” my father said.

“Even though it’s less than 2% right now?” I retorted

“Absolutely! By the time inflation rears its ugly head, it will be too late. It feeds on itself. It accelerates like crazy. Everything goes haywire. You can’t wait for that to happen. You’ve got to stay ahead of it. You’ve got to prevent it from happening.”

“Even though inflation has been pretty tame since the early 1950s?” I asked, playing the devil’s advocate.

My father smiled. “We don’t care how long it’s been tame. It could be ten years. It could be 50 years. All that counts is what’s happening now. And right now, all the signs point to trouble ahead. Martin says it will destroy the U.S. dollar. I agree.

“And if you think that’s bad,” he continued, “wait till you hear the rest of the story.”

Dad went on to describe a horror scenario that I had never heard him talk about before …

|

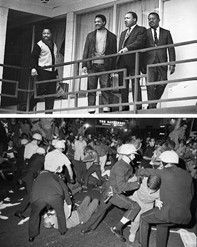

| Top: Assassination of Martin Luther King, April 4, 1968. Bottom: Riots at the Democratic National Convention in Chicago, April 5—7, 1968. Most people did not connect these events to monetary policy, but some observers, like the author’s father and Fed Chairman Martin, felt they were related to a broad easy-money syndrome that prematurely stimulated rapid economic growth, fomenting speculation, corruption and inequality. |

Not only distortions in interest rates (the price of money), but also major distortions in the price of all things.

Not only distortions in the marketplace, but also distortions in society: Income inequality. Political polarization.

Not just behind the scenes, but also out in the open: Mass protests. Riots. Violence. More assassinations like JFK’s. Even unnecessary wars.

“Face it,” he concluded with great emphasis. “Whether we like it or not, our entire culture — and all of our politics — is heavily influenced by money. You might even say it’s drenched in money. So, if you make that money too cheap or abundant, it goes to the wrong places. It enriches the wrong people. It drives Wall Street into a speculative frenzy. It corrupts Washington. It messes up everything.”

Fast Forward to Today … and Weep.

Try to look at today’s world from the perspective of a half-century ago.

The Fed has crushed interest rates to zero and promises to keep them there indefinitely. That’s infinitely more aggressive than the meager quarter-point cut that Fed Chairman Martin said would be “dangerous as hell.”

What’s worse, Fed Chairman Powell has suddenly added about $3.5 trillion to the Fed’s balance sheet.

That’s about three times MORE money printing than the shocking $1 trillion which Fed Chairman Ben Bernanke added after the Lehman Brothers collapse in 2008.

William Martin, the man who was the Chairman longer than anyone else in history, is turning in his grave.

My father, who feared this kind of disaster more than any other, is doing the same.

|

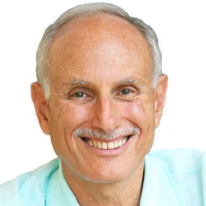

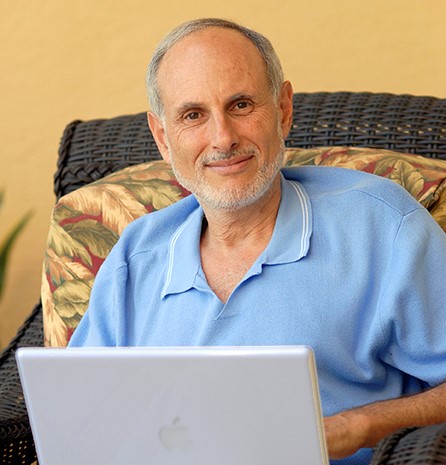

| In this video, Dr. Weiss presents the single best opportunity in the world today to profit from the monetary madness. In fact, one investment he’s been writing about in recent weeks, which traded for only $34.53 on July 18, has just jumped to more than $42,000 this weekend. |

What about you and me?

There’s very little we can do to stop the monetary madness.

But we CAN certainly take steps to protect ourselves and even make a lot of money in the process.

I explain exactly how in this 45-minute presentation.

Just be sure to watch it today. Because at the end of the day, we’re pulling it off line. And that’s also when this opportunity ends — for good.

Good luck and God bless!

Martin