|

“There’s a real possibility that within the year, we’re going to be dealing with the most serious incipient inflation problem that we have faced in the last 40 years.” — Larry Summers, former U.S. Secretary of the Treasury |

|

| By Tony Sagami |

I’d just turned 16 years old, and I couldn’t wait to get my driver’s license. A car meant teenage freedom, and, with the price of gas below 30 cents a gallon, I could roam around my small town for less than $5 a week.

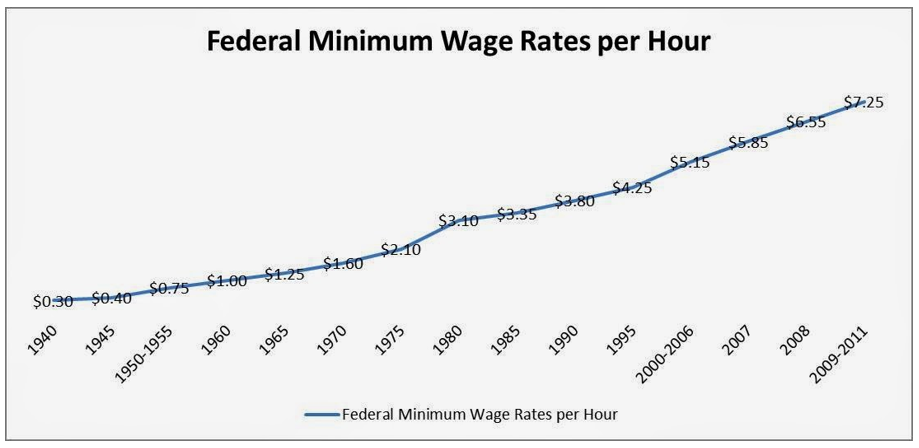

Five bucks may not sound like much, but that was a lot of money to a dumb kid on a rural farm. The minimum wage was $1.60 an hour back then, but my father paid me $1 an hour. And he always let me know I was lucky to be paid at all.

|

| Source: duckduckgo.com |

Boy, have times changed. Five bucks wouldn’t get you very far today, with the national average cost for a gallon of gasoline around $3.

Sure, that was a long time ago. But inflation is never going to go away. It’s just a matter of degree.

According to the latest Consumer Price Index (CPI) data, prices increased by 0.6% in March compared to February. That’s the fourth consecutive month of higher prices. On a year-over-year basis, prices were up 2.6%.

If you’ve been to the grocery store or a gas station recently, you don’t need to read about CPI data to know costs to feed your family and fill up your car have gone up.

Inflation Sensation

The thing is, the official CPI data doesn’t tell the real inflation story. The reason is that the CPI is calculated based on a basket of goods and services that Americans regularly spend money on.

|

However, the coronavirus pandemic has dramatically changed the way we spend our money.

For example, I haven’t gone to a movie, attended a sporting event, flown on an airplane, stayed at a hotel or bought new clothes in over a year.

But the CPI calculation includes all those categories. That’s dumb, and it’s misleading, too.

Moreover, the CPI doesn’t include a lot of things that are skyrocketing in price.

That’s why the head economist at the International Monetary Fund, Marshall Reinsdorf, said, “Spending patterns changed abruptly, and the CPI weight suddenly became obsolete.”

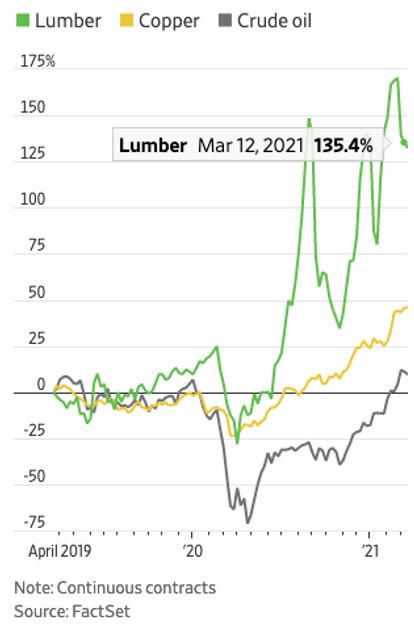

Commodities, in particular, are ground zero for inflationary pressure.

Consider: The price of lumber is up by 135% in the last year, which is why the Wall Street Journal reported that “The National Association of Home Builders says that rising lumber prices have added $24,000 to the cost of building the average single-family home and about $9,000 per apartment.”

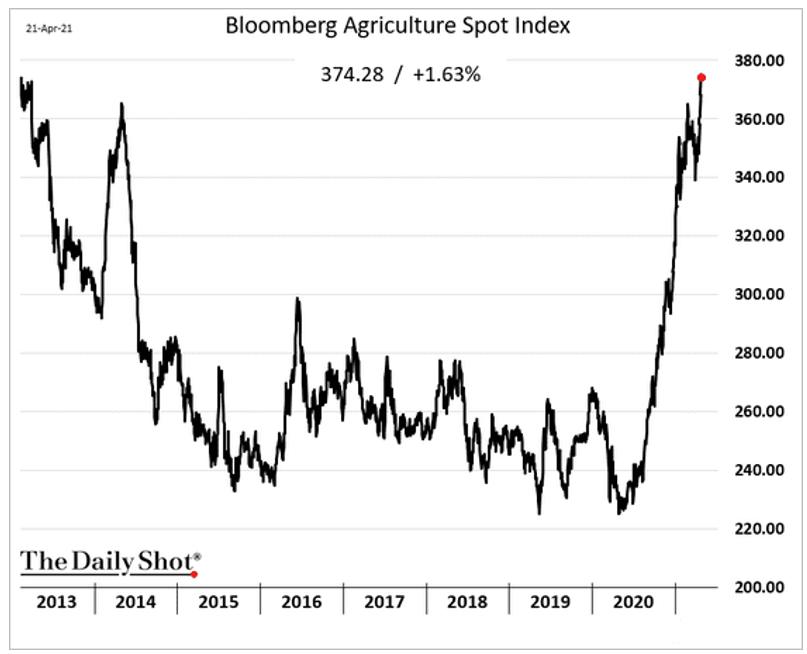

The same is true of industrial metals (copper and nickel) and food commodities, including corn, wheat, soybeans, vegetable oil and sugar.

|

The Commodity Research Bureau’s foodstuff index is up 15% this year, and grocery prices are at seven-year highs.

Some “adults” are taking notice. Two prominent economists — former U.S. Secretary of the Treasury Larry Summers and former International Monetary Fund chief economist Olivier Blanchard — expect President Joe Biden’s stimulus programs to send inflation rocketing higher.

Summers says the new $1.9 trillion stimulus package is unnecessary and too large coming on the heels of $3 trillion of coronavirus-related aid last year. We’re talking about a staggering total of $4.9 trillion in less than a year.

Plus, Biden’s new multitrillion-dollar infrastructure package is going to throw fuel on the inflation fire.

And the Federal Reserve isn’t going to do a darn thing about it.

Charles Evans, president of the Cleveland Federal Reserve, said he wouldn’t get nervous until inflation rose to 3%. And even then, he’d only start thinking about raising interest rates.

“I believe that it could be 2024 earlier than we really elevate the rate of interest goal,” said Evans.

“Commodity Markets Are Roaring”

Investors are catching on. Google searches for the keyword “inflation” hit their highest level since at least 2004 when Google began collecting search information.

What does this all mean?

Well, it’s a good time to consider adding heavy doses of hard assets (like gold, silver and industrial metals) as well as soft commodities (things grown rather than extracted, such as soybeans, cocoa, coffee, cotton, sugar, rice and wheat as well as all manner of livestock) to your investment portfolio.

Now, that doesn’t mean you should rush out and load up on commodity stocks and/or commodity-related exchange-traded funds (ETFs) right at today’s market open.

But make no mistake: Inflation is coming back, and that means a whole new world of market winners and market losers.

It’s up to you to decide how you’ll play it.

Best,

Tony Sagami