Three huge global industries disrupted by cannabis

|

Decades ago, when I first heard about the movement to legalize marijuana, I figured it was strictly about pot smoking.

I didn’t like the idea. Heck, I’ve never even had soft drinks — let alone pot. So, I naturally assumed the pot industry would never amount to very much.

On that score, I was obviously wrong.

In fact, this industry now has the potential to compete with, or even disrupt, at least three large global industries …

Global Industry #1: Big Tobacco

Cigarette companies have traditionally been among the most profitable in the world.

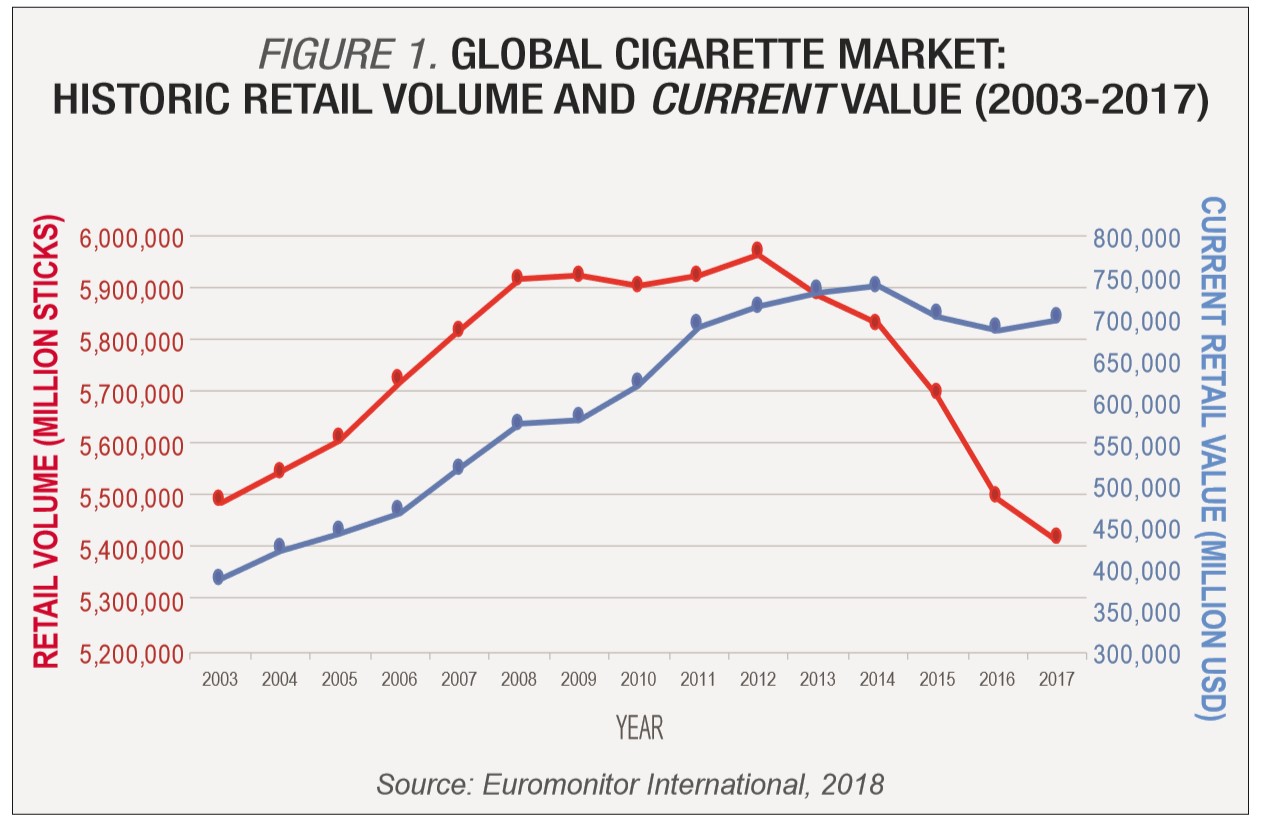

Each year, they sell over five trillion cigarettes to more than one billion smokers, collecting close to $700 billion in revenues.

Sure, in recent years, dark clouds have emerged with much stronger evidence about the dangers of smoking and an increasingly negative regulatory environment.

But the tobacco companies found their way around the obstacles by shifting their focus to Asia and, more recently, to Africa, where regulation was weak, the population was growing, and income was rising.

|

Plus, big tobacco companies came up with another way to keep the money flowing: They jacked up prices.

Result: Even though unit sales (red line in chart) went down, total revenues (blue line) held up pretty well.

Here’s the key:

- Cigarette companies know that sharply higher prices are a stop-gap solution; that they cannot be sustained.

- They recognize that marijuana is less addictive than nicotine, less damaging to the lungs or throat, and a lower cancer risk.

- Plus, they can’t help but notice that the same governments cracking down on tobacco are opening up to marijuana.

This helps explain why Altria, America’s #1 tobacco giant, plowed $1.8 billion into marijuana suppliers. Others are bound to follow.

Global Industry #2: Alcoholic Beverages

This industry is nearly twice as big as cigarettes, with $1.3 trillion in 2017 and expected to reach nearly $1.9 trillion by 2026.

Like tobacco, it’s fueled by high growth in emerging markets and rising incomes.

Unlike tobacco, however, it’s not running into stone walls erected by regulators.

Still, beverage companies see pot as a major area for expansion and diversification.

Examples:

- Constellation Brands, America’s biggest alcoholic beverage company, invested $4 billion in marijuana growers.

- North America's No. 2 beer company, Molson Coors, has inked a joint-venture with the pot producer that snagged the biggest supply contract for recreational marijuana ever signed in Canada. The new JV will develop, market, and sell non-alcoholic cannabis-infused drinks.

- Plus, expect more to come.

Global Industry #3: Pain Medication

|

The opioid epidemic is teaching Big Pharma a big lesson.

Regulators and legislators are also finally waking up.

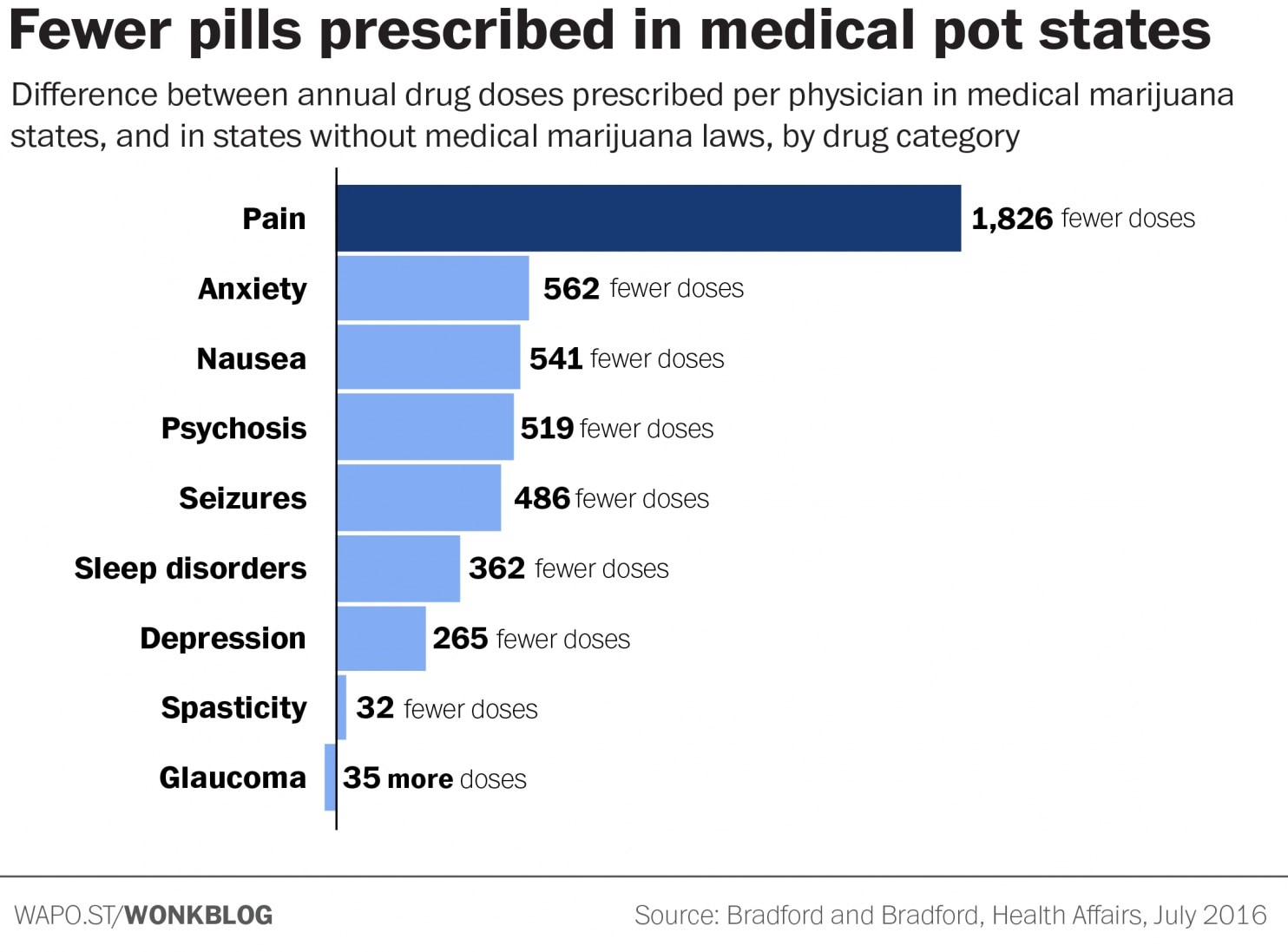

Meanwhile, sales of both prescription and over-the-counter drugs are falling in U.S. states where pot is legal.

The chart above depicts just the beginning of that trend. More recently, two papers published in the Journal of the American Medical Association: Internal Medicine reported that prescriptions and usage of opiates plunged in states after they legalized medical marijuana.

No wonder makers of two of the most popular opioids — Oxycontin and Vicodin — also happen to be two of the biggest contributors to anti-pot lobbies.

Right now, in the U.S. alone, the pain management market is worth an estimated $77 billion yearly.

Among the players are big names like Abbott Laboratories, AstraZeneca, Depomed, Endo Pharmaceuticals, GlaxoSmithKline, Johnson & Johnson, Mallinckrodt, Merck, Novartis, Pfizer, Purdue and Teva.

These big companies are also about to soon wake up and smell the weed.

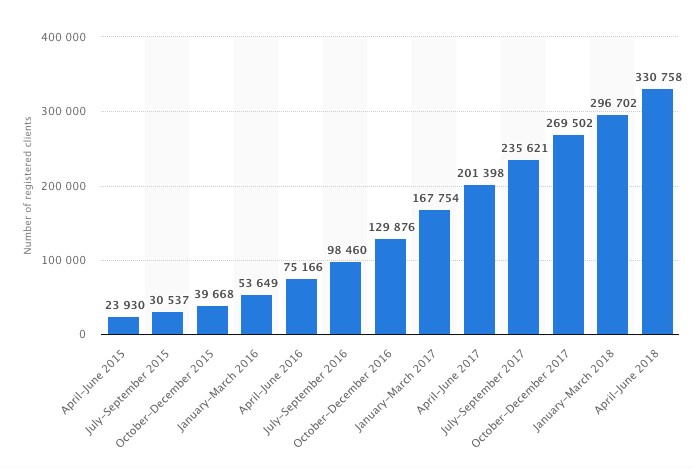

Meanwhile, the number of patients legally registered to take cannabis-related drugs, medicines, and treatments is sky-rocketing.

|

Medical Marijuana Patients Registered in Canada

|

And this trend is likely to get another boost, once insurance companies start reimbursing for treatments.

Our colleague, Sean Brodrick, was among the first to recommend opportunities in this sector. I’ll make sure he follows up soon.

So, stand by for more!

Best,

Martin