Tomorrow’s Election; 10-Year Anniversary of Debt Crisis

|

Wall Street experts don’t seem to have a clue about how tomorrow’s election results will impact investors.

Economists at Bank of America provide historical data to demonstrate that the market does best when Republicans control the White House and Democrats control Congress.

But then they say that, if the same thing happened this time, the market would go the other way. Go figure!

Goldman Sachs argues that, regardless of the outcome at the polls tomorrow, both parties will make infrastructure spending a priority … and then not pass any infrastructure legislation. More useless info!

The folks at JPMorgan Chase agree with that kind of non-opinion. No matter what happens in the election, they proclaim, nothing much is going to change.

Virtually all the experts are looking in the rear-view mirror. Midterm elections of the past have been mostly dull, neutral events. So they assume this one will be, too.

Here’s what I think they’re overlooking:

First, the dynamics of the election itself: It packs more caustic energy than any other since the Civil War. The early-voting turnout has smashed all records. Most metrics on political polarization have gone through the roof. And no matter who wins, the losers will be livid, fearful and screaming for revenge.

Very bad news for stocks, especially in the long term!

Second, they seem to be ignoring the dramatic changes that have occurred in the economy and society over the last ten years. To better understand what I mean …

Let me take you back in a time

machine to the Fall of 2008 …

Lehman Brothers is failing.

Over a single weekend in mid-September, the Fed chairman, the Treasury secretary and other high-ranking officials huddle at the office of the New York Federal Reserve in downtown Manhattan.

They seriously consider bailing Lehman out. But Lehman’s assets are so diseased that even the U.S. government, the grand lender of last resort, won’t touch them with a ten-foot-pole.

For the Fed chairman and Treasury secretary, it is the long-dreaded day of reckoning. It is the fateful moment in history that demands a life-or-death decision about one of the biggest financial institutions in the world — bigger than General Motors, Ford and Chrysler put together.

Should they save it? Or should they let it fail?

Their decision: To do something they have never done before.

They let Lehman fail.

“Here’s what you’re going to do,” is the message from the federal authorities to Lehman’s highest officials. “Tomorrow morning, you’re going to take a trip down to the U.S. Bankruptcy Court at One Bowling Green. You’re going to file for Chapter 11. Then you’re going to fire your staff. And before the end of the day, you’re going to pack up your own boxes and clear out.”

Until that day, nearly everyone assumed that giant firms like Lehman were “too big to fail,” that the government would always step in to save them.

Now that myth is shattered, and it sets off a chain reaction of shocking events that make Lehman’s failure seem tiny by comparison.

Money markets are dead. For years, America’s biggest industrial and retail companies have been using these markets to borrow from Peter to pay Paul. Now, unless the markets come back to life within days, most of those companies will have to file for bankruptcy.

America’s largest banks are insolvent. That includes Citigroup, Bank of America, and many others.

The entire financial system is on the brink of an imminent meltdown.

And our leaders are at the critical crossroads of a millennium:

They either let the global economy collapse, it somehow absorbs the shock and eventually resolves the imbalances that caused it. Or …

They try to assume God-like powers, bail out all the big failing players, flood the market with boundless liquidity, and hope it makes a difference.

They choose the latter.

They gather up all the textbooks on monetary policy written in the past 100 years and toss them into the Potomac River.

They rush the $700-billion Troubled Asset Relief Program (TARP) through Congress and sign it into law in record time.

And the U.S. government loans, invests or commits …

- At least $200 billion to nationalize the world’s two largest mortgage companies, Fannie Mae and Freddie Mac …

- About $25 billion for the failing Big Three auto manufacturers …

- At least $150 billion for the failed AIG Insurance …

- Over $350 billion for Citigroup …

- Another $200 billion in loans to banks under the Fed’s Term Auction Facility (TAF) …

- $300 billion for a Federal Housing Administration rescue bill to refinance bad mortgages …

- $87 billion to pay back JPMorgan Chase for bad Lehman Brothers trades …

- $50 billion to support short-term corporate IOUs held by money market mutual funds

- $500 billion to rescue various other credit markets …

- $620 billion to fund bailouts by foreign central banks, such as the Bank of Canada, Bank of England, Bank of Japan, National Bank of Denmark, European Central Bank, Bank of Norway, Reserve Bank of Australia, Bank of Sweden and Swiss National Bank …

- Another $120 billion in aid for emerging markets, including the central banks of Brazil, Mexico, South Korea and Singapore …

- Countless trillions to guarantee the FDIC’s new, expanded bank deposit insurance coverage from $100,000 to $250,000 …

- Plus much more for other sweeping guarantees.

In sum, government decides to kill the devil they know — financial collapse followed by Great Depression ... and worry later about any unknown devils they might encounter down the road.

What they don’t realize is that three hellish megatrends are already deeply ingrained in the global financial system. And nearly everything that’s done to supposedly “save the system” merely makes it worse …

Hellish megatrend #1

The Most Extreme Wealth

Concentration in U.S. History

Much of the new funny money from the Fed is diverted to nonproductive uses. Result: Less investment in industry and fewer high-paying jobs.

Worse, the Fed’s unprecedented money-printing drives interest rates down to practically zero. The vast majority of America’s savers and investors lose the opportunities they used to have to make a decent yield without taking oversized risks.

Practically the only big beneficiaries of the money-printing are high-stakes speculators. And among them, only a minority are consistent winners. Big banks and billionaires often enjoy windfall profits. Most others are left behind.

All this holds down the income gains of the overwhelming majority of Americans, while spurring the wealth accumulation for a very small minority.

End result: The greatest wealth concentration in American history.

However, the trend actually began in the late 1970s. Here are the facts:

• In 1978, the richest one-thousandth (0.1%) of America’s households own 7.1% of the nation’s wealth.

• By 2012, that share balloons to 22%.

• And by 2017, it is close to 25%.

That means the richest Americans more than triple their share of the nation’s assets.

The trend is even more extreme among the richest one-ten-thousandth (0.01%) of America’s families:

• In 1978, this topmost tier controls 2.2% of America’s wealth.

• In 2012, they control an estimated 12%.

• And by 2017, their share of the nation’s wealth balloons to an estimated 14%.

This means their share of the asset pie grows more than sixfold. And it means these super-rich families control 1,400 times more than the average wealth-per-capita in the U.S.

Clearly, this is not just a problem for the poor. Nor is it an issue limited to the nation’s middle class. It also hinders high-net-worth investors from growing their nest eggs.

The super-rich have controlling interests in the nation’s big corporations. Those companies, in turn, buy back massive amounts of their own shares, which forces them to cut back sharply on the dividends they pay out to average shareholders.

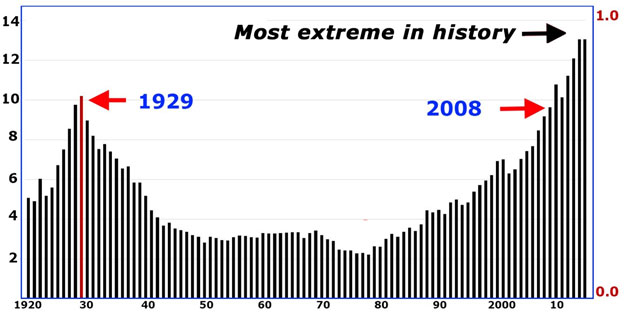

The best data on this subject, from an exhaustive study published by the National Bureau of Economic Research, is capsulated in the black bars of the chart below.

U.S. Wealth Concentration, 1920 — 2017

(% of nation's wealth held by 0.01% of households)

|

The chart paints a broad picture of American society in the 20th and 21st centuries.

In the Roaring 1920s, the top tiers of society (the richest 0.01%) get rich rapidly. Their share of the nation’s wealth doubles from 5% in 1920 to a peak of 10% in 1929.

Starting in 1929, however, they begin to suffer big losses. A large portion of their fortunes is wiped out in the Crash and the Great Depression. Indeed, this period is the only time in modern U.S. history that we witness a very significant — and long-lasting — reduction of wealth disparities.

Now, fast-forward to the 1970s. This is when wealth concentration in America reaches an all-time low. And this is also when it begins to rise again, especially as inflation heats up toward the end of that decade.

From that point forward, each period of growth and each economic crisis merely hastens the rise of the super-rich and accelerates the relative decline of all others in society.

The next critical point in history is 2008, where I began the story today. It is not only the year when Lehman Brothers fails; it is also the year when income disparities in America match the peak levels of a similar kind of turning point nearly nine decades earlier — 1929.

In other words, in 2008, wealth concentration in America is close to what history says is a breaking point. And not coincidentally, that’s precisely when the Housing Bust, Debt Crisis and Great Recession begin.

The year 2008 is also the year when the U.S. government launches its unprecedented rescue operations. Although the stock market falls and the economy declines, there is a very critical difference between the Great Recession of 2009-'10 and the Great Depression of the 1930s:

The Great Depression greatly reduced the wealth share of the super-rich. The Great Recession does not. Quite to the contrary, during and after the Great Recession, the concentration of wealth surges to new, all-time highs never before witnessed in the United States.

What other hellish megatrends accompanied this sea change?

What does it mean for you?

How will it impact your investments in 2009 and beyond?

I address these questions and more next time.

Good luck and God bless!

Martin