Top 5 Consumer Staples Stocks to Buy Right Now

[Shopping cart Image: Phil! Gold via CC by SA 2.0]

Consumer staples. These are the products that are generally in demand at all times, regardless of the economic condition, such as beverages, food, household items, and even tobacco products. Consumers need food and other essential items daily, and that makes companies in this sector an attractive investment option--providing steady growth, dividends and low volatility.

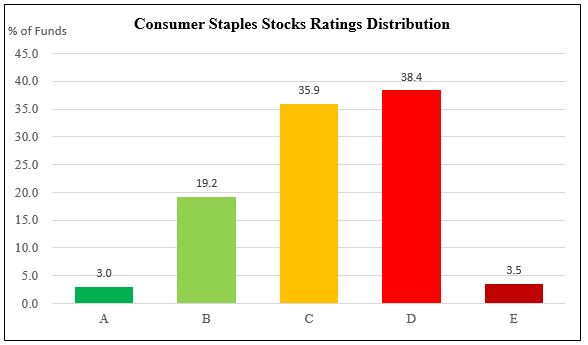

This is how the consumer staples sector stacks up based on our investment ratings.

As you can see from the graph above, most the stocks have either a HOLD (35.9 percent) or a SELL (41.9 percent) recommendation from Weiss. This may suggest that although the products are always in demand, only a handful of companies are providing desirable growth, dividends and low volatility for the investor.

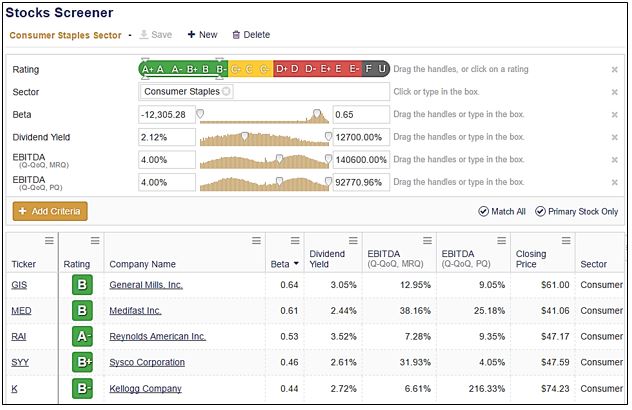

We picked out five BUY stocks in the sector to identify the ones at the very top. They offer an above industry average dividend (at least 2.12 percent), below average volatility (beta of 0.65 or less), and a four percent earnings growth over the last two consecutive quarters.

General Mills (GIS) manufactures and markets branded consumer foods. The company’s stock has 3.05 percent dividend yield, a beta of 0.57, and is B rated by Weiss.

Medifast Inc. (MED) produces and sells weight loss, weight management, and healthy living products. The company’s stock is currently rated a B, offers 2.44 percent in dividends, and is stable with a 0.42 beta.

Reynolds American (RAI) is the only tobacco company on the list and, according to the recent news, may be taken over by British American Tobacco (BTI). Reynolds is rated A-, pays a 3.52 percent dividend, and has a beta of 0.44.

Sysco Corp. (SYY) markets and distributes a range of food products primarily to the food service industry. The company pays a 2.61 percent dividend, with low volatility (beta of 0.21), and is rated B+ by Weiss.

Kellogg Company (K) manufactures and markets ready-to-eat cereals and convenience foods. This is a low volatility stock with a beta of 0.42, holds a B- investment rating, and pays a 2.72 percent dividend.

Any of these five could prove to be a wise long-term investment.

The Top 5 Consumer Staples Stocks to Buy