D.C.'s Debt Crisis is About to Explode — But You Can Take Action

|

Across the Atlantic Ocean, in Great Britain, one of the world's oldest democracies, the head of the government is going down in flames, to one defeat after another.

No matter how you feel about Brexit — Britain's attempt at a peaceful exit from the European Union — the absolute chaos in Parliament marks a dark day.

Because without a deal, Britain is hurtling toward stumbling out of the EU with no treaties or protections. This has already triggered one company after another to lay off workers and leave for other shores. Experts warn "no deal" could spiral into food lines, shortages, even riots.

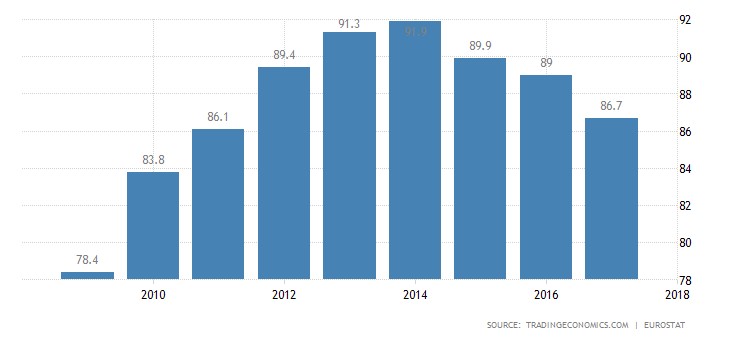

And how could Europe bail out Britain, even if it wanted to? That continent is collapsing under a mountain of debt the size of the Alps!

|

The eurozone recorded a government debt equivalent to 86.7% of the country's GDP in 2017.

Closer to home, our own democracy is being tested. And it's another crisis in the making fueled by mushrooming debt.

Freshmen members of Congress are pushing for a "Green New Deal," universal healthcare and other programs that sound great — until it's time to pay for them.

The question is: How can a country with $22 trillion in official debt and another $105 trillion in unfunded liabilities ever hope to pay for all of that?

The short answer: Not a chance in hell.

Let's take a quick look at the fine mess that the fine folks in Washington have gotten us into:

The most debt any government should have is about 50 cents of every dollar that the country produces in a year — 50% of GDP.

But Washington has piled up $22 million in debts, or an astounding 103% of GDP.

In the UK, government debts are 80% of GDP; in France, 99%; in Italy, an over-the-top 142%; in Greece, a shocking 180%.

It's only a matter of time before the chickens come home to roost.

Readers often ask me why it's inevitable that these governments will default.

Question No. 1 is …

"Couldn't the U.S. and Europe

simply borrow more money?"

No! They are already borrowing every dollar and euro that investors will loan them!

And now, those investors are beginning to close the spigot. Government bonds are beginning to decline; interest rates are beginning to rise.

Debts are so massive, so utterly unpayable, that the investors who have been buying their bonds are already beginning to revolt.

This is the very essence of a sovereign-debt crisis:

Investors wake up.

They realize that not only will the debt never be repaid; some large governments may fail to make timely payments on interest and principal due every day.

And it becomes a self-fulfilling prophecy.

Investors sell their bonds. Bond prices drop and interest rates rise uncontrollably. This makes it even harder for governments to pay interest on the money they owe. And all this makes outright default more likely.

It's a deadly spiral; one in which the first investors to bail out win. The last investors to dump their government bonds lose.

And so the stampede begins.

I'm also asked a second question:

""Why can't these governments

simply PRINT enough money

to get them out of trouble?"

But creating money out of thin air is no solution.

The U.S. and Europe are already printing money like there's no tomorrow, but debt is piling up faster than ever and the economy is still coming unglued.

For example, just recently, on March 7, European Central Bank President Mario Draghi shocked the world by announcing more below-zero interest rates and a new, massive round of money-printing.

Did investors rejoice? Quite the contrary! They know the economy is sinking regardless of the money-printing. So they dumped the euro and European bonds.

I see only one outcome: We're looking at a financial judgment day of Biblical proportions.

This is precisely what Edelson Institute Senior Analyst Sean Brodrick was talking about in the urgent phone call we just made public. What he said on that call chilled me to the bone.

In all the years I've known Sean, I've never seen him this worried.

"It's all about to hit the fan," he said.

"The next 5 years are going to be train a ride through hell."

"It'll make the Great Recession of 2008 and 2009 PALE by comparison."

"A rollercoaster ride like no generation alive in our country or, for that matter, Europe has seen."

"The greatest dangers — and profit opportunities — of our generation are beginning NOW."

|

You've got to hear this for yourself.

If you value your wealth, your investments and your financial security, drop everything and listen NOW! →

Martin D. Weiss

Founder

Weiss Ratings and The Edelson Institute