I’m writing this column on Monday, which is earlier than usual because I was scheduled for jury duty Tuesday. I don’t know how it’ll go, of course. The first time I was tapped years ago, I got weeded out during the jury selection process. The next time my number came up, I was released because they didn’t need any more jurors that day. But I’m happy to fulfill my civic duty.

And the whole experience actually got me thinking about the bull market, and how I might rule on “The Case of a Lasting Market Top.” Specifically, is this market “guilty” of conspiring to steal your hard-earned wealth? Or is it still innocent and worth sticking with?

Counsel for the bulls would no doubt highlight how the S&P 500 has tested — and held — its 200-day moving average multiple times. In the futures market, it happened twice in early February and a couple more times earlier this month.

They would also cite strong earnings growth as a reason to stay long. S&P 500 companies are expected to report year-over-year growth of more than 17% for Q1 2018. If the actual numbers come through that strong, it’ll be the best result since Q1 2011. It would also represent an acceleration from the 15% seen in Q4 2017.

A few other tidbits they’d throw out there for consideration: The Syria missile strikes were relatively surgical, and (so far) haven’t provoked a counterstrike from Syrian allies Russia or Iran. Early profit results from the mega-banks were solid on the surface. President Trump hasn’t ramped up his China trade war talk again. And volatility is easing back from the elevated readings we saw in February.

But I’m not going to dance around anything here, or leave you guessing about my feelings. I’m just going to just come out with it ...

I find the bull market “guilty” as charged! In other words, the bullish evidence just isn’t compelling enough to counter the view that a significant top is likely in.

Why? Well, you probably saw my special Monday update on the financial stocks, and how they have reacted poorly to supposedly “strong” earnings. I believe rising credit concerns and collapsing yield spreads are behind that action, and it’s not bullish in the least. You simply can’t have a strong, fundamentally healthy bull market without the financials participating.

How about those earnings? Sure, analysts are projecting S&P 500 profits to rise more than 18% THIS year. But they also see the rate of growth slowing substantially to 10.4% NEXT year, according to FactSet.

And remember, we’re talking about perennially bullish Wall Street analysts here! There’s a very strong likelihood they’re aiming too high, and that actual results will come in lower. That’s especially true if the troubling credit market signals I’m seeing now get even worse later.

But the biggest development is on the policy front. The Federal Reserve and other central banks are slowly turning off the spigot of easy money “rocket fuel” — by raising interest rates, dialing back QE, or both.

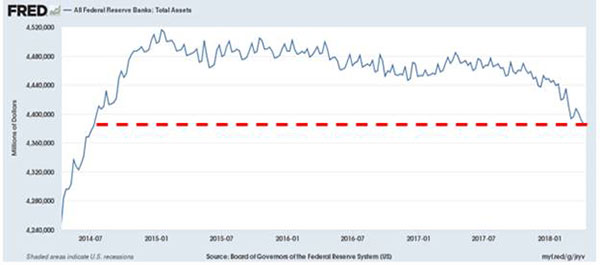

Just look at this chart of the Fed’s balance sheet. You can see that the Fed is now actively shrinking its asset base by tens of billions of dollars. In fact, the balance sheet just dropped to its lowest level since July 2014!

|

Pinpointing the exact top in any market is tough. What’s more, market tops tend to take months to form rather than just a few days or even weeks. You can clearly see that if you go back and review the trading action around the Dot Com Bubble peak in 2000 and the Housing Bubble peak in 2007.

But the preponderance of evidence I’m seeing tells me this “Everything Bubble” market is running out of hot air. That’s why I’ve been urging you to take protective steps to prepare for what’s coming next. Whether that involves repositioning your 401(k), throwing junky SELL-rated stocks over the side, or adding positions that profit when select stocks fall (like I just recommended in my High Yield Investing newsletter) is up to you.

Just don’t wait too long. Because if I’m right, the gavel could come hammering down on stocks ... soon.

Until next time,

Mike Larson