Focus for many mainstream market participants and observers early this week is on inflation.

The U.S. dollar is softening, yields on U.S. Treasuries are rising and commodity prices are surging. Stocks sold off early Monday, as the Nasdaq Composite extended into the red for a third consecutive trading session.

The thing is, the emerging “party line” is that this is still a “risk on” environment, with markets pricing in faster growth and hotter demand.

Wait till the Federal Reserve moves from hinting at to implementing “yield curve control” in response to what’s happening in money and debt markets lately. Our central banks simply can’t risk the undoing of all they’ve tried to do in response to the COVID-19 crisis.

And that brings us to Bitcoin.

The world’s No. 1 cryptocurrency has almost literally set the investing world on fire in 2021, rising from around $29,000 on Dec. 31 to a Feb. 21 high of $58,330.57 on coinmarketcap.com.

Folks, that’s over a 100% rise in just seven weeks.

Now, Bitcoin has backed off its recent highs, trading down about 8% to around $52,000 Monday morning. And it’s dipped below a $1 trillion market capitalization.

But this is actually “normal” volatility for Bitcoin — and crypto generally. This is still a maturing asset class.

And it is maturing: The world’s No. 2 crypto, Ethereum, is fueling the build-out of what could be the first significant peaceful existential threat to the postwar global economic, financial and security system.

Hyperbole? Maybe. But the circumstances sure beg for more inquiry. That’s why we have Alex Benfield and Sam Blumenfeld covering the crypto space on a daily basis.

Here’s their dispatch from last Friday, which begins with a discussion of “altcoins,” which are alternatives to Bitcoin, and includes a roundup of action on our proprietary Weiss Cryptocurrency Indexes:

Binance Coin continues its astronomical run, cresting over $300 today. This comes as Binance Smart Chain-based decentralized finance applications have seen a ton of interest, mainly due to lower fees than Ethereum-based competitors.

Many observers in the crypto universe have been talking about a potential “flippening” event, where BNB might overtake ETH as the No. 2 crypto asset, something that could happen if more and more people switched to Binance-based DeFi apps. We’re still well away from something like that, though it is interesting to see some true competition for Ethereum Dapps (decentralized applications).

While BNB may not overtake ETH, the asset is still red-hot, smashing through all resistance levels on this parabolic run. BNB is currently up more than 580% this month, a truly amazing run.

Here’s BNB in U.S. dollar terms via Binance:

Binance Coin might try to overtake Ethereum, but what remains the world’s No. 2 crypto is not backing down.

ETH seems to be moving more slowly than the rest of the market during this bull cycle. It’s knocking on the door of $2,000, but it’s had some trouble breaking above that level. The takeaway here is that ETH’s apparent “slow growth” is bullish: It continues to climb higher despite flows into other notable coins and DeFi tokens.

Here’s ETH in U.S. dollar terms via Coinbase:

Folks, perhaps we’ve “buried the lede” here, but Bitcoin crossed $1 trillion in total market capitalization for the first time.

This is a major milestone. In terms of total asset valuation, Bitcoin trails just five total companies in the world.

The King of Crypto is rapidly approaching silver’s $1.5 trillion market cap, but it still makes up just 9% of gold’s $11.3 trillion. Like Ethereum, Bitcoin’s upward trajectory, despite flows into altcoins, is extremely bullish.

Here’s Bitcoin in U.S. dollar terms via Coinbase:

Now let’s turn to my colleague Sam Blumenfeld for an overview of the Weiss Crypto Indexes …

Index Roundup

Over the past week, we’ve seen the top cryptocurrencies set new highs. But smaller altcoins have outpaced them. Bitcoin surpassed $54,000 during trading this morning, and Ethereum looks set to cross the symbolic $2,000 price level.

Meanwhile, a flood into altcoins through Bitcoin and Ethereum pairs have led to a recent boom for smaller and less-established cryptocurrencies because of their potential.

The Weiss 50 Crypto Index (W50) gained 8.05% this week, as the broader market looks to continue exploring new highs.

The Weiss 50 Ex-BTC Index (W50X) increased 10.15%. Bitcoin slightly underperformed this week, but this is to be expected during periods where altcoins rally.

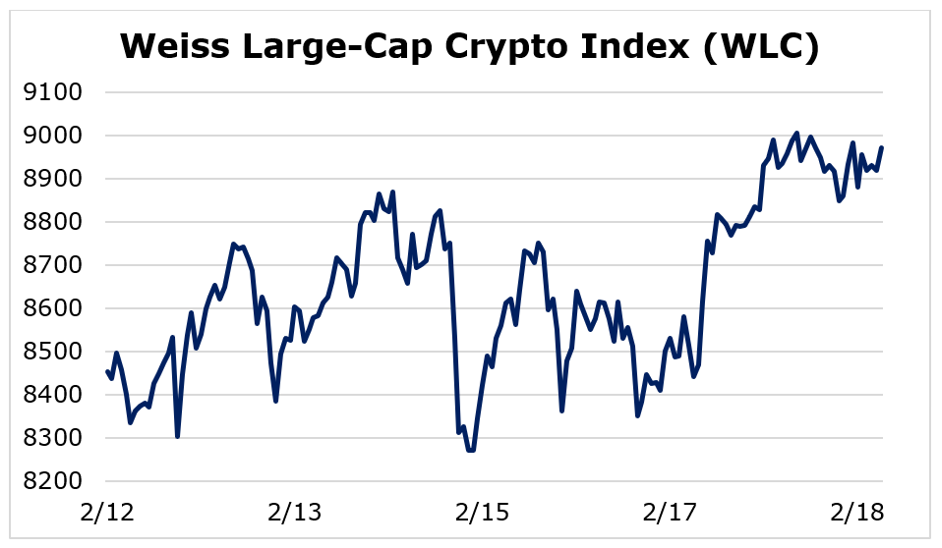

Breaking down performance this week by market capitalization, we see that large-cap cryptocurrencies lagged behind smaller and mid-sized altcoins.

This is predictable during “alt season” because the smaller coins are typically bought using Bitcoin or Ethereum. The Weiss Large-Cap Crypto Index (WLC) rose 6.13%.

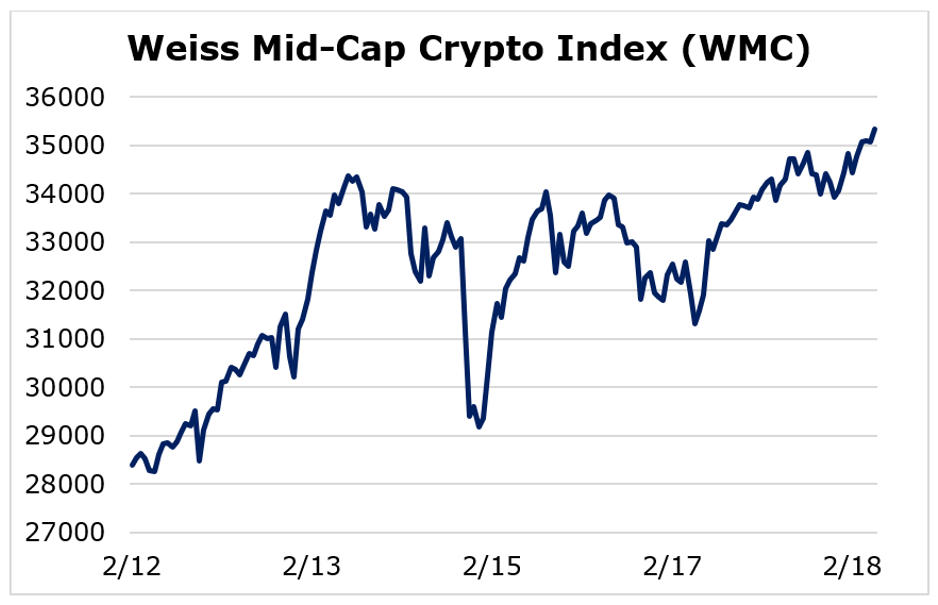

Mid-cap cryptocurrencies rallied, as the Weiss Mid-Cap Crypto Index (WMC) climbed 24.52%.

The small-caps performed the best this week, as the Weiss Small-Cap Crypto Index (WSC) soared 41.24%.

Moving forward, we’ll likely see a continuation of alt-season. It’s positive news that market-leaders Bitcoin and Ethereum continue to set new all-time highs despite outflows into altcoins.

While corrections are common in the crypto market, its overall health and fundamentals look stronger than ever.

Notable News, Notes and Tweets

• Pomp and the rest of Crypto Twitter continue their campaign to recruit Reddit’s r/WallStreetBets crowd.

• Crypto analyst Luke Martin acknowledges BNB’s major breakout and other positive market catalysts.

• MicroStrategy chief executive Michael Saylor raises over $1 billion to buy more Bitcoin.

• While institutions increase adoption, retail traders embrace crypto’s future.

What’s Next

It seems like we pass another critical milestone for the cryptocurrency industry almost daily now, such is the nature of a parabolic bull market.

The significance of Bitcoin becoming a trillion-dollar asset can’t be overstated — it’s simply more validation for the King of Crypto and the industry at large. Ethereum is also setting new highs despite the fact that it hasn’t experienced a parabolic breakout like some other crypto assets.

The rise of the Binance smart chain brings some healthy competition for Ethereum and its DeFi application ecosystem. Competition like this usually sparks development wars and pushes the entire industry forward with a newfound sense of urgency.

The index roundup for this week confirmed our assertion that we’re in the midst of an altcoin season. “Alt season” always brings with it some exciting price runs in smaller-cap cryptos and can serve to bring attention to some undiscovered and undervalued projects.

The fact that this alt season is coinciding with new all-time highs for many blue-chip cryptocurrencies highlights the excitement in this space.

As always, stay tuned for more news and insights.

The trend is still your friend here. That includes excesses of monetary and fiscal policy as well as the broader outlook for Bitcoin and other cryptocurrencies. And the environment for new, breakthrough projects remains healthy.

Best,

David Dittman