What to buy before Powell & Co. slash rates next week

|

The Federal Reserve is going to cut interest rates when it meets next week. That's all but guaranteed.

And it will happen despite a flurry of incredibly strong economic data that suggests rate cuts are not needed at this time.

The stock market recently hit record highs, the economy created 224,000 jobs last month, the latest retail sales report came in extraordinarily strong, and GDP is still growing.

I find it incredible that the Fed feels it needs to chop rates against such a positive backdrop. All this is going to do is push the stock market even higher.

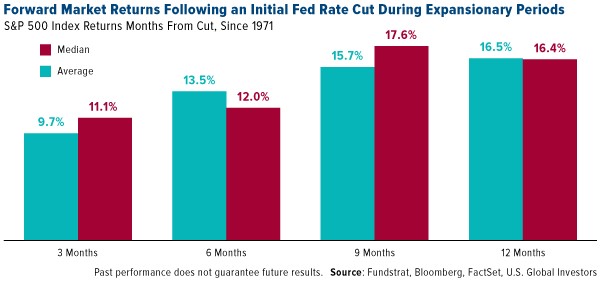

How do I know that? In EVERY instance since 1971, cutting interest rates while the economy was expanding has pushed stock prices higher -- going out three months, six months, nine months and even 12 months.

|

No exceptions. 100% of the time.

The median stock market advance was almost 18% in the following nine months. If history repeats itself, the S&P 500 would hit 3,500 by next April.

How many dollars would an 18% gain add to your 401(k) balance?

Well, it depends where you have your money. Some parts of the stock market do much better when interest rates are falling, such as:

Financial stocks: Banks, brokers and insurance companies.

Here are some ETFs you can consider:

- Vanguard Financials ETF (VFH)

- SPDR S&P Regional Banking ETF (KRE)

- iShares U.S. Financial Services ETF (IYG)

Real estate: Homebuilders, Real Estate Investment Trusts and building materials.

ETFs to consider:

- Vanguard Real Estate ETF (VNQ)

- Schwab U.S. REIT ETF (SCHH)

- iShares U.S. Real Estate ETF (IYR)

Dividend-paying stocks: As interest rates fall, the relative attractiveness of stocks that pay dividends rises among the income-focused crowd.

ETFs to consider:

- Vanguard High Dividend Yield (VYM)

- iShares Select Dividend (DVY)

- SPDR S&P Dividend ETF (SDY)

Or if you, like the Federal Reserve members themselves, expect interest rates to keep falling, you could load up on long-term Treasury bonds with something like the iShares 20+ Year Treasury Bond ETF (TLT).

We could argue about the wisdom (or lack thereof) of interest-rate cuts at this time. But the last thing President Trump wants is for the economy to drop into a recession or for stocks to enter a bear market before the 2020 election.

Why do you think Trump has so aggressively and publicly browbeaten Fed Chairman Jerome Powell to cut interest rates?

Like all politicians, Trump wants to stay in power. That's why the Federal Reserve is going to accommodate him with even more rate cuts.

Those monetary steroids are going to push stock prices higher … and why you need to stay invested.

Yeah, I know the bull market is very old. And I know that putting new money into the stock market while it is hitting all-time highs may feel uncomfortable ...

But it is the most profitable move you can make.

Well, other than this one …

If you’re looking for a little more insight in managing this crazy market, take a look at my Weiss Ultimate Portfolio service. It’s having a great year. Just last week, we made a 39.4% gain in PaySign (PAYS) after only a little over a month invested.

I’m lining up more recommendations that I plan to release in the next few days, and I hope you’ll join me for those. To learn more, click here.

And if you're more conservative-minded when it comes to your portfolio, take a look at Mike Larson's Safe Money Report. When it comes to managing risk, nobody does it better than Larson. Click here and see if you agree.

Best wishes,

Tony Sagami