|

What’s wrong with boring? Absolutely nothing, at least in the investment context.

That’s a message I’ve been conveying in investor presentations ... on my Twitter feed at @RealMikeLarson ... in conversations with colleagues ... and in my columns here. There’s a very simple reason: Boring stocks and sectors are working best in this market!

Just look at this chart. It shows the performance of NextEra Energy (NEE, Rated “B”), the leading electric utility in Florida and a name I added to the Safe Money Report model portfolio a while back.

|

Nothing is stodgier than the business of providing power to businesses and households, right? It doesn’t have the cachet of, say, Artificial Intelligence (AI), Software as a Service (SAAS), Autonomous Vehicles (AVs), or any of those other whizbang technologies that get their own acronyms and tons of airtime on TV.

But profits matter a lot more than prestige when it comes to investing. And in that regard, NEE is downright exhilarating! The stock just hit an all-time high, and it has delivered total returns of more than 28% in the past year.

That’s more than DOUBLE the 13% return of Amazon.com (AMZN, Rated “B-”) ...

It’s more than FIVE TIMES the 5% return generated by Alphabet (GOOGL, Rated “B”) ...

It’s 31x the 0.9% return of movie-streaming giant Netflix (NFLX, Rated “C”) ...

As for Facebook (FB, Rated “C+”)? Well, it hasn’t generated any returns at all in the past 12 months, losing 2%.

This isn’t a case of cherry picking one winning utility, either. As I noted last week, sector ETFs that track boring stocks are trouncing their flashier competitors.

What’s behind this investor embrace of all things boring? Falling long-term interest rates and the flattening yield curve, to start.

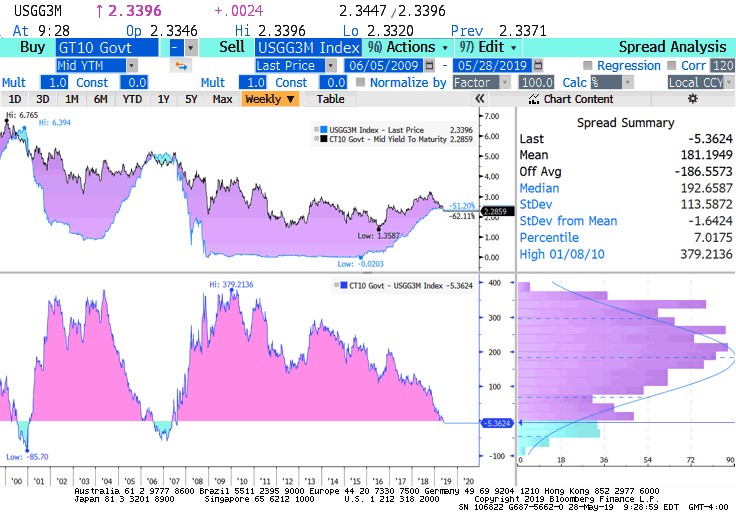

The yield on the 30-year Treasury bond just sank to 2.72% yesterday. That’s the lowest in 17 months. Meanwhile, the yield curve (as measured by the 3-month Treasury bill rate vs. the 10-year Treasury note yield) just inverted again.

At negative-5 basis points (0.05%), it’s the most inverted it has been in 12 years as you can see in this chart.

|

Falling rates and an inverted curve are clear-cut harbingers of an economic slowdown at best, or a recession at worst. They encourage investors to pile into stocks that offer A) Better yields than Treasuries and B) Recession-resistant business models.

Utilities fill both needs quite nicely. The Utilities Select Sector SPDR Fund (XLU, Rated “B-”) yields around 3.1%. That’s 130 bps more than the 1.8% yield of the SPDR S&P 500 ETF (SPY, Rated “C+”) and 50 bps more than the 2.6% yield of the iShares 20+ Year Treasury Bond ETF (TLT, Rated “C”).

Plus, you’re still going to turn the lights on, cook dinner and cool your condominium whether the economy is shrinking or growing. This makes utilities more attractive at this stage in the cycle than, say, technology or transportation stocks.

Of course, utilities aren’t the only “Safe Money” investments out there. Other stocks in other sectors are great plays at this stage in the cycle, as are a select handful of income-focused ETFs. I recommended my subscribers grab solid, high-single-digit profits in just a few months on one of them last week.

You can get specific names and “buy” and “sell” targets in my newsletter. I’d love to welcome you aboard as a subscriber. Or if you’re not quite ready to take that step, at least promise me you’ll embrace boring investments. Your portfolio will thank you!

Until next time,

Mike Larson