Why I’m making a MAJOR Shift in the Financial Sector

On Friday morning, the breathless anchors on CNBC couldn’t stop crowing about a trio of “fantastic” first-quarter bank earnings results. JPMorgan Chase (JPM). Citigroup (C). Wells Fargo (WFC). They pointed out how all of them “beat expectations,” and several guests suggested buying the heck out of them.

But you know what? All the stocks rolled over and tanked on the day!

How can that be? How could “better-than-expected earnings and revenue” result in such lousy market action? And what does it mean to investors like you?

Well, I just gave my High Yield Investing subscribers the full scoop in their hot-off-the-presses April issue. I also made a recommendation designed to help them PROFIT from problems in financials. If you’re a subscriber, make sure you act on that. If not, you can get on board by clicking here.

Suffice it to say the argument boils down to this: The best days are BEHIND this sector! The big-picture trends they were benefiting from, including improving credit quality and positive interest rate movements, are kaput.

Start with this indisputable fact: Interest rate “spreads” are collapsing! Take a look at the lower left-hand panel of this graphic. It shows the 5-30 Treasury spread, or the difference between yields on the 5-year Treasury note and 30-year Treasury bond:

|

You can see it has collapsed recently, with very sharp, persistent, non-stop declines. That’s just like what we saw happen as the housing bubble was starting to pop.

As a matter of fact, the 5/30 spread is now the lowest since July 2007 — right as the Financial Select Sector SPDR (XLF) was topping out. It subsequently collapsed from around $30 to less than $5!

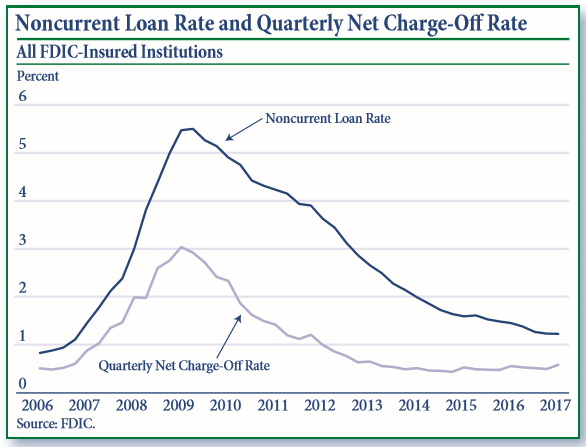

Then there’s the issue of credit quality. This chart from the FDIC shows the progression of loan delinquency rates and loan charge-off rates for the past 12 years. You can see that they both surged when the housing market collapsed, then dropped sharply after the Great Recession ended.

|

But look at the far right of the chart. You can see that the decline in noncurrent loan rates is flattening out, while the charge-off rate is actually starting to climb.

This is precisely what you see at the early stages of every major turn in the credit cycle! It foretells a coming stretch of rising bad debt provisions, increased charges against bank earnings, and tighter lending standards for new borrowers.

Bottom line? All that happy talk about “beats” on the revenue and earnings front isn’t worth squat! The news is likely to get progressively worse with time if my research is correct. That’s why I’ve shifted from a multiyear bullish stance on financials to a bearish one.

I’m not saying the XLF is going to plunge more than 80% like it did the last time rate spreads and credit quality collapsed. But I am saying that risk is rising, and the cycle has likely turned.

So, if you own the major money-center banks like those I mentioned at the outset, sell them. Meanwhile, to help you out even more, here is a list of lower-rated financial stocks to consider unloading ...

|

The list includes only U.S.-based financials with a SELL (“D+” or lower) grade from Weiss Ratings. I screened out stocks with market capitalizations of less than $500 million, closing prices below $5, and 30-day average trading volume of less than 50,000 shares. The table is sorted in descending order by market cap.

You’ll see that some well-known names on the list, like American International Group (AIG), are already falling. Others haven’t taken on water ... yet. But if my work is correct, these stocks will prove poisonous for your portfolio. Be sure to inoculate yourself now!

Until next time,

Mike Larson