Will Tech’s ‘Big Four’ Adapt to State Power Like Microsoft Did?

“It should be clear for all to see,” wrote Jon Markman in the July 24, 2020, issue of Jon Markman’s Pivotal Point, “that Microsoft (Nasdaq: MSFT, Rated “B+”) was a huge winner in the pandemic.”

Evidence the company is thriving amid crisis is already in, as Jon noted:

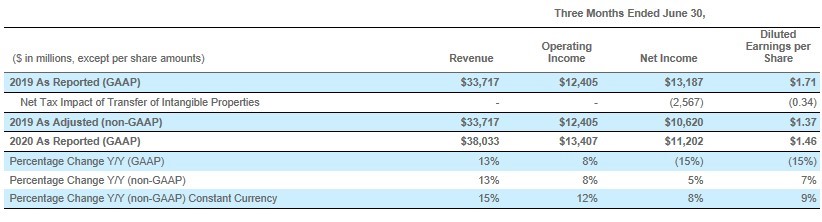

According to a corporate press release, second-quarter revenues surged to $38 billion, a 13% increase year over year. Sales from its Azure cloud business ramped up 47%. Overall, the company reported $11.2 billion in profits.

Source: Microsoft It turns out working from home is a boon for companies that provide IT infrastructure.

And this monster trend is only getting started.

The Redmond, Wash.-based software giant is in peak form because years ago managers decided to begin moving customers and its own infrastructure to the cloud. That meant all the heavy lifting, processing and storing of data was running in robust data centers all over the world. When most of the world shuttered due to COVID-19, Microsoft was ready.

Indeed, Microsoft — good, old Mr. Softy — could very well be the poster company for the good side of what Martin Weiss has described as “a historic SPLIT between two entirely different worlds moving though time along two divergent paths — the traditional world of brick and mortar, which is in crisis, and the modern digital world, which is booming.”

There are other challengers, of course, and four of them — Facebook Inc. (Nasdaq: FB, Rated “B-”), Apple Inc. (Nasdaq: AAPL, Rated “B-”), Amazon.com Inc. (Nasdaq: AMZN, Rated “C+”) and Google parent Alphabet Inc. (Nasdaq: GOOGL, Rated “B”) — will themselves report second-quarter earnings on Thursday afternoon, July 30.

Facebook had planned to report its second-quarter results on Wednesday, July 29. But the social media giant moved its announcement back a day because of a “scheduling conflict.” Management had already withdrawn financial guidance for the three months ended March 30, 2020, due to uncertainty created by the novel coronavirus.

That “scheduling conflict” is probably founder and CEO Mark Zuckerberg’s appearance before a House Judiciary Committee hearing on antitrust practices of “Big Tech” companies. His peers from Apple, Amazon and Google will be there, too.

Not Mr. Softy … well, not this time, of course. It’s important to remember United States v. Microsoft Corporation for a few reasons.

No. 1, antitrust actions take a long time. That case was initiated by the Federal Trade Commission in 1989 and wasn’t ultimately closed until 2011. Long-term consequences won’t be known for years.

No. 2, the settlement — which was reached in November 2001 and approved by a federal court in June 2004 — opened the way for companies like Google to emerge and eventually dominate the internet. So, there’s no small irony packed into this week.

No. 3, the case — eventually, indirectly — forced a lot of change on the company.

Let’s focus on this aspect, because adaptability, as Jon noted in yesterday’s Pivotal Point, is the thing that’s separated Microsoft from another former tech high-flyer:

For a long time, Microsoft was only about Windows, its dominant personal computer operating system.“Windows Everywhere” was its strategy to deploy the operating system to data centers, mobile devices, video games and computers of every sort.

In a July 2013 memo, then CEO Steve Ballmer told employees the company was in a unique position to leverage the platform’s 1 billion users. He thought he could squeeze them all into some device running Windows, whether they liked it or not.

History teaches us these shoehorn strategies work better on paper than in real life. Regardless, to bolster the Windows Phone lineup, Ballmer engineered the buyout of Nokia (NYSE: NOK, Rated “D+”). In contrast with the euphoria of Apple’s (Nasdaq: AAPL, Rated “B-”) iPhone, the move was an unmitigated disaster. Two years later, The Verge noted the cost of failure was the staggering sum of $8 billion. But Microsoft managers learned from this mistake.

The value of Microsoft to customers wasn’t Windows crammed onto their smartphones and Xboxes. The value was the digital services the company offered.

When Satya Nadella became new chief executive in 2014, this new strategy kicked into high gear.

Microsoft began deploying its services across other platforms. The Office productivity suite migrated to iPhones and Androids. Windows Azure, its cloud computing service, became Microsoft Azure. And product managers went all out to attract Linux developers to the platform.

By March 2018, Windows was not even a division at Microsoft. Engineers who once focused entirely on the operating system were split up between Azure and Office 365, the cloud-based version of the best-selling productivity suit.

Ben Thompson, an analyst at Stratechery, explained the end of Windows succinctly. The internet reduced application lock-in. PCs became good enough, so customers didn’t upgrade as frequently. And smartphones changed the way people sourced information.

Microsoft managers adapted.

And the results are stunning.

We’ll see about Facebook, Apple, Amazon and Google and their adaptability on Thursday.

As Martin noted in Monday’s Weiss Ratings Daily Briefing, “These Big Four tech companies have some $5 trillion in market cap, more than the total GDP of Japan. But, due to the economic turmoil, the earnings guessing game on Wall Street is like two dozen guys shooting craps on the steps of a fire escape.”

Not so with Microsoft.

As I said earlier, second-quarter earnings for these four companies will be released this week. Smart investors should be comparing their success at adapting to Microsoft’s. It’ll be a very telling indicator for future profits.

Best wishes,

David Dittman