Will the next debt crisis be worse than 2008? When will it begin?

I was born in 1946, soon after World War II ended and just as a postwar economic boom was getting underway.

Many people thought that boom would last only a year or two. The Great Depression was still fresh in their collective memory. They feared the country would soon sink back into the abyss.

So, just three years later, as the economy began to dip into recession, most economists warned that the boom was over. They were wrong.

They said the same thing in 1953, 1960, 1969, and during the periodic setbacks that followed. But they were wrong again and again.

To their great surprise, the postwar boom continued decade after decade. And with each passing phase, we witnessed a generational shift of far-reaching consequences:

The voices of caution dimmed.

Die-hard skeptics died.

Complacency replaced caution.

And debt emerged as the new goddess of greed.

All helping to power an extension of the postwar World War II boom far beyond anyone’s wildest dreams: 64 years of massive economic growth ... until, that is, the turn of the Century.

Then, something broke.

In the early 2000s, the Nasdaq fell by about 75%.

In 2006, the rot of asset destruction spread to housing and real estate, gutting their value.

In 2008, it infected almost every asset in the world, threatening to destroy the financial system.

And in the early 2010s, it nearly brought down at least five European nations — Portugal, Ireland, Italy, Greece and Spain.

Clearly, the 64-year postwar boom — continuing, sustainable growth interrupted by painful-but-healthy recessions — was over.

Yes, stocks went on to make new highs again. And yes, the global economy recovered. But the postwar boom of the 20th Century was replaced by something very different in the 21st Century:

The wildest speculative binges since the 1920s ...

The greatest social inequality and political divisions since the Civil War ...

Fueled by the biggest central bank money-printing of all time ...

Leaving us vulnerable to a bust that could be even greater than the Debt Crisis of 2009.

You can see piles of evidence everywhere. But for now, let me focus your attention to two in particular.

|

|

Click image for a larger view. |

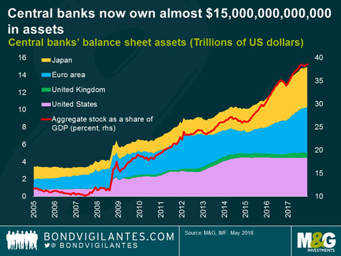

First — the massive expansion of central bank assets (the most direct measure of their money printing operations).

As you can see in the chart to the left, central banks are now the biggest bond investors in the world, holding more than $15 trillion worth.

It’s mountains of paper. And it’s mostly paper that, in another era, would have been bought by private investors. Instead, it clutters the books of central banks in the U.S., Euro area, U.K. and Japan.

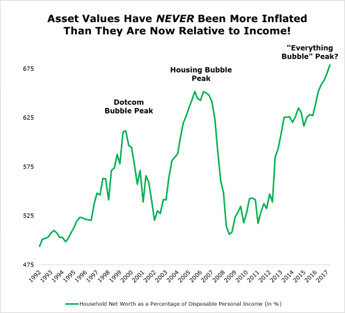

Second — look at this chart by our colleague Mike Larson:

|

|

Click image for a larger view. |

U.S. asset values reached a peak in the dotcom bubble ... and then plunged.

They reached an even higher peak in the housing bubble ... and then plunged even further.

Now they’ve eclipsed the prior peak in the “Everything Bubble,” and are vulnerable to the next wave of asset destruction.

Many people think this boom will last forever. The Great Debt Crisis of 2008 has been largely wiped out of their collective memory. They have virtually no fear that the country might sink back into the abyss.

Are they wrong? Could the next decline be worse than the 2008 catastrophe? When might it begin?

Give me your answers by emailing your comments to [email protected]. Then next time, I’ll give you mine.

Best wishes,

Martin