Will They or Won't They Cut? For the Fed, that is the Question

|

Will they or won't they?

That's the question everyone on Wall Street is asking this week. Only for the first time in several years, it's in reference to Federal Reserve rate CUTS, rather than hikes. And depending on how Fed Chairman Jerome Powell answers, it could have significant impacts on your portfolio.

Let's back up a bit and set the stage first. The Fed began raising rates in December 2015, and last increased them in December 2018. The moves raised the benchmark Federal Funds rate from a range of 0% to 0.25%, up to 2.25% to 2.5% — or a total of 2.25 percentage points (225 basis points, or "bps").

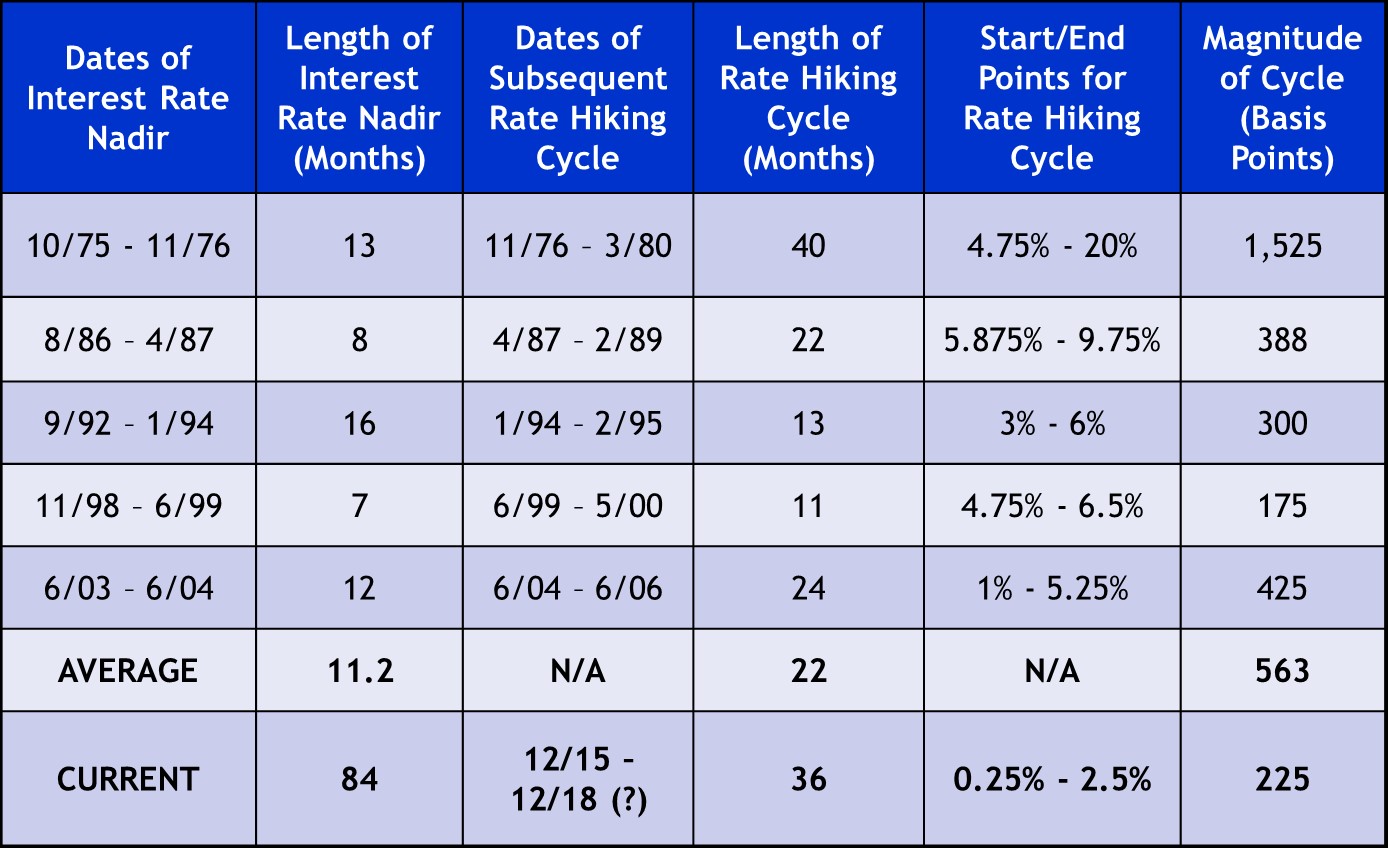

How does that cycle measure up to the past? This table shows you. It contains data on the last five Fed hiking cycles going all the way back to the mid-1970s.

|

You can see a few different things. First, rates remained at rock-bottom levels for a record amount of time (84 months) before the hikes began. Second, the hiking process was much longer and more drawn out than usual at 36 months. And third, it was smaller in magnitude than almost every cycle in recent history at only 225 bps.

Yet here we are with Wall Street clamoring for cuts. Even more remarkably, big money managers and analysts are doing so without signs of significant market stress or a sharp downturn in the economic data.

So, will Powell cut? And if so, when? The current Fed meeting wraps up today, and I doubt we'll get a cut this soon. More likely, the Fed will lay the intellectual groundwork for a cut at one of its upcoming meetings. The next two are scheduled for July 30-31 and Sept. 17-18.

Regardless of when the Fed cuts, it will likely be met INITIALLY with market euphoria. No one likes cheaper money more than Wall Street speculators.

But will that short-term sugar high last? Not if I'm right about where we are in the economic and credit cycles.

Look, the Fed isn't considering cutting rates because everything is coming up roses. They're doing so because it's not. The yield curve has inverted. The global economy is slowing. The trade and tariff battles are ongoing. And the Fed is worried sick that'll cause growth and inflation to weaken notably here. None of those are bullish forces.

Moreover, in past rate-cutting cycles, the bullish benefit of the first cut or two wore off very quickly. Just look at the bear markets of 2000-'03 and 2007-'09.

The Fed lowered rates repeatedly, sometimes in between regularly scheduled meetings AND sometimes by more than the customary 25 basis points. But the S&P 500 still plunged 50% an 57%, respectively.

It wasn't until all the excesses of those cycles were wrung out … and assets like stocks and homes got dirt-cheap … that the cumulative impact of all the Fed cuts finally helped turn the market tide.

So, my advice is simple: If the Fed lowers rates today, or if it waits until one of the next couple of meetings, feel free to play along with any short-term rally if you're a TRADER.

But don't dawdle. More than likely, the impact won't last … and the underlying, weak fundamentals will reassert themselves.

What about if you're a longer-term INVESTOR?

Then your best bet is to use any rally to lighten up on stock exposure. Or at the very least, rotate out of aggressive, offensive stocks and sectors ... and in to more conservative, defensive ones. That will help prepare your portfolio for the tougher times I see ahead.

And never forget that you'll hear a lot of bad information and analysis about the Fed from people who should know better — regardless of what policymakers do or say today and later this year. Try to filter that out, and just focus on the true Fed facts and data you'll get from us at Weiss Ratings.

My colleague Tony Sagami recently shared "5 Ways to Prep Your Portfolio for the Worst." You'll find some great ideas in his article, some of which you can start acting on today.

Until next time,

Mike