Yes, You Can Make 10% in Treasuries ... 10% in LOSSES!

|

Don't let the pundits fool you. You can make 10% in U.S. Treasuries.

10% in LOSSES!

How is that possible? Aren't Treasuries a perfect "safe haven" investment ... the kind that's tailor-made for proverbial "widow and orphan" buyers? No, not really - and unfortunately, many investors just don't appreciate how much money you can lose on them!

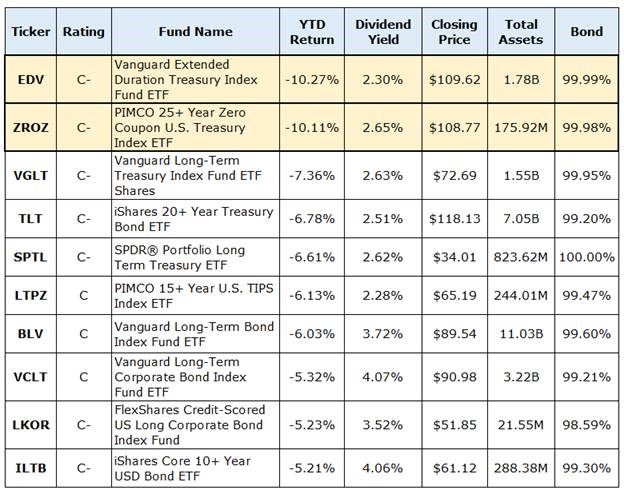

Take a look at this Worst Bond ETFs in 2018 Screener I built using the tools available to Weiss Ratings Platinum subscribers (If you haven't tried them out, you can gain access by calling us at 877-934-7778).

It shows the performance of all unleveraged, fixed-income ETFs in our coverage universe, including details on their yields, prices, total assets and total returns. (I sorted the list so it would show the worst offenders at the top.) Data Date: 2/26/18

Data Date: 2/26/18

You can see that the Vanguard Extended Duration Treasury Index Fund ETF Shares (EDV, Rated "C-") and the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (ZROZ, Rated "C-") are in the infamous "10% Club," with both losing a bit more than that.

We're not talking about long-term losses, either. They racked up that much red ink just in the first two months of 2018.

Even worse: These two ETFs sport dividend yields of only 2.3% and 2.6%, respectively. That means you've already lost enough in price to wipe out your yield as much as 4.5 times over. Ouch!

What's happening? How can Treasury funds tank so much?

Well, if you go down this list, you'll see some version of the words and numbers "Long-Term," "15+" and "20+" on multiple occasions.

And that's the real problem.

Longer-term Treasuries ... along with the ETFs and mutual funds that invest in them ... have much higher "durations" than other bonds and bond funds.

Duration is simply a measure of interest-rate risk. If a fund has a duration of 24.4 years like EDV did recently, that means it'll lose roughly 24.4% of its value for every percentage point move higher in the overall level of interest rates.

The yield on the 30-year Treasury bond recently topped 3.2%, after dropping as low as 2.7% in December. That's been a problem for EDV, ZROZ and other high-duration funds. And if rates climb further in the remainder of 2018, the losses are going to keep growing and growing.

That's why I warned about the risks in Treasuries again last week, continuing a string of warnings about the risks of many bonds and bond funds that date back more than a year.

Frankly, if you need income and yield, I'd much rather you focus on the kinds of dividend-paying stocks and other plays I recommend in my High Yield Investing newsletter rather than lousy U.S. T-bonds. Many of those positions have worked out well for my subscribers, and I have every reason to expect that to continue in 2018 and beyond!

Until next time,

Mike Larson

P.S. Are you getting my updates on Twitter, too? If not, you can follow me using the handle @RealMikeLarson.