“Mr. Independence” — Forbes

“The only one with no conflicts of interest” — Esquire

“The first to see the dangers” — The New York Times

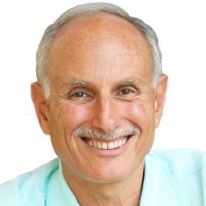

Dr. Martin D. Weiss is the founder of Weiss Ratings, the nation’s leading provider of 100% independent grades on stocks, mutual funds and financial institutions, as well as the world’s only ratings agency that grades cryptocurrencies.

He founded his company in 1971, and thanks largely to his strict independence, has established a 50-year record of accuracy that’s often the envy of competitors.

For example, the U.S. Government Accountability Office (GAO) reported that the Weiss insurance company ratings outperformed those of the nation’s largest insurance rating agency by a factor of three to one, while beating those of Standard & Poor’s and Moody’s by even wider margins.

The Wall Street Journal reported that investors using the Weiss stock ratings could have made more money than those following the grades issued by Deutsche Bank, Merrill Lynch, J.P. Morgan, Goldman Sachs, Standard & Poor’s and every other firm reviewed.

Barron’s named Weiss “the leader in identifying vulnerable companies,” while Forbes, The New York Times and many others have recognized Weiss for his strict independence and accuracy.

Dr. Weiss began learning finance and economics from his father, J. Irving Weiss in 1959, and received his doctoral degree in cultural anthropology from Columbia University in 1984, specializing in economic anthropology and Japan studies.

Dr. Weiss began learning finance and economics from his father, J. Irving Weiss in 1959, and received his doctoral degree in cultural anthropology from Columbia University in 1984, specializing in economic anthropology and Japan studies.

In 2017, to better help investors in these volatile times, he returned from semi-retirement to re-assume his role as Weiss Ratings CEO, where he currently leads an international team of researchers, data scientists, stock analysts, and computer programmers.

As a teenager, Martin taught foreign languages at the Berlitz School on Wall Street and in Rockefeller Center, New York. Having lived in Latin America and Asia for nearly two decades, he is fluent in Portuguese, Spanish, Chinese and Japanese, among other European and Asian languages.

Martin Weiss's Articles

By

Martin D. Weiss, Ph.D. On

December 3, 201807:55 AM EasternBitcoin Crash:

Why This Time is Different

Palm Beach Gardens, FL– Statement by Martin Weiss, Founder of Weiss Ratings, on the recent plunge of bitcoin, decline in the cryptocurrency market, and...

By

Martin D. Weiss, Ph.D. On

December 3, 201807:55 AM EasternLast year was great for Bitcoin. This year was terrible. But what about next year?

This coming Wednesday, Dec. 12, we will hop online and give you the answer — along with 8 bold forecasts for...

By

Martin D. Weiss, Ph.D. On

November 28, 201807:55 AM EasternThe Next Crypto Bull Market:

How to Maximize Gains and Minimize Losses

(Transcript, edited for clarity)

Announcer: Weiss Ratings has burst onto the scene as the world’s only financial rating...

By

Martin D. Weiss, Ph.D. On

November 26, 201807:55 AM EasternWith Bitcoin’s latest decline, it couldn’t be more timely.

Indeed, back in January, when we first launched our Weiss Cryptocurrency Ratings, we gave Bitcoin a "C+" because its technology was...

By

Martin D. Weiss, Ph.D. and

Juan M. Villaverde On

November 21, 201807:55 AM EasternBitcoin has just suffered another big decline. It’s now down by 77% from its all-time highs.

But it’s not the first time!

After it began trading ten years ago, Bitcoin plunged by at least 70%...

By

Martin D. Weiss, Ph.D. On

November 19, 201807:55 AM EasternLet me take you on a quick trip to the recent past.

The time is mid-August, 2015.

Bitcoin investors are tired and disgusted. Their beloved cryptocurrency has crashed and then gone nowhere for...

By

Martin D. Weiss, Ph.D. On

November 14, 201807:55 AM EasternWe just launched our 3-part webinar series, "New Crypto Bull Market About to Begin."

In Part 1, we show you how past crypto declines led to an average rise of 63-fold … why history is now likely...

By

Martin D. Weiss, Ph.D. and

Juan M. Villaverde On

November 14, 201807:55 AM EasternMartin Weiss and Juan Villaverde prepare you for a potentially massive crypto bull market about to begin. We just launched our 3-part webinar series, “New Crypto Bull Market About to Begin.”

...

By

Martin D. Weiss, Ph.D. On

November 12, 201807:55 AM EasternWill Bitcoin be a lot more valuable by 2028?

Or will it be mostly dead?

Will it be replaced by the more advanced cryptocurrencies that merit our highest Weiss Ratings?

If so, will those...

By

Martin D. Weiss, Ph.D. and

Juan M. Villaverde On

November 9, 201807:55 AM EasternAfter it first began trading ten years ago, Bitcoin plunged by at least 70% on four separate occasions.

Each time, Wall Street “experts” wrote Bitcoin’s obituary. But each time, it came back...

Dr. Weiss began learning finance and economics from his father, J. Irving Weiss in 1959, and received his doctoral degree in cultural anthropology from Columbia University in 1984, specializing in economic anthropology and Japan studies.

Dr. Weiss began learning finance and economics from his father, J. Irving Weiss in 1959, and received his doctoral degree in cultural anthropology from Columbia University in 1984, specializing in economic anthropology and Japan studies.