|

Billion-dollar companies like Apple and Facebook aren’t as cash-rich as you might think. But these two surprising stocks are.

Do you have a little Scrooge McDuck in you? I know I sure do.

Scrooge McDuck, the fabulously wealthy uncle of Donald Duck modeled after Ebenezer Scrooge, loves to swim in his pile of gold coins and mountain of dollar bills.

I don’t have anywhere near enough wealth to swim in, but I admire (and often invest in) companies that are sitting on Scrooge McDuck-style cash hordes.

Here is a list of the U.S. companies with the largest treasure chests of cash in the world:

|

- Apple (AAPL) — $210.6 billion

- Microsoft (MSFT) — $133.8 billion

- Alphabet (GOOGL) — $121.1 billion

- Facebook (FB) — $48.6 billion

- IBM (IBM) — $46.3 billion

- Amazon (AMZN) — $41.5 billion

- Oracle (ORCL) — $37.8 billion

- Cisco (CSCO) — $33.4 billion

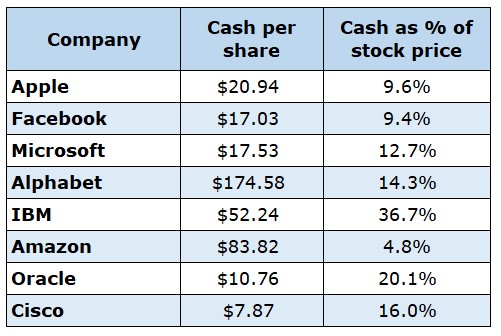

As you can see, Apple, Microsoft and Google all have over $100 billion of cold, hard cash in the bank. However, there's something more important than the nominal dollar amount. That is, how much that cash is as a percentage of the stock price.

|

Quite a different story when that cash is shown as a percentage of the stock price, isn’t it?

Under this list, Apple and Facebook aren’t as cash-rich as you might think. Meanwhile, Scrooge McDuck would go bananas over cash-rich IBM and Oracle.

Note: To be fair, I need to disclose that my Weiss Crypto Investor subscribers are happy shareholders of Facebook, Amazon and IBM. It just goes to show you how easy it is to profit in the cryptocurrency world without investing a dollar directly in it unless you want to. (And we show you how to do that too — click here to see how.)

Let me be clear; cash in the bank is wonderful, but it should not be used as a standalone "Buy"/"Sell" indicator. It is just one factor — though a very important one —that you should consider when evaluating a stock.

Which is exactly what we do at Weiss Ratings.

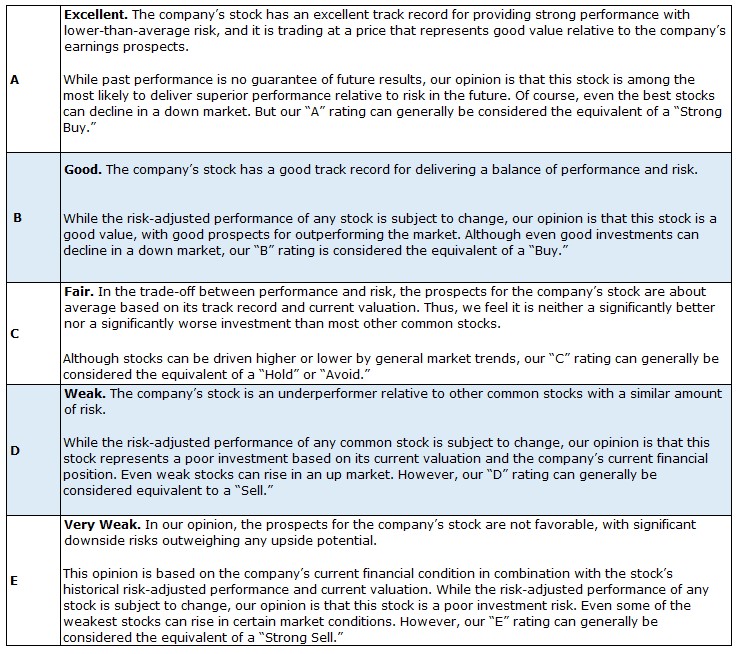

Weiss Ratings is a rules-based rating system that takes thousands of pieces of stock data and, based on its own model, balances potential reward against the amount of risk to assign a rating.

These ratings are based on cold, hard numbers and emphasize strong balance sheets and rock-solid financial statements. Here’s how it works:

The results provide a simple and understandable opinion as to whether we think the stock is a “Buy,” “Sell” or “Hold.”

|

The best part is that our Weiss Ratings are free. And I think you’d agree that “free” is a very good price.

To check the Weiss Rating on any stock, ETF or mutual fund, go to https://weissratings.com and enter the ticker in the search bar.

Presto! You’ll become a better-informed — and, in my opinion, a more successful — investor.

Best wishes,

Tony Sagami