It was the best of times for some stocks earlier this year. But it’s the worst of times for them now – and that has implications for investors like you.

The year started off with markets mired in a low interest rate environment. U.S. Treasury yields were falling to historic lows thanks to central bank-inflicted negative yields across the pond in Europe (and in Japan). Those negative yields made even our low yields look attractive by comparison to global investors.

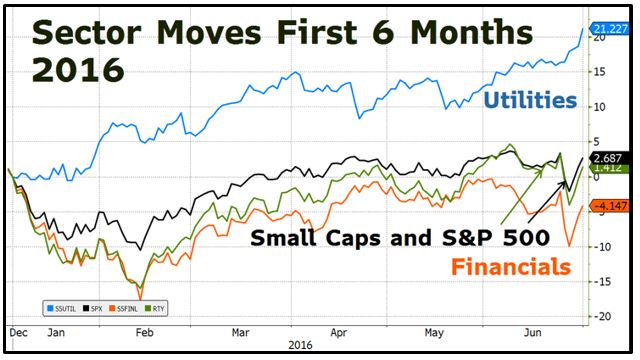

As the yield on the 10-year Treasury sank toward just 1.31% at its low in June, income-seeking investors also piled into stable, low (or no) growth, mature sectors like Utilities, Telecoms, and Consumer Staples. And why not? With US markets trading in a sideways range for 32 months, there wasn’t much upside to be found elsewhere. Any return, however little, in defensive, bond-like stocks was better than nothing.

Indeed, you can see in this chart that the performance leadership in the period leading up to the presidential election was largely coming from the utilities and telecom sectors. Traditionally strong sectors like financials, small caps, and healthcare where shunned:

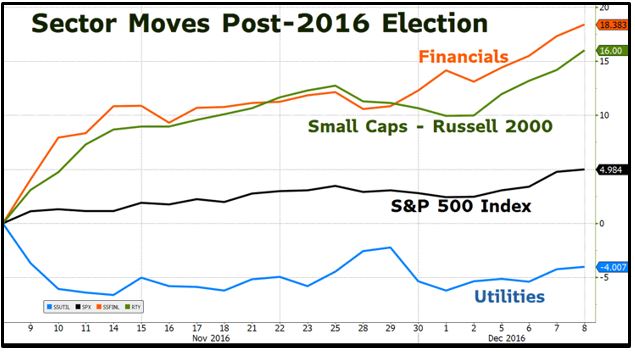

But the game-changing election threw a wrench into all that. As you can see from this chart, financials, small caps and industrials are now the winners, a reversal of what we saw in the first part of the year:

What’s driving this new development? Companies are expecting tax reform from the pro-business combination of a Trump presidency and a Republican-led Congress. That should provide more money to fund growth, something that is critical for small businesses and small cap stocks.

After all, when you’re a small business, the savings are a God-send because you rely on capital to grow. The more you have, the more you can re-invest back into your business – in the form of capital expenditures, research and development, and more. That helps create a positive feedback loop to hiring and consumer spending. Conversely, with large caps, the savings don’t always go back into the business, as the payment of one-time dividends or buying back shares sometimes takes precedence to please shareholders.

In addition to the election, we have economic data looking better, confidence rising, and employment picking up. That’s also giving investors the go-ahead to buy riskier stocks, or even beaten-down stocks.

Bottom line: I wouldn’t be surprised to see a pull back soon, given the extreme move. But have your shopping list of small cap stocks ready to purchase, because the fundamentals are lining up quite in favor of this market niche.

Our Weiss Ratings stock screeners can help with that, by the way. You can screen every stock in the market for things like market cap, total return, dividend yield, volatility, and more. Just click here to get started.