|

She was way out of my league, but I somehow got a beautiful cheerleader to be my girlfriend in high school.

Her father, however, did not care for me and wasn’t shy about letting me know … with one notable exception.

When I knocked on her door, I could hear cranked up “oldies” music and loud laughing coming from behind the front door. Her the normally sour-faced father opened the door and slapped me on the back. He gave me a big smile and pushed a cold beer into my hand while welcoming me into his house.

“Come on in, Tony!”

The father, along with his wife, were laughing, dancing, quite tipsy and happy as clams. They were celebrating something. Something big.

That something big was a mortgage burning party. My girlfriend’s parents had paid off their home mortgage and were celebrating that freedom.

For that one day, the joy of paying off their mortgage was greater than the bad taste the protective father had about me. I was a dumb teenager at the time, but it made a lasting impression on me.

Home mortgage burning parties are almost unheard of today. In fact, Americans are doing exactly the opposite … NOT paying their mortgages.

Those were simpler, pre-COVID-19 pandemic times. That’s because home buyers have to hope they can keep their jobs and feed their families before worrying about mortgage payments.

|

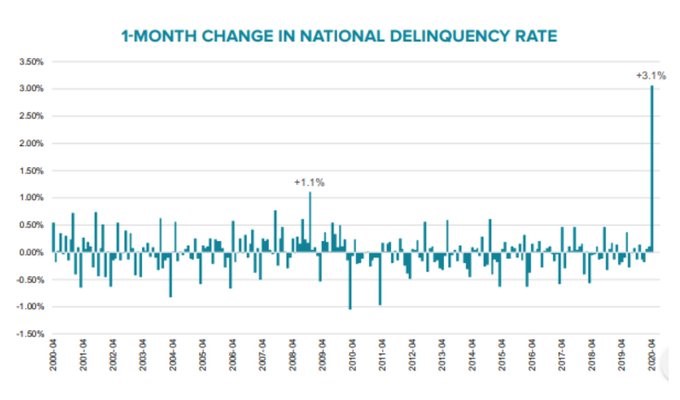

According to Black Knight, a mortgage data company, the number of Americans past due on their mortgage jumped by 1.6 million in April, a whopping 90% increase from March. The mortgage delinquency rate has jumped to 6.45%, more than double the 3.06% in March.

That is the largest single-month jump in history and nearly three times the

peak of the 2008-09 Financial Crisis

|

|

Source: Black Knight |

Consider this perspective: It took 18 months during the Great Recession before the first 1.6 million homeowners became delinquent on their mortgage.

Today, a total of 3.6 million Americans are already behind on their mortgage payments.

Of course, the coronavirus pandemic is behind the surge in delinquencies, but thanks to the Coronavirus Aid, Relief and Economic Security Act, homeowners can suspend mortgage — aka forbearance — payments for up to a year on federally backed mortgages

8.8% of mortgages are currently in forbearance mode and that number is growing by the day. Black Knight said that mortgage lenders are getting about 27,000 new forbearance request EVERY day!

After the coronavirus unemployment benefits run out next month, I expect to see a second wave of delinquencies. And that’s bad news not only for unemployed homeowners who could lose their homes, but also for the entire real estate sector.

After all, foreclosures can drag real estate prices lower.

Perhaps a lot lower.

We all need a place to live, so we can’t just sell our houses ... even if we are convinced that home prices were headed lower.

If you really believe that real estate prices are headed lower and are willing to take some risk, you might consider these three ETFs that are designed from falling real estate prices:

Pick No. 1: ProShares Short Dow Jones U.S. Real Estate Index ETF (NYSE: REK, Rated “D+”) is designed to move in the inverse direction of the Dow Jones U.S. Real Estate Index.

Pick No. 2: ProShares Ultrashort Dow Jones U.S. Real Estate Index (NYSE: SRS, Rated “D”). This ETF is just like REK, but will move twice (200%) the inverse direction of the Dow Jones U.S. Real Estate Index. Double opportunity ... but with that comes double the risk if the markets move against you.

Pick No. 3: The Direxion Daily MSCI Real Estate Bear 3X ETF (NYSE: DRV, Rated “B-”) is designed to move three times (300%) the inverse direction of the MSCI US IMI Real Estate 25/50 Index (a REIT index).

Definitely consider these three options, and of course, don’t forget to make your mortgage payments.

Best wishes,

Tony Sagami