99% Average Yearly Returns in Good Times and Bad

Based on actual recommendations made in REAL time to REAL subscribers who invested REAL money.

• 99.3% average yearly return from 2012 through 2017 (before broker commissions).

• Portfolio growth from $10,000 to $248,516, even assuming 52.9% in taxes paid each year.

• Growth 17.5 times faster than S&P 500.

My publisher, Martin Weiss, is so conservative, it drives me batty.

He likes to play it safe and try to double his money every 9 to 10 years. I like to use leverage, take defined risk with money I can afford to lose, and aim to double my money in just one year.

Do that with some degree of consistency, and after a few years, a small investment can mushroom in size.

Here’s an actual example:

If you’d have followed my real-time recommendations from January of 2012 through year-end 2017 ...

|

You’d have average returns of 99.3% per year.

You’d have seen a $10,000 initial investment grow to $248,516, nearly 25 times your money.*

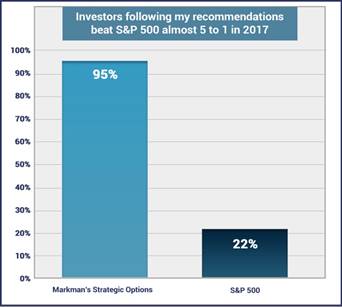

You’d have grown your wealth 17.5 times faster than investing in the S&P 500.

And that assumes you took out 52.9% of your profits each year to pay the highest federal and state income taxes in the country!

If you invested in a tax-protected account, you could have done even better. Then, your $10,000 would be worth $516,403, or 37 times better than the S&P 500.