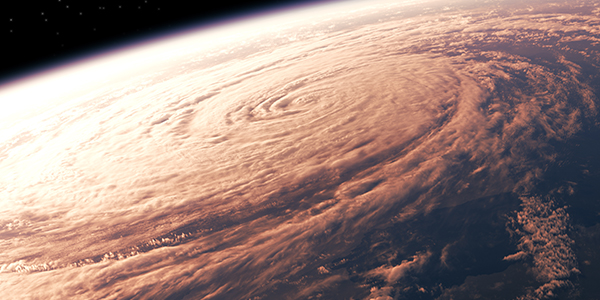

Looking for a Port in this Market Storm? Then Try These Conservative Dividend Plays

|

|

The market is getting buffeted by two powerful forces: The geopolitical fallout from North Korea’s aggressive nuclear test and worries over major economic and insurance losses tied to Hurricane Irma. That has investors like you looking for ports in the storm, and my favorite “Safety Stocks” could help you out!

These are stocks that tend to do well even during temporary bouts of uncertainty. While a severe drawdown panic like we saw in 2008 will leave no stock safe, in this environment they should work. That’s because economic data isn’t showing signs of a recession.

I wouldn’t be surprised if we see a correction of high flying speculative names, and a passing of the torch to larger, consistent, mature, dividend-paying business in the Utilities or Consumer Staples sectors. That’s because no matter how worried investors get, they still like having electricity, drinking beer, smoking cigarettes, using toothpaste, and washing dishes. Okay maybe they don’t “like” those last two tasks … but they have to do them nonetheless!

So here are two safety stock lists to keep handy. One shows companies with at least $50 million in market cap and 50,000 shares in average trade volume in the utilities space. The other is similar, but for the consumer staples sector.

Both are filtered to show only companies that are delivering positive YTD returns, and positive returns over the last week. That helps you zero in on strong performers in both the long and short run:

List #1: Leading Utility Stocks

List #1: Leading Consumer Staples Stocks

Hopefully the market will stabilize and this short-term volatility will pass. But if you’re looking for some more conservative, dividend-paying stocks … and a way to shield your portfolio from what might come next … these lists should help you find potential buys. Happy hunting!

Best,

Mandeep

Small Cap Edition, By Mandeep Rai, Senior Analyst Mandeep Rai has more than 15 years of investing experience, working as both a stock and credit analyst. At Weiss Ratings, he researches and evaluates financial and economic themes, and makes decisions on when to buy or sell specific shares for the Top Stocks Under $10 portfolio. |