|

One week ago, I warned it was time to face the facts —

That the official number of new COVID-19 cases had just surged to record highs in select regions …

That those spikes were just the first phase of a perfect storm, and …

That the storm posed a grave threat to your financial future.

Now, just seven days later, the clouds are already darker, and the entire Western world is confronting a new rude awakening.

Compare last Monday with what’s happening today … and you’ll see exactly what I mean:

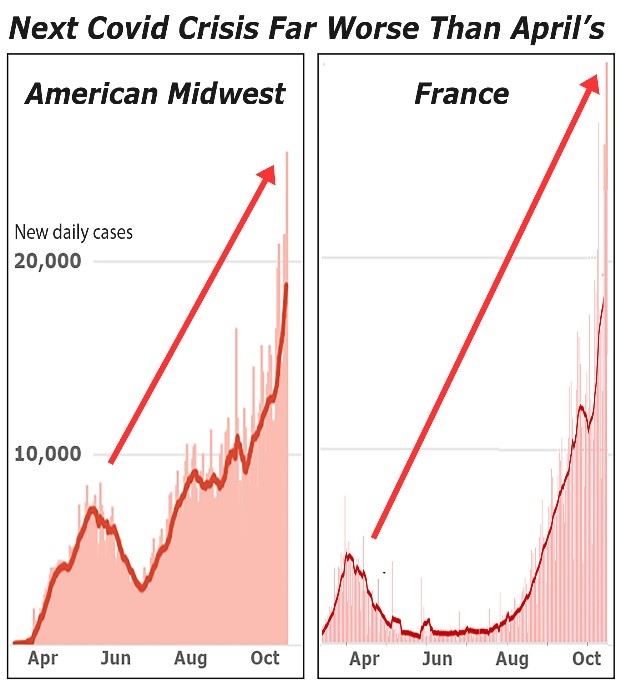

Last Monday, it was just the American Midwest, France and a few other areas that were reporting record highs in new daily cases.

Now, it’s the ENTIRE United States and ALL of Europe.

Last Monday, the coronavirus news was relatively subdued, and most people were focusing on getting back to normal.

Now, the virus has burst back into the headlines, and millions of people around the world are shifting back into panic mode.

Last Monday, most investors were largely ignoring COVID-19.

Today, many investors are heading for the exits.

|

| Just seven days ago, the American Midwest and France were among the few reporting record highs in the new daily COVID-19 cases. Now, it’s all of Europe and the United States. |

One week ago, political leaders in the U.S. and overseas were just beginning to talk about steps to mitigate the virus.

Now, local and national governments have already announced a wide range of new restrictions and lockdowns:

New York State and New Jersey have imposed quarantine restrictions on visitors from 43 states and territories.

Chicago has slapped an early curfew on bars and restaurants, while banning large social gatherings.

El Paso, Texas just issued a new curfew last night, as its hospitals and ICUs hit full capacity and officials scramble to find additional morgue space.

And overseas, this trend is moving even more swiftly …

Ireland and Wales have imposed strict lockdowns. Nationwide!

Spain has declared a state of emergency and also enacted nationwide lockdowns.

Italy has just announced its fourth and harshest round of coronavirus restrictions since its spring lockdown. Beginning today, restaurants and bars must close by 6 p.m. Gyms and movie theatres must shut down entirely.

And this is just the beginning.

Yes, many people dispute the validity of the official data.

But no one can dispute the impact it has on the decisions people make — be it politicians enacting measures, investors rushing for the exits or voters casting their ballots.

What Will Happen Next? The Pattern Is Clear …

A few governments in the U.S. and around the world will crack down hard and all at once.

Some will do virtually nothing, letting the virus run its natural course.

But most feel caught between a rock and hard place.

If they move too swiftly with Draconian measures, they fear mass rebellion by businesses and the working population.

If they do nothing, they fear the wrath of first responders, hospitals and the most vulnerable populations.

So, how do they respond to these conflicting forces?

The same way most politicians respond most of the time: little by little.

They start small. Then, they announce incrementally tougher COVID restrictions.

One painful step at a time.

For income investors, it’s the worst of all worlds.

They get no relief from the daily staccato of bad news. And they see little hope of the closure that might come with a once-and-for-all, get-it-over-with event.

Meanwhile, the Fed cuts your yield down to zero and promises to keep it there for at least three years.

How can you escape the twin jaws of high risk and zero yield?

What can you do immediately to earn reliably large, extra income?

To give you the answers, I just recorded a new one-hour webinar this past Friday.

Good luck and God bless!

Martin