|

My sons keep buying wacky things — cryptocurrency coins I’ve never heard of, Reddit-touted “value” stocks and some “non-fungible tokens” — and making huge profits on them.

In fact, they’re making more money on a percentage basis than I am in the stock market.

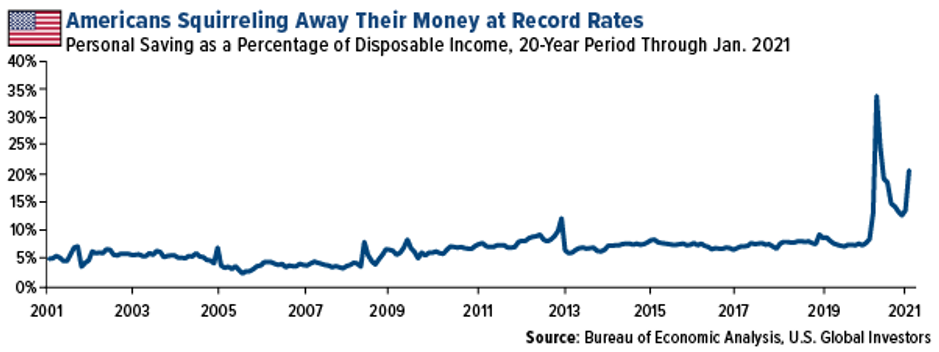

The thing is, right now, money flows, not fundamentals, are driving the stock market.

Between ZIRP (zero interest rate policy), $120 billion a month of quantitative easing and government overspending, including the Biden administration’s $1.9 trillion coronavirus package, trillions of dollars are being pushed into the stock market.

Indeed, the next leg of the bull market is going to be financed by retail investors flush with “stimmy” cash looking for a place to stash it.

Get this: Deposits to U.S. bank accounts hit $16.45 trillion last month, which is $3 trillion more than in January 2020.

|

That flood of money is financing a new speculative mania in all sorts of “assets.”

It goes beyond Reddit Army-fueled rallies in GameStop Corp. (NYSE: GME) and those “special purpose acquisition companies” (SPACs).

People are throwing money around like it’s going out of style.

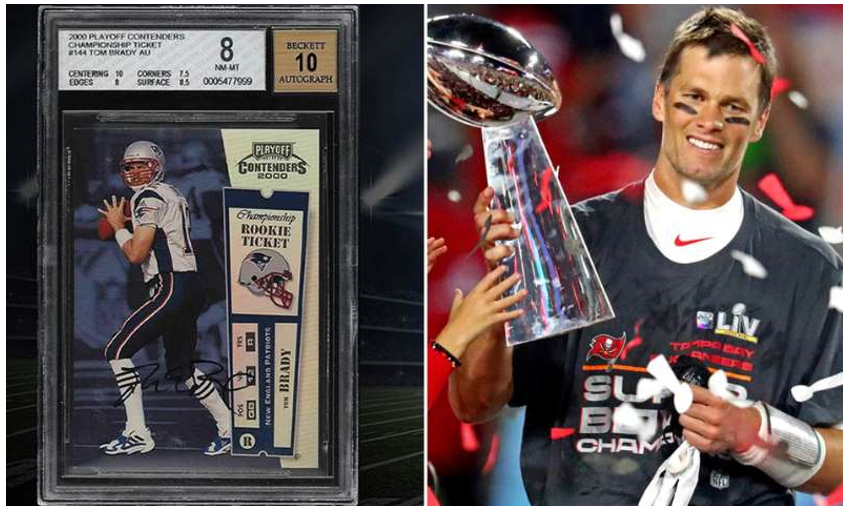

For example, a Tom Brady rookie card sold for $1.3 million last week. I like Tom Brady … but $1.3 million? That’s just crazy.

|

| Source: MSN |

NFTs — that’s the acronym for “non-fungible tokens” — are the new rage for music and art. An NFT is a unique digital file stored and authenticated on a blockchain.

Fans have been buying them by the boatload.

Here’s where it gets interesting/sublime/ridiculous …

The venerable auction house Christie’s sold an NFT by someone named Beeple for $69.3 million. And an electronic musician 3LAU has sold $11.7 million worth of NFTs related to one of his previously released albums.

Trust me, it’s not just sports cards and NFTs ...

The aftermarket for “collectible” sneakers is also hotter than ever. Recently, a pair of Nike tennis shoes — the SB Low Staple NYC Pigeon — sold for $33,400.

|

| Source: DuckDuckGo |

OK, at the risk of triggering a tidal wave of replies from cryptocurrency fans, let’s note too that Bitcoin’s market capitalization blasted past $1 trillion (a couple times, in fact; it’s just volatile).

Of course, in committed crypto fans’ eyes, the next stop is surely $2 trillion, and soon.

I’m not calling all cryptocurrencies wacky assets. But clearly the money flood is finding its way into that market as well.

With all this easy money sloshing around these days, I suspect wacky assets will continue to shine … for a while. When the flood inevitably recedes, I’m not so sure they’ll look so good.

I hope you’re not left holding those bags.

Best,

Tony Sagami