Aetna announced last week it will stop selling health insurance through the Obamacare exchanges in 11 of the 15 states where it currently operates. The company joined other major health coverage providers Humana and UnitedHealth, in significantly reducing their Obamacare business.

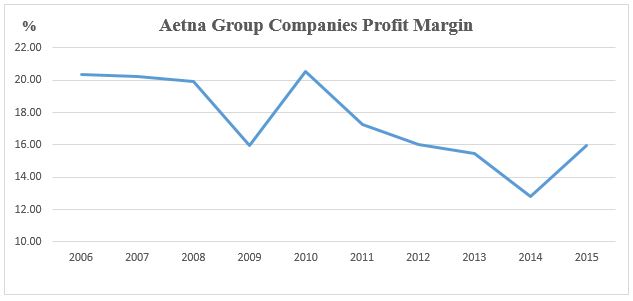

Aetna states their decision to leave is based on decreasing profits. Its group companies showed a decrease in the average profit margin from 20.4 percent in 2006 to 16 percent in 2015.

This decrease can be explained by the medical loss ratio provision of the Affordable Care Act (Obamacare), which mandates that all health insurers must spend 85-87 percent of collected premiums on providing health care services, leaving them with a profit margin of 13-15 percent.

But the mandated medical loss ratio is not where expenses really stop. Insurers still have to spend additional dollars on running the business, for example, on administrative expenses and any other business related fees.

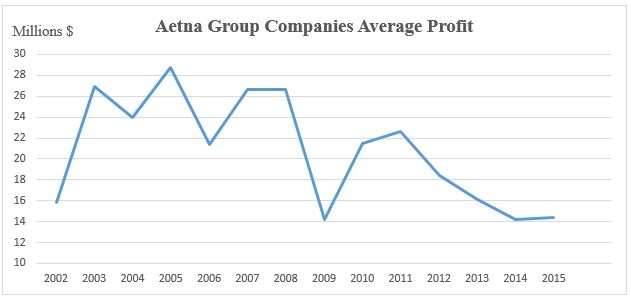

Although there are many additional expenses incurred by the health insurers and their net profit margin may be low, that small percentage can still equate to a good chunk of change.

In Aetna’s case, the average net income of its group companies was $14.4 million in 2015 and $14.2 million the year before, much smaller when compared to $27 million in 2007 and 2008, but still quite profitable. Coventry Health and Life Ins. Co., the most profitable Aetna company in 2015, netted $260.2 million, outweighing smaller losses from other sister companies.

So overall, it looks like Aetna may not be in such a bad shape--the company is still making money… maybe just not enough of it.

Its decision to abandon the exchanges will surely further challenge Obamacare’s plan for affordable insurance for all. Reduced competition in the exchange may also lead to increased premiums, as there will be fewer options to choose from.

Aetna’s stock is currently rated B (BUY) and closed the week up 0.8 percent, an indication that the decision to leave may have been driven by the shareholders. Overall, the company is still quite profitable and it appears the shareholders come before the policyholders.