Editor's note: Tony just sent this note to Weiss Crypto Alert subscribers, and he's been getting a lot of great feedback on it. We think you may also appreciate Tony's take. And be sure to watch our Megatrends and Megaprofits video for more of Tony's — and the rest of the Weiss Ratings team's — timely … and timeless … trading ideas, strategies and more for the new decade.

Tony will return with fresh investing ideas after the holidays. In the meantime, here he is with some timeless lessons from another history-making decade …

|

I picked a lousy time to become a stockbroker.

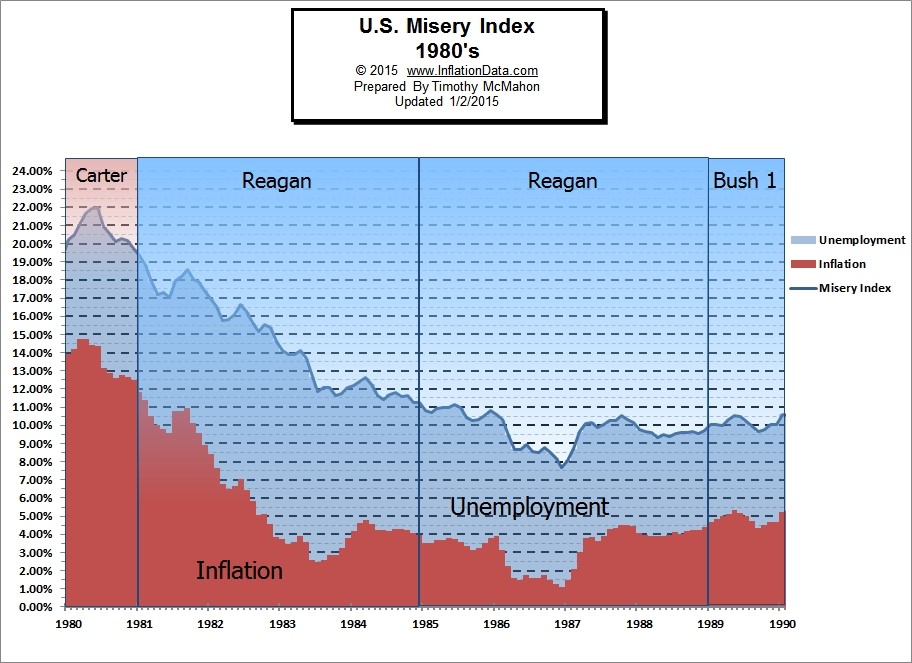

The 1980s were a tough time to be a retail stockbroker. I was young, dumb and full of ambition. Inflation was running at a double-digit rate, peaking at 14.5% in April of 1980. The Federal Funds rate hit 20% in 1981. And the U.S. economy was mired in a recession.

Millions of Americans were unemployed, and consumers stopped buying homes and cars. My largest client, a successful homebuilder, went out of business, filed for bankruptcy and saw his account plummet from seven figures to zero in a year.

|

The Misery Index, which is a combination of inflation and unemployment rate, reached 19.7% in 1980 ... levels not seen since the Great Depression.

Times were tough. Especially for a commission salesman, like me.

But President Carter appointed no-nonsense man of integrity, Paul Volcker, to head the Federal Reserve and he attacked inflation like a rabid dog. Volcker was the ultimate public servant and personified the ideal of doing what was right even if politically unpopular.

Volcker understood that his tight monetary policy was unpopular. Farmers drove their tractors in circles around the Federal Reserve building in protest. Auto dealers mailed keys of cars they couldn't sell. Homebuilders sent blocks of wood with knotholes to the Fed.

In response, Volcker held the first-ever Federal Reserve news conference on Oct. 6, 1979. The problem was that Pope John Paul II was visiting Washington and the news networks didn't have any extra TV crews.

Volcker told CBS to abandon the pope and cover him instead. "Send your crew here. Long after the pope is gone, you'll remember this one."

Volcker was right — not only about the press conference, but about the destructive effects of inflation and the right-but-unpopular way to combat it.

Volcker passed away last week, and I personally mourned his death. Sure, he made life tough for a young, dumb stockbroker. But our country desperately needs someone like him to lead the Federal Reserve.

Since Volcker, the people running the Federal Reserve have been as blind as Mr. Magoo. They have somehow concluded that our country is better off with zero interest rates, quantitative easing and monetary policy so accommodative that the ultimate return of the business cycle will send our economy into a recession so prolonged — and inflation so persistent — that we're going to see the Misery Index return to 1980-levels.

When? I don't know, but I'd make sure your portfolio has enough haywire insurance to keep you out of the economic poorhouse.

What kind of haywire insurance? Cash, gold and digital gold, aka cryptocurrencies.

In fact, for the first time ever, I just recommended a gold mining stock in the Weiss Ultimate Portfolio. It’s time you start looking into these insurance opportunities, too.

Best wishes,

Tony Sagami