“Where do I put my hard earned cash?” “Who should I use to finance my auto or home loan?” These are the questions asked by many, and sound decisions must be made in order to preserve and manage your money responsibly.

Weiss Ratings rates, and provides reports on, all U.S.-based and federally insured banks and credit unions.

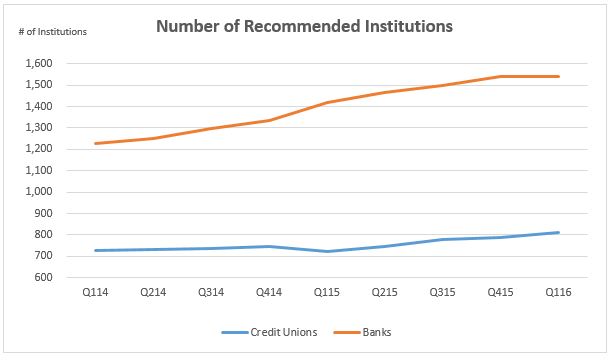

In Q1, 2016 Weiss rated 6,038 banks and 6,017 credit unions. Out of the rated banks, there were 1,540 recommended institutions with a safety rating of B+ or higher, and out of all the rated credit unions there were 811 institutions within the same rating range. Both banks and credit unions had been experiencing a steady growth in the number of recommended institutions since Q1, 2014.

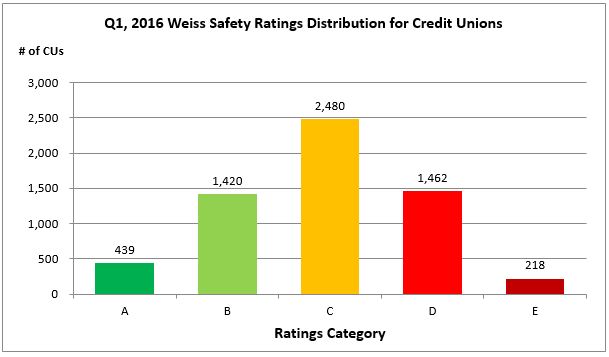

The graph below shows Q1, 2016 credit union ratings distribution across all Weiss ratings categories. The highest concentration of credit unions was within the C range, representing 41.2 percent of the credit union industry.

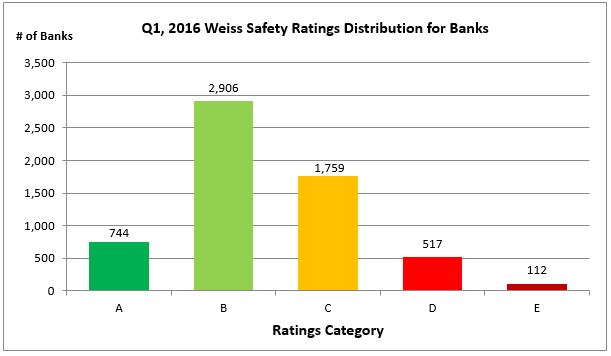

As compared to credit unions, most banks in Q1, 2016 were rated within the B range, representing 48.1 percent of the U.S. banking industry.

The most visible difference in ratings among the two financial institution types falls within the B and C range.

Be sure to check Weiss Safety Ratings when choosing a financial institution, but don’t forget to keep other factors in mind as well, such as fees and interest rates on loans and deposits.