Charter Communications (CHTR) received approval from the federal regulators last Monday to take over Time Warner Cable (TWC) and is in line to become the second largest internet and television service provider in the nation. The approval came with many restrictions protecting video streaming companies, such as Hulu and Netflix, and providing cheaper broadband services to low-income families.

Charter closed last Monday up 4.6 percent trading at $207.01 per share and was upgraded to C (HOLD) by Weiss Ratings on April 15th. Time Warner Cable finished the day at $209.63, gaining 4.1 percent holding a B (BUY) rating from Weiss.

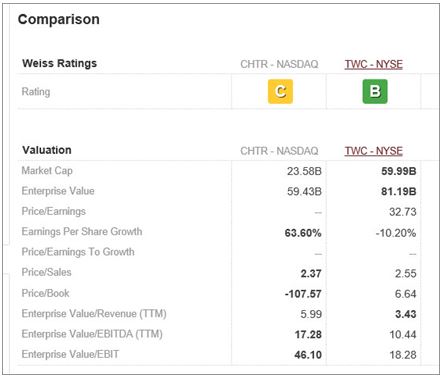

Weiss Ratings Comparison tool indicates the differences between Time Warner and Charter Communications financials, revealing that Charter is actually much smaller of the two.

Charter’s market capitalization of $23.6 billion and enterprise value of $59.4 billion is well below that of Time Warner, $60 billion and $81.2 billion, respectively. The latest filings have also revealed that TWC had a much stronger bottom line than CHTR.

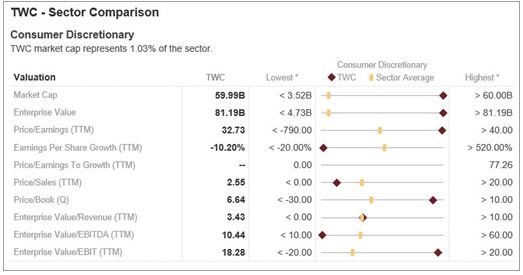

The Sector comparison report indicates that Time Warner is ahead in many areas amongst its consumer discretionary peers.

It looks like the deal may leave Charter in debt but the additional customer base of TWC may be worth the risk.

Strong Medicine to Cure Valeant

Valeant Pharmaceuticals International (VRX) has just announced it has hired a new CEO with hopes to bring the company back to life. Joseph Papa will take over in early May in an attempt to strengthen the company that lost 51 percent of its value in just one really bad day back on March 15th. Many investors, big and small, lost a lot of money when VRX dropped from $69.04 per share all the way down to $33.51.

Weiss ratings downgraded Valeant from C (HOLD) to D+ (SELL) on March 11th, four days before the massive drop in its value.

As of April 28, Valeant has regained 5.2 percent since losing half of its value back in March.

Stocks

Want to see investment ratings of companies headquartered overseas? Weiss Ratings gives you the ability to view them with ease.

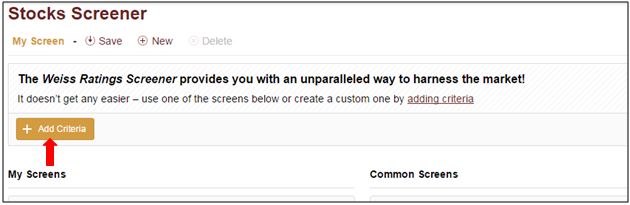

Simply sign into your account: select “Stocks” under the “Investment Ratings” tab and click on “Stocks Screener”.

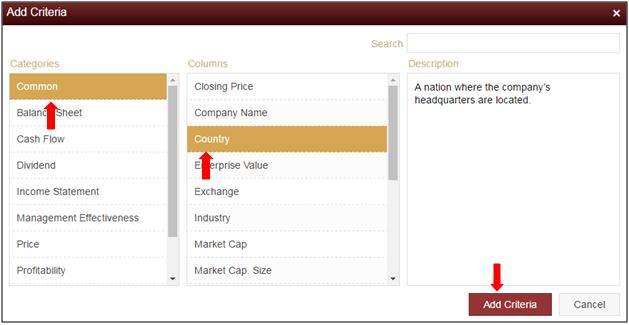

In the screener click on “Add Criteria”

Then, select Common>Country and click “Add Criteria”

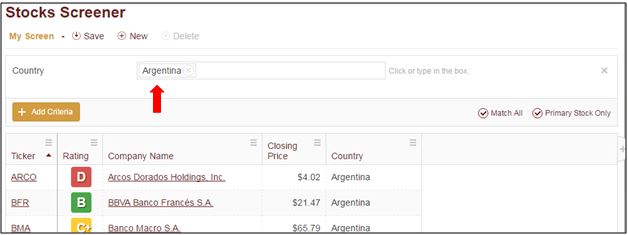

Now you can either type in the country name or select one by clicking on the “Country” box.

ETFs

Based on Weiss Ratings data, energy focused ETFs may not be the best investment option for you at the time.

The energy ETF list contains nearly 20 investments, most of which fall in the Weiss SELL universe receiving either D or E rating. These funds have very negative one-year performance.

Mutual Funds

Equity precious metals dominate the mutual fund list with one-year return of 20 percent or more.

Check out these funds and many more on Weiss Mutual Fund Ratings page.

Build your own custom lists using our “Mutual Funds Screener” or explore Industry and Individual comparison reports.

Banks

Find the highest rated banks near you to safeguard your hard earned cash!

Weiss Ratings makes it really easy for you with its “Recommended Banks by State” search tool. Select your state, click view and see all banks rated B+ or better with branches in your state.

You may also utilize our “Banks Screener” to search for a bank based on other criteria, such as: asset size, rating, deposits and many more…

Credit Unions

With safety ratings on over 6,000 credit unions, Weiss Ratings empowers you to slice and dice every single one of them in order to make a better financial decision.

We provide you with the following for every credit union:

- Rating history, where you can see the institutions prior safety ratings along with the major financial highlights.

- Comparison Report to compare against three other institutions side by side.

- Industry comparison to see where a credit union stands amongst its peers.

- And we even give you glossary to look up terms used.

Insurance

Seems like almost every day the Mother Nature forces leave a path of destruction in various corners of the country. Property gets damaged and sometimes people get hurt too and when that happens we count on our insurance companies to help us out. Whether it’s a new roof, car repairs or a medical bill, we rely on them to cover most and maybe all of the expenses. But how do you know if your insurer will be able to pay up? Well, that’s where Weiss Ratings steps in with its unmatched accuracy in insurance ratings and easy to understand ratings system.

We give you ratings on over 3,600 insurers, from which you can pick and choose the ones to entrust your life and property with.

Select “Recommended Insurers by State” and see the highest rated institutions in your area.

Or, simply check out all strongest insurers with a Weiss safety rating of A or B.

Failures

Institution Name |

Industry |

State |

Total Assets in Millions |

| Health Republic Ins of New York Corp | Insurance | NY | 525.3 |