Sure, 2017 was a good year for the stock market, but it was a really amazing year for Bitcoin and other cryptocurrencies. The S&P 500 rose 21.4%. Bitcoin soared 1,403%.

Yup, 64 times better than the S&P 500!

|

The world’s second most popular cryptocurrency, Ethereum, was up by 10,000% last year. This means that a modest $1,000 investment would have turned into almost $1 million!

The average cryptocurrency was up by 3,300% last year. Which is, as far as I know, the best year for ANY asset class in the history of the world.

Whether you think Bitcoin and other cryptocurrencies are good or bad probably depends on your age. Most people in my age group think cryptocurrencies are stupid, while most people my children's age think they are brilliant.

But whether you're a hip millennial living in your mother's basement or an old fart with gray hair like me, you need to familiarize yourself with the underlying technology that makes cryptocurrencies possible.

I'm talking about blockchain technology — and you need to learn about it. That's because blockchain is going to not only change your life for the better, but it could also make you very rich.

Most people associate blockchain with cryptocurrencies like Bitcoin. However, blockchain has many, many more applications beyond cryptocurrencies.

Such as? You need to be a super computer nerd to really understand the inner workings of blockchain technology. But what it does is actually quite simple: Blockchain is an incorruptible global digital ledger of economic transactions.

Think of the board game Monopoly. Instead of having a banker (centralized) that handles all the transactions, blockchain is like having every player keep simultaneous track of all transactions and jointly verify every single one of them.

|

This creates four key, valuable benefits:

• Decentralization means that data on a blockchain isn't stored in a central location, but rather on servers all over the world. This prevents any corporation, government or cybercriminal from gaining control of the network.

• Blockchain eliminates the need for intermediaries. Transactions on blockchain networks can strictly peer to peer, between a sender and a receiver; no intermediary.

• Blockchain-based transactions are processed 24 hours a day, seven days a week and usually are lightning-fast. Processing and settlement times drop from days to seconds.

• Blockchain-based transaction are secure. As the name implies, each transaction is a chain of digital "blocks" that contains records of transactions that are connected to all the blocks before and after it.

OK, what does that mean in real life? Here's just one of the many real-life problems that blockchain can solve.

FACT: According to the International Criminal Policing Association (Interpol), more than a million people die each year from counterfeit drugs.

One million!

In fact, the World Customs Organization estimates that there are now "more fakes than real drugs in the market."

|

Image credit: OliverWyman.com

Meanwhile, the World Health Organization estimates that the counterfeit pharmaceutical industry is worth $75 billion a year. The reason is that producing/selling fake medicine is 10 to 25 times more profitable than selling illegal narcotics.

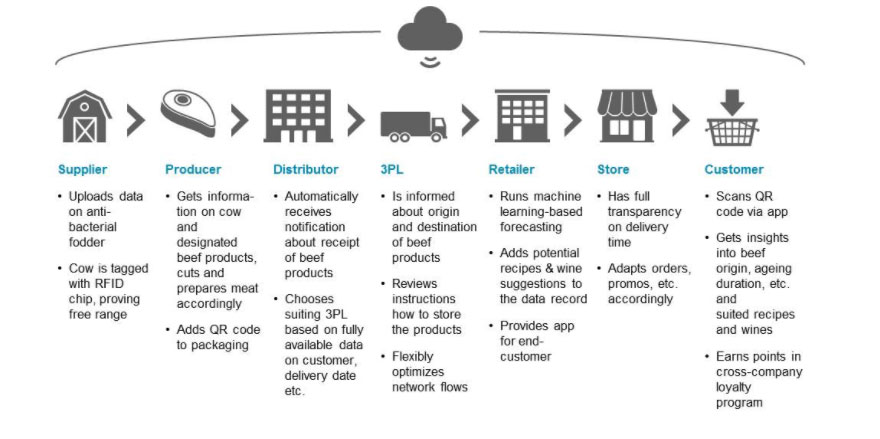

With blockchain technology, every link in the pharmaceutical supply chain — from manufacturer to distributor to transporter to drugstore to your mouth — can contribute data to a chain that verifies the authenticity of every pill.

A user-friendly mobile app can check each pill's entire history and would be able to trace the origin of every pill.

In short, blockchain technology can destroy the counterfeit business model because it uses the same encryption that protects Bitcoin and all cryptocurrencies.

My point isn't that you should or shouldn't invest in cryptocurrencies, including Bitcoin. Instead, my point is that you absolutely should invest in companies that will dramatically grow their profits from adoption of blockchain technology.

And let me tell you; investing in blockchain is going to be bigger than the Beatles. Even bigger than the internet.

Best wishes,

Tony Sagami

P.S. Weiss Ratings, the nation’s leading independent rating agency of financial institutions, recently gave Bitcoin a B- rating. To get our Weiss Cryptocurrency Ratings sent straight to your inbox every Thursday afternoon, click here.