Booming U.S. oil and gas production means big profits for pipeline operators

|

|

Sarah Palin is probably pretty delighted that Donald Trump is the president. Not because they're both Republicans, but because she is no longer the most-hated conservative politician in American.

One of Palin's most famous campaign slogans from the 2008 presidential election was "Drill, baby, drill!" This summarized her solution to America's energy independence.

Love her or hate her, she was absolutely right about the vast reserve of oil and natural gas lying beneath our feet. According to the U.S. Energy Information Administration, domestic oil production is at an all-time high, and it's set to increase by another 2 million barrels per day by 2020.

That's just oil. The natural gas story is even better …

The U.S. is now a net exporter of natural gas, and we are quickly turning into a natural gas superpower. The EIA expects natural gas production to increase by 8% this year to 90.2 billion cubic feet per day and hit 92.2 Bcf per day in 2020.

Of course, after you produce all that oil and gas, you need to deliver it to the people and businesses that need it.

That's a problem because of the aggressive opposition to pipeline projects. Remember all the Keystone XL and Dakota Access pipeline protests?

|

I was surprised to recently learn, however, that the pipeline blocker-in-chief, Barack Obama, believes that he deserves the credit for our newfound energy independence. In his words:

"You wouldn't always know it, but (American energy production) went up every year I was president.

"That whole, suddenly America's like the biggest oil producer and the biggest gas — that was me, people."

Really?

Frankly, I've never understood the objection to pipelines, which have a substantially safer record than trucks, railroads or ships.

However, I do understand that there are lots of intelligent, reasonable people who vehemently object to pipelines.

But the ones who live in New York state are about to find out that there are negative consequences to that opposition …

Utility company Con Edison announced that it will not take on any new natural gas customers because of a shortage of natural gas. It cited new buildings, new businesses, and conversions from coal to natural gas in existing buildings.

In a statement this week, the company said:

"As a result, and to maintain reliable service to our existing natural gas customers on the coldest days, we will no longer be accepting applications for natural gas connections from new customers in most of our Westchester County service area beginning March 15, 2019."

Another utility, National Grid, has issued similar warnings. "New-customer cutoffs in the city may be just around the corner," reported the New York Post.

|

The reason for the supply shortage is not because there is a shortage of natural gas.

Rather, the reason is that the state of New York, under Gov. Andrew Cuomo, has consistently opposed new pipeline projects. And that's because of pressure from the anti-fracking, anti-pipeline environmental crowd.

Cuomo and environmentalists are pushing for renewable sources of energy — solar, wind and geothermal — to replace natural gas. And sure, it may happen years into the future. Just not today or anytime soon.

In the meantime, not enough natural gas is reaching people and businesses that need it.

Without access to natural gas, construction and development in the affected parts of New York is about to come to a screeching halt.

- State Assemblywoman Amy Paulin, from Scarsdale, said it's going to "devastate" local development.

- Mayor Noam Bramson, from nearby New Rochelle, said, "This obviously has serious potential implication for our entire region."

- Yonkers Mayor Mike Spano said, "Developers are already telling us they can't build more housing or commercial buildings until this is resolved."

Hopefully those politicians will connect the dots, realize that THEY are the problem, and open their minds to realistic solutions.

Look, I'm all for renewable energy, and I look forward to the day when it satisfies most of our energy needs. But New York, as well as many other parts of our country, needs gas today.

Unfortunately, this constant opposition to pipeline projects is unrealistic. And it's a serious economic headwind to meeting this growing energy need.

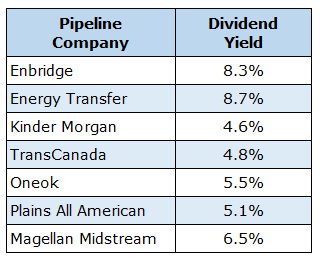

Meanwhile, companies that own existing oil and gas pipelines are swimming in money. I'm talking about companies like Enbridge (ENB), Energy Transfer LP (ET), Kinder Morgan (KMI), TransCanada Corp. (TRP), ONEOK Inc. (OKE), Plains All American Pipelines (PAA) and Magellan Midstream Partners (MMP).

And if you like dividends, each one of the above stocks pays an annual dividend of 4% to nearly 9%.

|

| Data source: Dividend.com |

If you're more of an ETF investor, there are two ETFs that focus on pipeline stocks: Alerian MLP ETF (AMLP) and JPMorgan Alerian MLP (AMJ).

In fact, the more the environmentalists oppose pipelines, the better for the above companies and funds.

Someone who knows a whole lot about oil, natural gas and all kinds of other commodities that are in strong cycles — and especially in supercycles — is my colleague Sean Brodrick. And he's hosting an event Tuesday, Jan 29 at 2 p.m. Eastern where he's revealing his stunning predictions for 2019 to 2023.

Click here to let him know you're coming. His cycles research has predicted every major crisis and every major bull market in the last 30 years, so it may be well worth your time to see what he has to say.

Best wishes,

Tony Sagami