[Image: Surface Coal Mine, Gillette, Wyoming by Greg Goebel [CC BY-SA 2.0] via Wikimedia Commons]

With the energy sector struggling to maintain its steam and companies going bankrupt, we’ve decided to take a look at energy stocks and give you some insight on what’s going in the industry based on our ratings’ analysis.

We reviewed 997 Weiss rated energy stocks:

- Out of those 997 stocks only 5 are in the Weiss BUY category (rated A+ down to B-), or just 0.5%

- 111 (11.1%) have HOLD recommendation (rated C- to C+)

- And 881, or 88.4% of all Weiss rated energy stocks are a SELL (rated D+ through E-)

We also prepared a list of 19 worst energy stocks using the exact same tools that you can access on Weiss Ratings website.

These stocks have all of the below criteria:

- Are rated D or E (SELL)

- Had a 52-week low within the last 30 days

- Did not make any money year-over-year as of the most recent quarter

- And did not generate any cash from operations for the same period

- Are not OTC stocks

We went even further to pick out the 10 worst stocks out of those 19.

| Company Name | Ticker | Weiss Investment Rating as of 5/9/2016 |

| MCW Energy Group Limited | MCW.V | D- |

| CARBO Ceramics Inc. | CRR | D |

| Summus Solutions N.V. | SS.V | D |

| Gulf Island Fabrication Inc. | GIFI | D |

| Logan International Inc. | LII.TO | D- |

| Lightstream Resources Ltd. | LTS.TO | E+ |

| Tuscany Energy Ltd. | TUS.V | D- |

| Questfire Energy Corp. | QB.V | D |

| Petrus Resources Ltd. | PRQ.TO | E- |

| Amyris, Inc. | AMRS | D- |

We looked at a few recent bankruptcy filings by energy companies and provided you with Weiss Investment Ratings history on them to show the rating movement prior to the bankruptcy. The three companies mentioned below had been downgraded by Weiss before their bankruptcy filing.

| Company | Ticker | Bankruptcy File Date | Weiss Rating History |

| Midstates Petroleum Co | MPOYQ | April 30 | Downgraded to E+ on April 8 |

| Ultra Petroleum Corp | UPLMQ | April 29 | Downgraded to E+ on March 11 |

| Peabody Energy Corp | BTUUQ | April 13 | Downgraded to E+ on March 23 |

Keep in mind, all of this information and the tools are available to you, as a subscriber, on our website. You can get an unbiased opinion and accurate facts on any of our investment ratings.

Stocks

Comcast (CMCSA) is about to buy Shrek, Kung Fu Panda, Madagascar ... The deal to acquire DreamWorks Animation (DWA) for $3.8 billion was announced on Thursday April, 28 and is expected to take effect by the end of the year.

The announcement contributed to a 24 percent increase of DreamWorks shares closing at $39.95 on Thursday, April 28. The price went up a bit more last week, closing at $40.01per share on Friday, May 6.

Comcast was upgraded to A- by Weiss Ratings on May 2 and DreamWorks received an upgrade to a C on May 3.

Check out all upgraded and downgraded stocks by Weiss.

ETFs

The gold fever is picking up with the price climbing over the $1,300 mark and hitting a 15 month high on May 2nd. Investments with emphasis on gold have benefitted from the rise.

Some Weiss rated commodities precious metals ETFs show strong year-to-date returns but all have HOLD or SELL recommendations by Weiss.

Mutual Funds

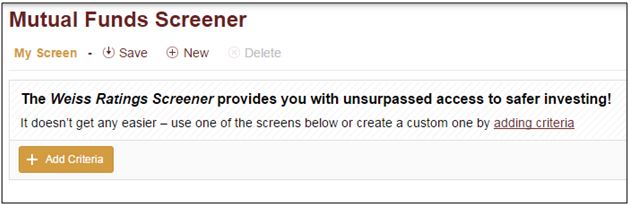

Weiss Ratings analyses over 27,000 mutual funds assigning every one of them with an investment rating.

Our mutual fund page allows you to view the Mutual Fund of the Day, see all funds with a rating change, or view BUY, HOLD, and SELL mutual funds.

Utilize the Weiss Ratings mutual funds screener to slice and dice thousands of funds in search for the best of the best.

Banks

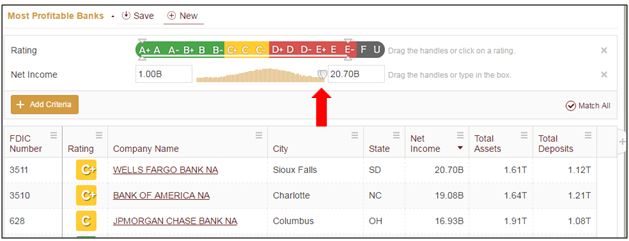

We give you the top 25 most profitable banks. These banks had a net income of at least $1 billion in Q4, 2015 and are listed in a descending order.

Take a look and see if your bank is on here. You can also see the safety rating, total assets, and total deposits on this pre-set screener.

You may add additional criteria to narrow down your search even further. Or, drag the handles on “Net Income” bar and expand the results.

Credit Unions

Did you know that credit unions can convert to banks?

This doesn’t happen very often, but with limited field of membership and a cap on small business lending, some credit unions choose to apply for a charter-change in order to stay competitive with banks and expand their business. Such conversions allow an institution to serve everyone, not just the limited groups of people and there’s an opportunity for additional small business lending, which is heavily regulated in the credit union industry.

The major downside to this conversion is that banks have to pay federal income tax, whereas credit unions are exempt. The conversion must be agreed upon by the credit union members and an application submitted for the state and federal regulators approval.

Insurance

The Florida Office of Insurance Regulation has approved the take-out of 15,000 personal residential policies from the state government backed Citizens Property Insurance Corp for the July 19 period. These policies will be assumed by Southern Oak Insurance Corp.

Want to see the safety rating on your homeowner’s insurer? Click here and simply begin typing your insurer’s name in the search bar at the top of the web page.

Failures

Institution Name |

Industry |

State |

Total Assets in Millions |

| Trust Co Bank | Banks | TN | 20.7 |