Global markets were taken by surprise on Friday when the votes were counted in the U.K., as it became clear that Britain was going to leave the European Union (EU) after more than 40 years. Many, including Brexit supporters, were skeptical about the exit, thinking the demand to exit was over-hyped, and the Bremain vote would hold the day, much like the 2014 Scottish vote to separate from the United Kingdom.

Many of the initial market drops were simply taking back gains that had already factored in a Bremain victory. The biggest casualties were the UK Prime Minister, David Cameron, who has announced his intention to resign as soon as a successor was appointed, and the British Pound that dropped to the lowest point against the U.S. Dollar since 1985. Early morning trading on Monday didn’t help the Pound either.

The Dow Jones Industrial Average Index was down over 600 points or 3.4 percent by the time the markets closed last Friday while S&P 500 lost 3.6 percent.

Despite the Chancellor of The Exchequer (U.S. Treasury Secretary equivalent), and the head of the Bank of England both putting out statements to try to steady the markets it has become clear that there is turmoil ahead. There is no tangible plan for an exit from the E.U. from either the U.K. or E.U. Legislation allowing for a member country to exit is so vague it clearly never anticipated being enacted, especially from a major member.

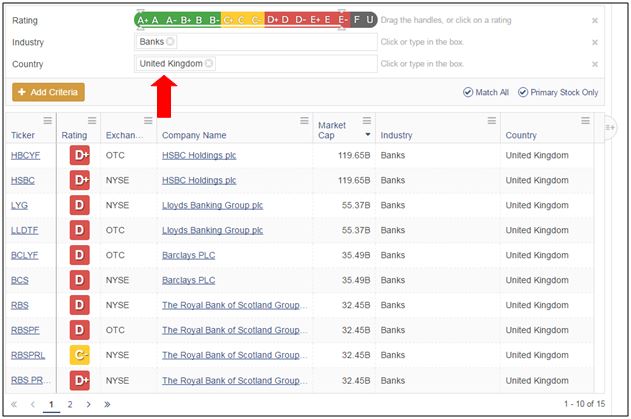

Banks were among the many businesses affected by the U.K. decision to leave the European Union with RBS down 24% and Barclays down 18% Monday morning. Here you can see the U.K. based bank stock ratings reflecting mainly SELL or HOLD ratings with a few BUYS.

You may change the country selection in the pre-set screener and see how other country based bank stocks are rated by Weiss. Simply begin typing the country name or click in the box and select from the drop down menu.

Businesses around the globe are bracing themselves for the difficult times ahead created by the exit vote. Companies operating in the U.K. can expect new regulatory hurdles, which may put a financial strain leading to possible job cuts and hinder current trade agreements. This may result in new regulations and added expenses for all involved.

The U.S. will be affected by the decision to leave the E.U. as imports become cheaper and trips to the U.K. become attractive with a weaker Great British Pound. Gold may well rise in value and the potential for both inflation and a static economy (stagflation) in the U.K. and a negative effect on the already weak E.U. as our largest trading partner could be bad for exports.

The U.K. will now have to face the permanent consequences of what was perceived by many as a protest vote against immigration, trade, and subsidies to poorer countries. Many are already questioning how that vote became their reality and are regretting taking that decision. Even though they were not entirely happy with the status quo they didn’t mean to throw the baby out with the bath-water.

Stocks

Weiss Ratings rates over 9,500 stocks daily giving you an opportunity to follow your currents investments and empowering you to pick the best new options. With the recent turmoil in the global markets due to Britain’s exit from the European Union be sure to keep an eye on your investments as many businesses will be and already being affected.

Add any stock to your watchlist and we will send you an email every time a change in rating takes place.

Or, check out the stock of the day and the most recent rating changes.

ETFs

With investment ratings on over 1,600 exchange-traded funds Weiss Ratings empowers you to make better financial decisions when investing your hard earned cash. Custom reports and search filters allow you to find an investment option that fits your needs the best.

Take a look at ETFs with 52-Week Highs or 52-Week Lows.

Take a look at all Weiss BUY (A or B rated) or Sell (D and E rated) ETFS, or maybe take a look somewhere in the middle on the HOLD (C rated) list.

Mutual Funds

Using Weiss Ratings mutual funds screener, we created a list of the highest rated and best performing funds in 2016. With our powerful screener tool we looked for only the BUY funds with a year-to-date total return of 15 percent or more. The search criteria generated over 40 mutual funds.

You can see that there are quite a few funds with year-to-date total returns reaching well over 20 percent. We created this list for you, but you have the power to modify it in any way you want.

To adjust the return criteria, simply drag the handle or type in the box. To add any additional criteria, click on “+Add Criteria”.

Banks

Weiss Ratings, the nation’s leading independent provider of bank, credit union and insurance company ratings, analyzed Q1, 2016 data and rated over 6,000 banks.

Weiss Ratings recommends that consumers do business with institutions rated B+ or better. Currently, 1,540 banks, or 25.5 percent, are rated B+ or better, meriting inclusion on the Weiss Recommended List.

You may also check out our pre-set popular lists:

- All Largest Banks with assets of $10 billion or more

- Banks with Most Deposits

- Largest Recommended Banks

Or use the banks screener to build your own.

Credit Unions

Did you know that credit unions have credit unions? In other words, there are corporate credit unions that service other credit unions which then service their members.

Corporate credit unions are owned by a group of member serving credit unions and offer services such as long or short-term investments, provide check clearing, electronic funds transfer, ATM networks and transaction services. There are only 12 corporate credit unions in the U.S. and nearly all consumer facing credit unions belong to one of them.

Insurance

Find all recommended (rated B+ or higher) insurers in your state. Click here to select the state and the type of insurance you’re looking for. Click “View” once you’ve made your selection.

You may also see the weakest insurers in your state. Select your state and insurance type and you will see a list of all D and E rated insurers offering a specific type of coverage.

You may also check out Weiss safety ratings on all insurers and use our insurance screener tool to narrow down your selection and find what you’re looking for.