Buy, Hold & Pray: America's Most Popular (But Dangerous) Investment Strategy

One-in-four Americans observe Lent. Most who do, give up something, like a favorite food or beverage.

One Good Friday many, many years ago when I was a young and mischievous boy, I suggested to my mother that she should give up spanking for Lent.

Of course, that didn't go over well with my mother, but I didn't get spanked that weekend. She did, however, scrub my siblings and I so thoroughly on Sunday morning that we had to be the cleanest children alive at Easter service.

Regardless of what faith you follow — if any — any day is a good time to think about what you can do to become a better parent, a better friend, or just a better person. And I hope you spend this day with people you love.

Both the stock and bond markets are closed for the Good Friday holiday. It's a nice reprieve from the past two months of wild trading action. So, let's take this quiet time to regroup and come up with a game plan to put in place before we encounter a bear that won't back down.

Buy, Hold & Pray: America's Most Popular (But Dangerous) Investment Strategy

The official definition of a bear market is when the stock market falls more than 20% from a 52-week high.

But even after losing a combined 1,148 points last Thursday (down 724 points) and Friday (down 424 points), the Dow has yet to fall into bear-market territory. And through Wednesday's close, the S&P 500 is only down 9% from its high.

Moreover, it has been so long since the last bear market — 2007-'09 — that a lot of newer investors have no idea what to expect. It is this lack of "tough times" experience that has so many investors bewildered about what to do.

In fact, a recent survey from Country Financial shows that nearly half of Americans don't have any idea what to do during the next bear market.

|

I suspect this deer-in-headlights attitude is largely because only 23% of investors expect the stock market to keep falling.

However, "wishful thinking" is not a successful strategy. It's also why I have always believed that the biggest enemy of a retirement savings account is the investor him or herself — not the stock market.

In short, while bear markets are painful, there are several ways to survive a period of falling stock prices ...

Bear Market Strategy No. 1:

Dial Down Your Stock Allocation

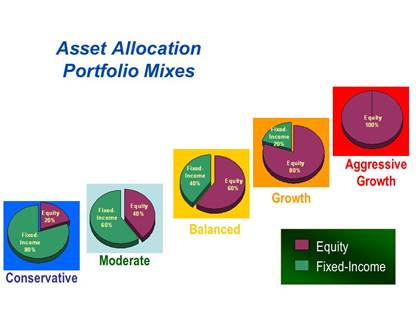

My experience is that most investors can handle 8%, 10%, 12% or even 15% drops in the value of their account. But there is a panic point that triggers a powerful "make it stop" reaction.

Everybody has a different point, but many investors panic after their account loses 20%, 30% or 40% and sell everything.

|

If your account is 100% in stocks, then you indeed will see your account shrink by 20% to 40% in a bear market. If that is above your tolerance zone, then you should drop your stock allocation from 100% to about 60% to 75% instead.

If all this financial stuff bores you to death and you don't want to bother with it, you could at least invest in a "target date" fund. It operates under an asset-allocation formula that assumes you will retire in a certain year, and automatically adjusts its asset allocation model as it gets closer to that year.

|

For instance, if you plan to retire in or near 2030, you would pick a fund with 2030 in its name. Vanguard, for example, offers target dates funds in five-year increments from 2020, 2025, 2030, 2035, 2040 ... all the way up to 2065.

Bear Market Strategy No. 2:

Predetermined Sell Points

Gut feelings or instincts are lousy excuses for investment strategies. I recommend that you use either (a) trailing stop-losses or (b) simple moving averages as predetermined selling points.

Stop-losses are like car insurance deductibles. A $1,000 deductible on a $20,000 car means that you have to absorb the first $1,000 loss, but nothing beyond that. The same principle is true of a stop-loss and I recommend 15% to 20%.

Moving averages are technical analysis indicators that measure the trend of a stock, ETF or index over a specified time frame. Moreover, moving averages also help you detect trend reversals and get you out before the small loses turn into big ones. The two most-popular moving averages are the 50-day and 200-day MAs.

Bear Market Strategy No. 3:

'Buy Your Straw Hats in January'

That was one of my father's overused slogans, and it meant you should wait for sales before spending your money.

Stock market investors are the only people who seem to enjoy paying more for stocks, the more expensive they become. Instead, develop a bargain-hunter mindset and be a buyer during bear markets.

This is especially true for investors with time on their side. That's because bear markets give you a chance to accumulate shares at lower prices. If you still contribute to a 401(k), your new contributions will be buying at lower prices, which will boost your account balance when the market eventually rebounds.

The risk is not the next 20% downturn, but rather missing out on the next 100% rebound.

Bear Market Strategy No. 4:

Portfolio Insurance

You can also buy investments that are designed to increase in value as the stock market falls, such as 'put' options and inverse ETFs.

|

An inverse ETF, also known as a "bear ETF," is designed to return the exact opposite performance of a certain index or benchmark. The above chart shows the performance of the ProShares Short S&P 500 ETF (SH) vs. the S&P 500. You can see that SH (blue line) has started to rise in value as the S&P 500 (orange line) has started to fall.

Of course, as the above chart also shows, inverse ETFs can and do lose money when the index is moving in the upward direction. So, use them with caution. Also, be sure to avoid the worst ones.

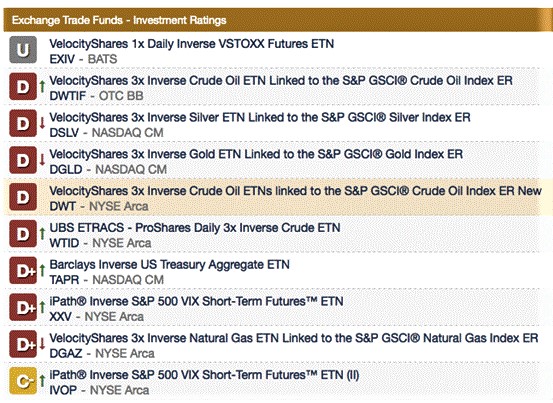

Here are the 10 lowest-rated inverse ETFs from Weiss Ratings:

|

Lastly, never forget that the very worst, worst thing you can do is what half of Americans told Country Financial they are going to do: nothing!

Buy, hold and pray is not a solid investment strategy in a bear market. The good news is, we aren't in a bear market. But if the bear does return, these four strategies will help keep your portfolio from getting gored.

Best wishes,

Tony Sagami