|

One of my friends — one of my richest friends — built himself a mini-empire of auto dealerships. And like many businessmen, he was forced to close his showrooms in the wake of the lockdowns. His sales have dwindled to almost nothing.

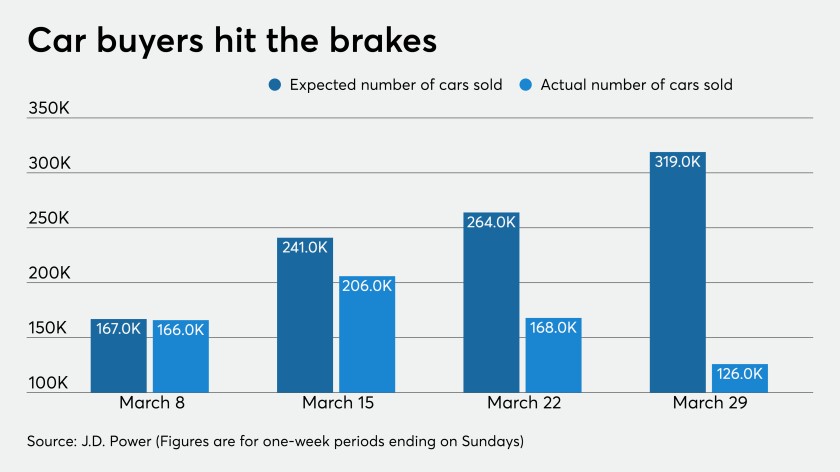

In March, auto sales dropped by 32% from February, marking their lowest level since the 2008-09 Financial Crisis. Even that understates how bad the problem is. After all, most of the U.S. didn’t go into lockdown until mid-March.

I asked my friend about the month of April and he gave me one of those “are you stupid” looks. ’Nuff said.

|

My friend employs hundreds of people — salespeople, mechanics and bookkeepers. He has been forced to lay them all off. It’s truly sad.

One thing my friend is very worried about is his vast used car inventory. I was surprised to learn that he makes more money on used cars than new cars, but the value of his inventory is falling fast.

|

The Manheim Used Vehicle Value Index, a widely used benchmark of used car prices, has dropped by 11% in just the last month and is down 10% on a year-over-year basis.

The last time used car prices dropped this much was during the 2008-09 Financial Crisis. Oops; there’s that pesky 2008-09 comparison again.

“Nightmare Scenario”

The combination of zero sales and falling used car prices is a perfect storm for catastrophe.

As the coronavirus forces consumers to stay at home and pinch pennies, auto dealers are facing a surplus of inventory and flatlining demand. Todd Caputo, CEO of Sun Auto, compared today’s market to that of 2008. But, he says, it’s worse today.

“There aren’t a lot of people in gloves and masks running out to buy cars. Auctions are mostly shut down and they’re filled with cars that have no buyers,” noted MaryAnn Keller, an automotive industry analyst.

Dale Pollack of Cox Automotive, the largest auto-auction in the United States, reveals that the pain in the used car market won’t abate when the virus does:

Six months from now, there will be huge, if not unprecedented, levels of wholesale supply in the market. Cars are coming in, but they aren’t selling. Today’s huge supply of wholesale inventory suggests supplies will be even larger in the months ahead.

And if that isn’t bad enough, Hertz, one of the largest car rental companies in the U.S., is teetering on the brink of bankruptcy. They’re rumored to begin selling tens of thousands of cars to partially pay off creditors.

This wave of forced selling will push used car prices down even further. There is no other way to put it: The auto business is in big trouble.

It may surprise you, but there are six publicly traded auto dealerships:

- Asbury Automotive Group (ABG)

- AutoNation (AN)

- Group 1 Automotive (GPI)

- Lithia Motors (LAD)

- Penske Automotive Group (PAG)

- Sonic Automotive (SAH)

I wouldn’t touch any of them. In fact, there is one under-the-radar and overvalued auto lender that is performing so awfully, I’ve recommended put options on it to my Stock Options Hotline subscribers.

Put options are investment vehicles that aggressive investors can buy if they expect the price of the underlying stock to fall within a certain time frame. With put options, you can double, triple, quadruple or even more times your money in a very short period of time.

Stock options aren’t for the faint of heart. They are volatile and move very fast. However, the risk is limited to the amount of money you invest and the potential for rewards is gigantic.

As with any type of investing, you’ll need to determine your tolerance for risk. But with my friend and other industry experts being extremely bearish on the overall auto industry, investors shouldn’t turn a blind eye to the potential opportunities in put options.

Best wishes,

Tony Sagami