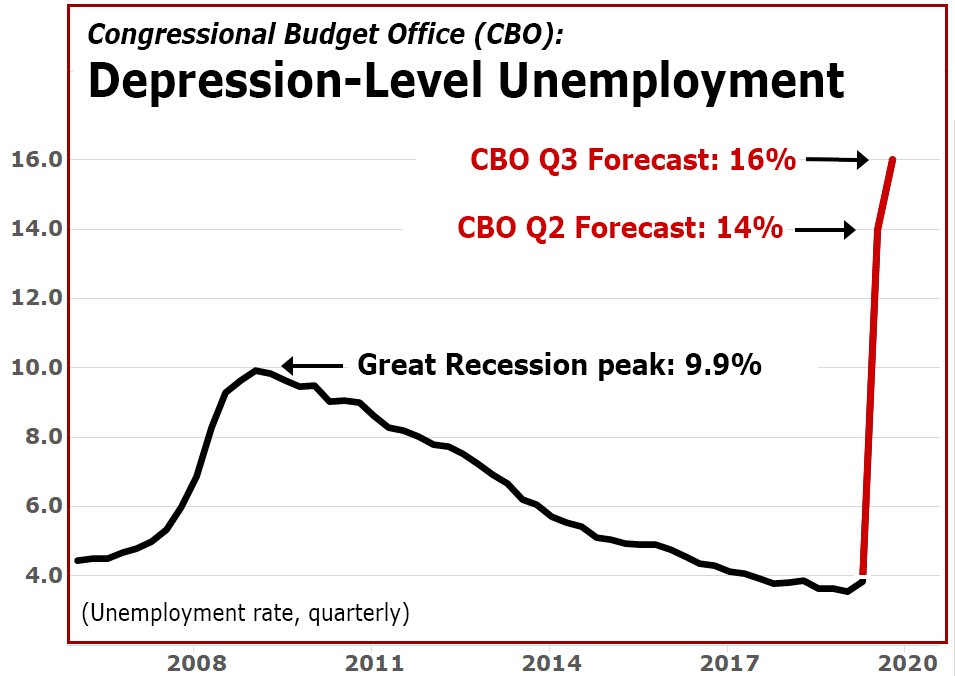

CBO: This Will Be Far Worse Than the Great Recession

|

The U.S. Congressional Budget Office (CBO) is one of the few institutions in Washington that’s still nonpartisan.

Its forecasts are objective and impartial.

But right now, they’re also shocking.

Case in point:

The CBO forecasts that the U.S. unemployment rate will surge to an average of 14% in the second quarter and 16% in the third quarter.

Even the lower, second-quarter forecast is four points higher than the peak unemployment rate of the Great Recession.

Our chart tells the story …

|

And, unfortunately, that’s just the beginning of the jobless horror story. Here’s why …

First, the CBO admits it’s largely basing its forecasts on the 26.4 million people who filed for jobless benefits through April 18. But what about the millions who are likely applying in the coming months?

Second, the CBO underestimates the vicious cycle that always drives the economy into a far deeper hole than official forecasters dare talk about in public:

Companies lay off millions of workers.

The laid-off workers cut spending to the bone.

The spending cuts instantly gut company earnings.

And, the gutted earnings drive companies to lay off millions more.

Third, the CBO says nothing whatsoever about the tsunami of financial failures that’s already on the immediate horizon.

And the stunning facts are just beginning to pour in …

Credit-Card Disaster

The Wall Street Journal reports that millions of Americans already are skipping their credit-card payments.

What’s worse, Capital One Financial Corp. (COF) and Discover Financial Services (DFS) are letting borrowers pause payments for a month or longer, lowering or waiving late fees and even forgiving some debts.

That way, they figure, they don’t have to report the loans as overdue or delinquent.

What they have not yet figured out is this: Banks are broadcasting the message to millions of employed Americans that they can skip their payments, too!

Mortgage Catastrophe

Black Knight reports that the number of Americans who have stopped paying their mortgages under forbearance programs with their lenders has more than TRIPLED just in the first three weeks of April.

And it has barely begun to surge.

Mark Zandi, chief economist for Moody’s Analytics, says 30% of Americans with home loans could stop paying. Even in the great mortgage crisis of 2008-2009, that number never topped 10%.

What’s worse, last time around, the mortgage mess was spread out over three years. This time, it has hit deep-recession levels in just four weeks.

Tsunami of Bank Failures Ahead

Among U.S. banks and credit unions, 1,381 get a Weiss Safety Rating of “D+” or lower.

This means that, even in a typical recession, they’re at risk of failure.

And in a great recession, thousands more are at risk.

But the evidence is clear that today’s crisis is already worse than the Great Recession.

What This Means for Stock Investors

Corporate earnings are already going up in smoke.

Companies are already slashing their dividends or canceling them entirely.

As a result, their shares got killed in March, and after a normal bear-market rally, they’re about to get killed again.

If history is any guide, stock investors will lose anywhere from half to nine-tenths of their money.

I don’t want that for you.

So, I hope you’re following my recommendation to build cash and stash it in a safe place.

Better yet, this tremendous economic disaster offers tremendous profit opportunities when markets fall.

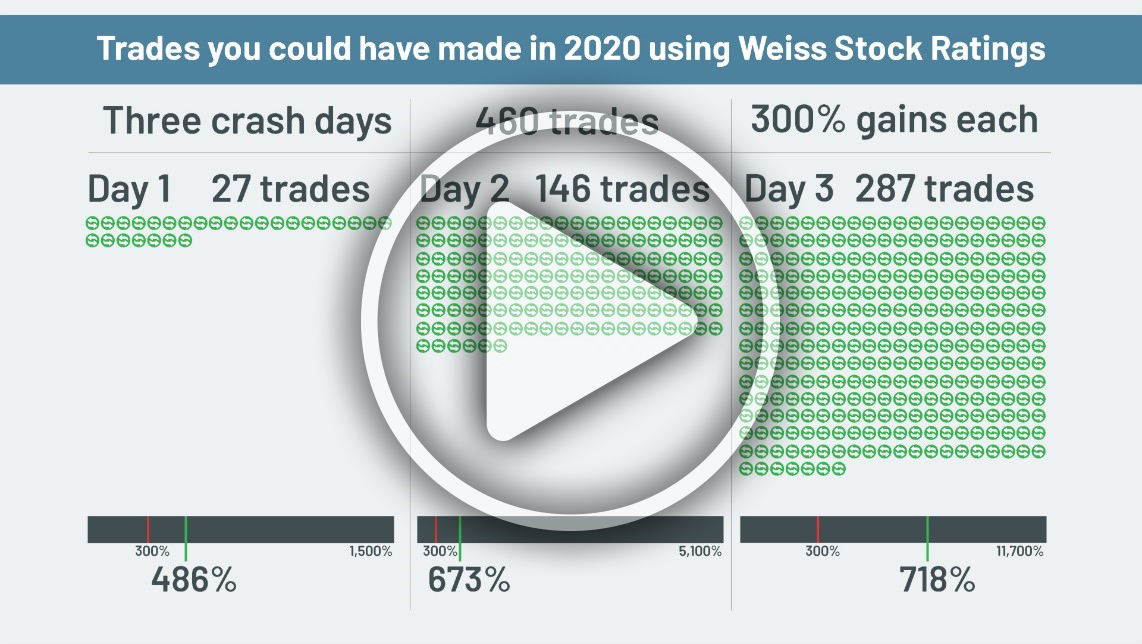

For example, on three crash days in March, I counted 460 distinct bear-market trades selected by our Weiss Stock Ratings. Each one could have made you 300% gains or more:

|

|

This is just one set of high-power profit opportunities I describe in my just-released blockbuster, Collapse of 2020: How to Build Wealth Swiftly |

On the first crash day, we saw 27 trades that returned gains ranging from 300% to 1,500%. The average gain was 486%.

On the second crash day, the numbers went parabolic: We saw 146 Weiss Ratings winners, ranging from 300% to 5,100%. Average gain: 673%.

On the third crash day, it was even better: 287 winners, ranging from 300% to 11,700%. Average gain: 718%.

Even if you invested only $10,000, and even if you chose the least profitable of these trades, you could have made about $30,000 on the first day, $30,000 on the second day, and another $30,000-plus on the third day. That's a total of more than $90,000 in gains.

Or, if you invested those same $10,000 in just the average trades — not the best ones, mind you, just the average ones — you could have made $48,600 on day one, $67,300 on day two, and $71,800 on day three. That's a total of $187,700.

To learn more, watch my half-hour presentation before it’s too late.

As soon as the current rally in the Dow fizzles out, you will have missed the best opportunity to get started.

Good luck and God bless!

Martin