|

This shelter at home stuff is getting old. Just like you, I’ve been cooped up in my home and I am getting pretty antsy.

Thank goodness for online shopping. I’ve been able to order groceries, household supplies and even food from many of my favorite restaurants. Honestly, I don’t know what I’d do without online shopping.

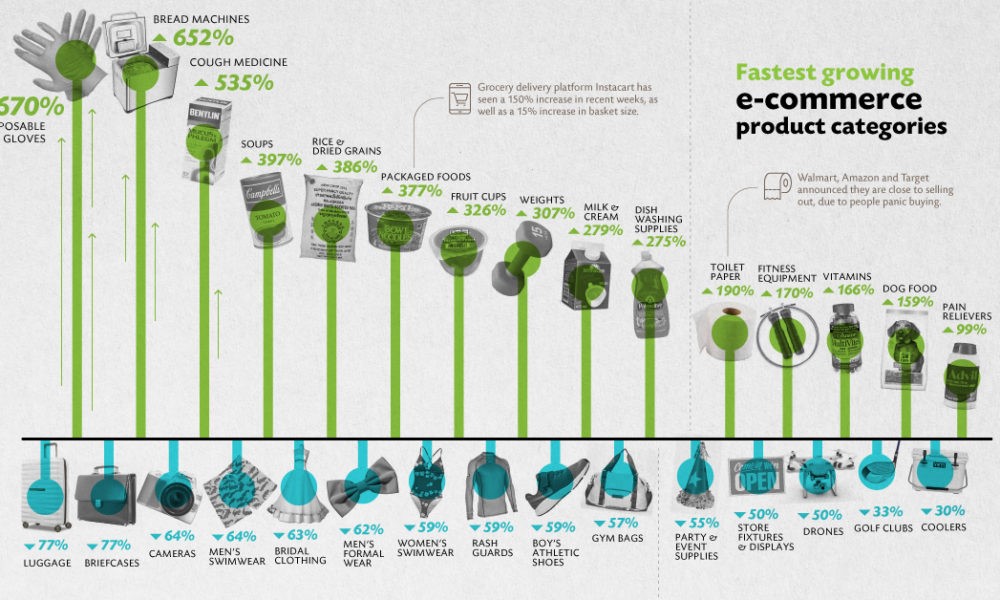

And I’m not alone: Americans are shopping over the internet in massive waves. According to Adobe Digital Insights, Americans increased their online spending by 52% in March 2019. Of these sales, take a look at the fastest growing product categories ...

|

|

Source: Visual Capitalist |

It’s no surprise gloves, masks and cleaning supplies soared while luggage plummeted.

Taylor Schreiner of Adobe Digital Insights said:

“U.S. consumers are turning to e-commerce more during the COVID-19 outbreak due to the fact that social distancing measures and shelter-in-place orders have made online shopping more convenient or, in some cases, the only way to get the goods they need.”

Remember, the shelter-at-home directive didn’t even take effect until the middle of March, so the April numbers will be huge. Like 100%-plus huge.

As investors, there are huge implications and opportunities. And I’m not talking about the obvious winners like Amazon.com (AMZN) and eBay Inc. (EBAY). I’m talking about the behind-the-scenes businesses that make it possible for our orders to show up on our front porch.

Logistics Real Estate? What’s That?

One part of the e-commerce food chain that I think is grossly overlooked by investors is logistics real estate.

Logistics real estate refers to the warehouses, distribution facilities and fulfillment centers that temporarily house the goods you buy over the internet.

Whenever a retailer sells you something, it has to move its goods from point A to B and several warehouse points in between.

With the rapid growth of e-commerce, it has equally increased the need for logistics real estate. According to Bloomberg News:

The growth of online shopping and the desire for quick delivery times has really driven a need for more warehouses, especially in the last mile.” Consumers are demanding fast delivery i.e. Amazon Prime two-day shipping. The more retailers promise speedy delivery, the more the need for logistics real estate soars.

One company that owns more logistics real estate than anybody else is Prologis, Inc (PLD).

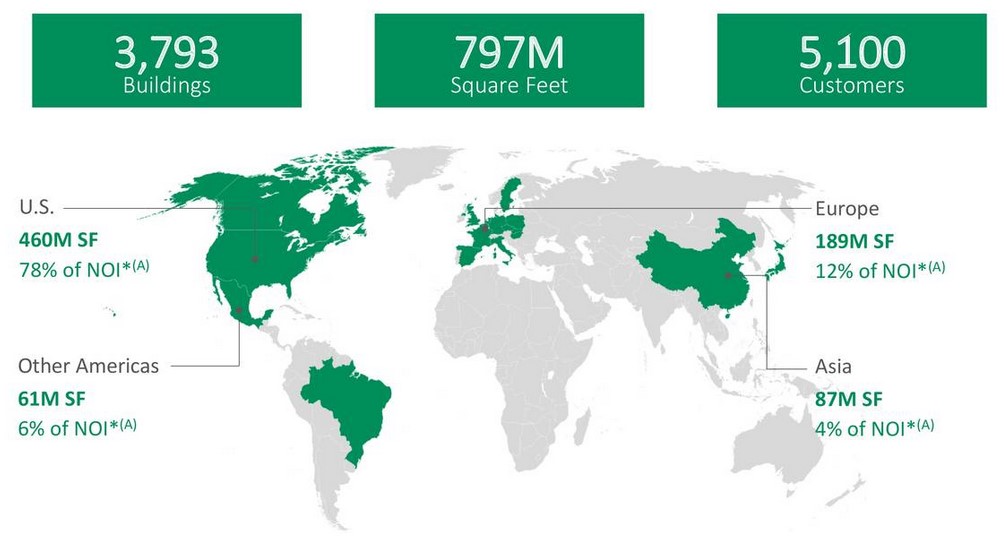

Prologis owns 797 million square feet of prime warehouse distribution space that is specifically designed to temporarily hold and then transfer e-commerce orders to our homes. Not to mention, they own 3,793 building across the globe and have 5,100 customers.

|

|

Source: Seekingalpha.com |

Prologis practically owns this market in North America. With Amazon, FedEx Corp (FDX) and Walmart Inc. (WMT) as Prologis’ three largest tenants, that’s not too surprising.

And business is BOOMING. Moreover, business is so good that Prologis is enjoying a 96%-plus occupancy rate AND has been able to raise its rents by an average of 4.3% over the last year.

The reason for the high occupancy rate is simple: These distribution warehouses drastically reduce the supply chain costs for e-commerce businesses.

According to a new Bank of America Merrill Lynch study in regard to supply chain costs, transportation costs represent 45% to 55%, labor costs 25% to 30% of total shipping costs and real estate rent is only 5% of supply chain costs. In short, the closer a warehouse is to the consumer, the higher the transportation and labor savings.

And there’s no question that the 797 million square feet (and growing) of distribution warehouses that Prologis owns is going to get more and more valuable as e-commerce grows.

But wait, it gets better. E-commerce companies use three times the amount of warehouse space as traditional retailers. That’s because goods packaged for logistics take up more space than pallets of products destined for store shelves.

Prologis is a REIT and must distribute at least 90% of its profits to shareholders. It currently pays a 53-cent quarterly dividend, and the next one will be paid at the end of June.

That doesn’t mean you should rush out and buy Prologis stock tomorrow morning. Timing a trade is still important. However, it is definitely a stock with one of the brightest post-lockdown futures I’ve seen.

That’s because e-commerce is going to keep accelerating, pandemic or not. The real question is, how fast will it grow?

Shop smart and stay safe.

Until next time,

Tony Sagami