Credit markets, foreign stocks and other markets all warn of more turbulence here at home. It's time to play things safe!

|

Last month, I headed out west to speak with investors like you at the San Francisco MoneyShow. Next week I’m heading north of the border to talk to more at the Toronto MoneyShow.

But regardless of WHERE I’m presenting, WHAT I’m presenting is going to be similar. My important message? Several indicators tell me this bull market and economic cycle are entering their dangerous, terminal phases.

You can see it in the volatility market. There, the never-before-seen record calm of 2016-'17 is giving way to increased uncertainty and unease.

You can see it in foreign markets. Stocks, bonds and currencies are collapsing from Jakarta to Istanbul to Moscow to Buenos Aires.

You can see it in the formerly red-hot Initial Public Offering (IPO) market. More garbage, money-losing companies have been coming public than at any time since the peak of the Dot-Com Bubble, but they’re now collapsing in value almost across the board.

You can see it in the out-of-control credit markets. Corporations have been borrowing record-high amounts of money … paying record-low spreads to do so … and frittering that money away on record-high levels of mergers, acquisitions, stock buybacks and other unproductive investments.

But now debt “spreads” are widening out, an indicator that investors are worried all that borrowed money won’t get paid back. And that action has continued since January DESPITE the bounce-back in stocks. Throughout the last few years until January, spreads and equities behaved in a similar fashion — making this a notable divergence.

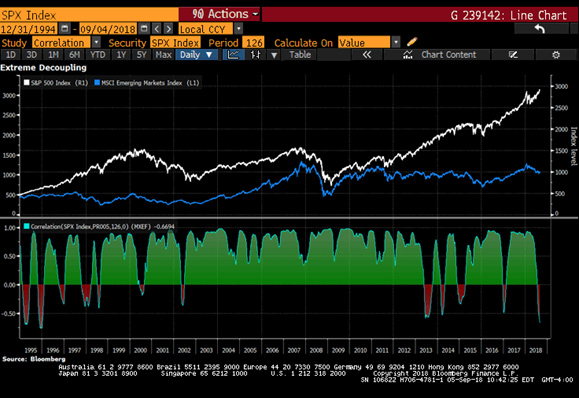

Speaking of divergences, here’s something shocking I came across …

It shows the spread between the performance of U.S. stocks and a broad-based emerging market stock index. You can see in this Bloomberg chart that our markets haven’t outperformed emerging markets to this degree since all the way back in 1996!

|

On the one hand, you could say “Sweet! Go USA!” On the other hand, you could say “Can our markets REALLY keep going up? Even when many of the world’s major indices are falling apart?”

So, my message in Toronto is going to be simple, and similar to what I just told a packed house in San Francisco. That is …

This is NOT the time to be taking crazy risks with your portfolio. This is a time to focus on “Safe Money” stocks. By that I mean higher-yielding, lower-volatility stocks with high Weiss Ratings … and recession-resistant businesses in sectors like utilities, consumer staples, healthcare and Real Estate Investment Trusts (REITs).

Related story: Rankings & Ratings Key — in Fantasy Football AND Investing

Those names are already delivering handsome, sustainable profits for subscribers to my Weiss Ratings’ Safe Money Report, and I have every reason to expect that to persist.

Oh, and if you happen to be in the Toronto area, you can attend the Sept. 14-15 event for free. Just be sure to register first by clicking here or calling 1-800-970-4355. I hope to see you there!

Until next time,

Mike Larson