Death Throes for Macy’s, Kohl’s, JCP and Other Major Retailers?

As we noted in May, Macy’s (Weiss Rating of D+, a Sell) customers are shopping elsewhere in droves. CEO Terry Lundgren clearly agrees. During the Q2 earnings call last Thursday, it was announced that Macy’s will close approximately 100 stores, or 15 percent of the full-line stores it owns.

This news, coupled with Q2 results beating analyst expectations, buoyed the stock price, which rose 17.1 percent on Thursday after the announcement, and ending 14.6 percent up for the week. Investors should note this rise takes place after some poor months of stock performance, and it only returns the price back to where it was on May 2, 2016.

When the CEO of a retail icon, such as Macy’s, comes out and recognizes that a physical location is worth more to the company as a piece of real estate than as a retail store, we have a problem. Breaking up is hard to do, but when does it stop? The plans that Lundgren outlined in the press release about moving with technology and enlarging its digital sales footprint are clearly an effort to try to re-shape the business, and are essential to any future longevity.

Following the story, Weiss modeling concluded retail stores were declining, and during June, Kohl’s (KSS), Dillard’s (DDS) and J.C. Penney (JCP) were also downgraded. It appears the stores are not suffering from a short term problem, but have a chronic disease.

Something must change or we will inevitably see the collapse of at least one of these retailers in due course. Or a merger. And we have seen how mergers succeed. (See Kmart and Sears for that story.)

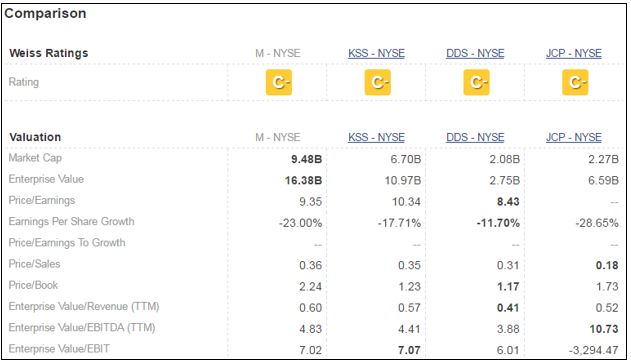

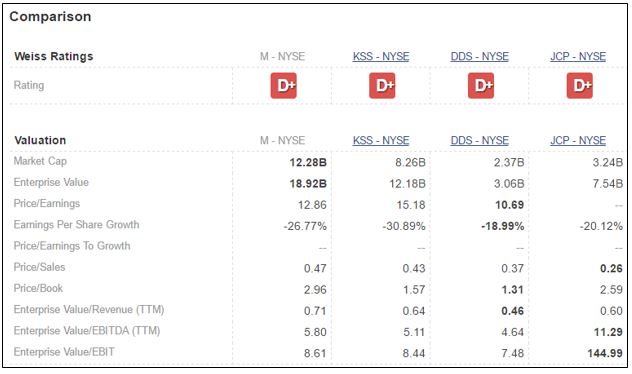

Compare the valuation charts we did both in May, and just now, for these retail competitors. Note that J.C. Penney is still very poor, but appears to have made some progress, unlike its competitors who, for the most part, are in a worse situation than they were previously.

This is what these retailers looked like back in May:

This is what they look like now.

Click here to access Macy’s comparison report where you can add your favorite retailers and set them side by side.