|

Safety-conscious savers and investors face a dilemma unlike any in history.

They have worked hard.

They have foregone luxuries.

And they have tried to build a decent nest egg for retirement.

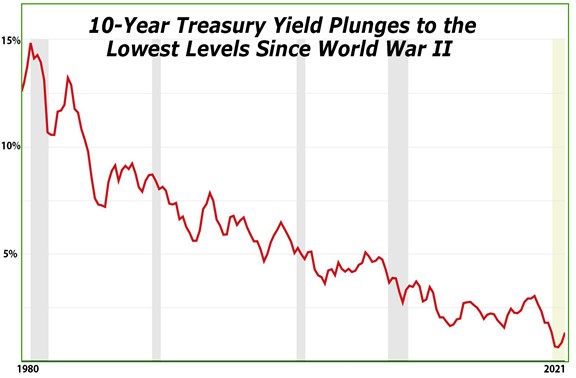

But if you think the Tech Wreck, the Great Financial Crisis or the Pandemic Panic were the primary threats to that goal, take a look at this chart ...

|

That’s right: Treasury yields have plunged to the lowest level since World War II.

In the early 1980s, if you bought a 10-year Treasury note, you could earn a guaranteed 10% yield or more. Even after inflation, it was still a good way to build a personal retirement fund.

In the early 1990s, you could make well over 5% — still not a bad deal.

But now, you can barely make a point and a half.

And even if you go for 30 years, all you can get is a couple of points — before inflation and taxes!

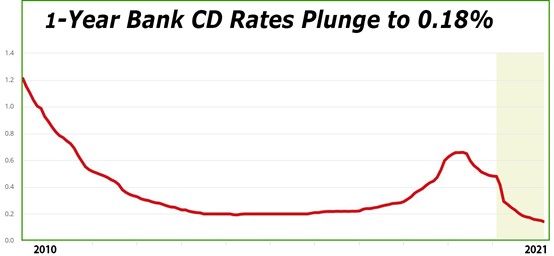

Prefer to just leave your money in a one-year bank certificate of deposit (CD)?

Ugh! That’s even worse:

The average rate on a bank CD today is 0.18%.

|

If you invest $10,000 for a year, all you’ll get is $18.

Barely enough for a cab fare home.

You see, this problem of steadily declining yields didn’t begin with the Tech Wreck, the Great Financial Crisis or any other particular crisis.

It began way back in 1980 and has continued ever since.

It was a fact of life long before the pandemic began.

It will continue as a fact of life long after the pandemic ends. In fact …

Even at the peak rate of the last decade, the very best yield that average savers could earn on bank CDs was still less than 1%.

What’s the solution for average savers and investors?

Watch my inaugural Weiss podcast video and I will give you my best answers.

Good luck and God bless!

Martin