‘Dominators and Disruptors’ Are Another Consequence of ‘Easy Money’

|

There was once a magic money tree that bloomed in never-never land. It bore fruit of golden apples and silver pears all year round. No one wanted for money as they could pluck gold and silver from the tree whenever they wished while the bank of never-never land tended the tree carefully. — South China Morning Post, Feb. 1, 2021 |

I don’t know whether to be proud or worried.

Two of my millennial-age boys have become Reddit day-traders.

One bought GameStop Corp. (NYSE: GME), while the other bought AMC Entertainment Holdings Inc. (NYSE: AMC).

|

It does make me happy that they’re showing an interest in investing while they’re in their 20’s. But I do wish they weren’t basing their stock selection on message-board chatter from anonymous strangers.

Both boys, by the way, were sitting on fat, triple-digit gains. Those giant gains have turned into losses, which I think is a blessing in disguise and a valuable education.

And they invested less than $1,000 each, so we’re not talking about huge amounts of money.

My boys have lots of company. According to Alexa Internet, Reddit is the 18th-most-visited website in the world and seventh-most-visited website in the United States.

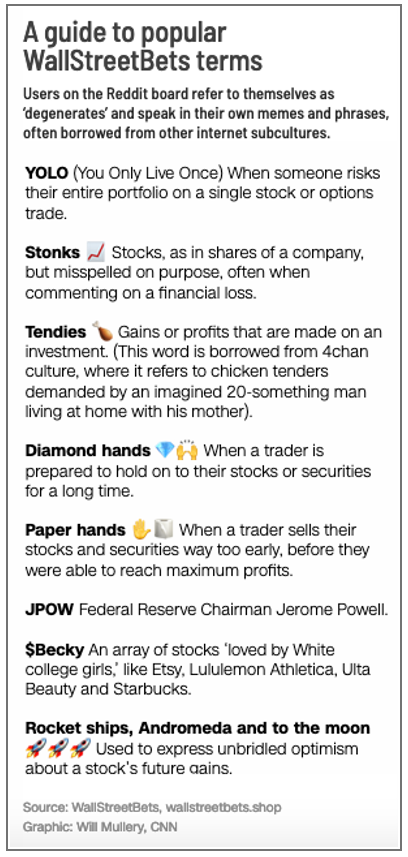

What’s behind this Wild West trading phenomenon?

There are lots of reasons, but I think the primary one is the gigantic increase in money supply. In 2020, the supply of money in the U.S. increased by a staggering 25%, the fastest pace of growth since the Federal Reserve was established.

That’s a consequence of the Fed’s extraordinary monetary efforts, including ZIRP (zero interest rate policy) and QE (quantitative easing), as well as borrow-spend-borrow-even-more approaches by politicians on the fiscal side.

All that newly printed money is sloshing around and spilling into the most unlikely places, such as the 1986 Michael Jordan rookie card that sold for $738,000 last week ... or the GME and/or AMC shares my sons bought.

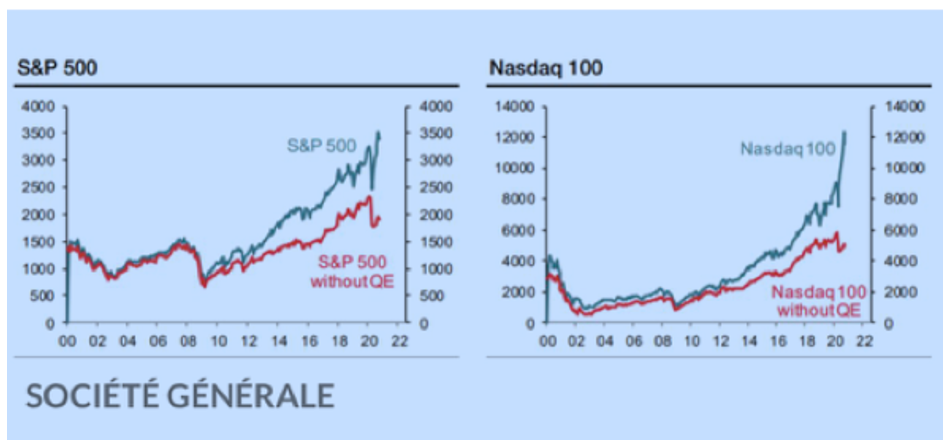

The dollars are pouring into “normal” stocks too, including those that make up the S&P 500 Index and the Nasdaq 100 Index.

Economists at French brokerage giant Société Générale S.A. went so far as to identify how much QE has affected the stock market.

|

As the accompanying charts show, both the S&P 500 and the Nasdaq 100 would be significantly lower without the impact of monetary steroids delivered by our zealous central bankers.

The concept of creating “magic money” isn’t new.

Roman emperors, Henry VIII, the Weimar Republic and present-day Venezuela did the same thing. The argument for “magic money” is that it’s better to print like there’s no tomorrow than risk even a recession, much less a depression.

Of course, each of those “magic money” economies eventually collapsed from excessive speculation, currency debasement and runaway inflation.

Can the U.S. escape the same fate? I’m not so sure ...

That doesn’t mean the stock market can’t go even higher. In fact, that’s exactly what I expect. We’re in the midst of an enormous shift in the way we interact — the way we do business, the way we entertain ourselves, the way we access food.

The way we buy and sell stocks, too.

Of course, this kind of disruption will create losers as well as winners. What the Fed is doing is easing the road for well-placed institutions amid what it perceives to be yet another crisis.

But I recommend you have a clear game plan to protect your profits when the “magic money” runs out.

That could be the use of protective stop-losses, which prevent small losses from turning into large losses. It could be the use of some type of market-timing exit system based, perhaps, on something like 200-day moving averages. Or it could be a greater allocation to cold, hard cash.

It could also be a long-term strategy focused on the companies built to survive and thrive — the “disruptors” that become “dominators.”

I know what won’t work over the long term: buy-hold-and-pray strategies and/or trading-by-Reddit.

Best,

Tony