Ethereum Blasts Through $4,000 Barrier! Here’s What’s Likely To Happen Next …

|

It’s happening, my friend!

|

Right now.

Just as we said it would.

The parabolic phase of the cryptocurrency bull market has begun.

Just this morning, for example, Ethereum (ETH), our No. 1 highest-rated crypto, blasted through the $4,000 barrier and reached a new all-time high of $4,157. (See chart.)

It’s now up 1,852% in the last 12 months alone.

That means if you had invested $10,000 on May 10, 2020, you’d have over $195,200 today.

The surge in Cardano (ADA), also among our highest rated, puts that performance to shame.

It’s up 3,349% in the last 12 months, turning a $10,000 investment into $344,900. Right now.

And if you had bought Ethereum or Cardano when we FIRST called the beginning of this bull market, you could have made much, much more.

But everything we see and everything we know tells us this is just the beginning of the parabolic price explosion we have been predicting.

Here’s why …

First, because the cyclical pattern of this bull market is almost identical to the pattern of all prior bull markets since the beginning of Bitcoin. And THIS is the year of the parabolic phase.

Second, because the price rises in the second half of the parabolic year are always bigger than those in the first half.

In the last bull market, for example, Ethereum rose elevenfold from Jan. 1 through May 10, 2017.

But anyone who thought that was the end was proven dead wrong.

From that point forward, Ethereum went on to rise another sixteenfold!

So even if you started at a time that most people thought was “late in the game,” you could STILL have turned $10,000 into more than $160,000.

And with other cryptocurrencies, like Cardano, you could have done far better.

Third, the Fed has just printed $3.6 trillion in fresh new dollars to pump into the economy and has vowed to keep printing MORE for years to come.

Among investors around the world who have nearly all their money in dollars or dollar-denominated assets, that’s scary as all hell. And it’s driving them to rush into crypto.

Care to guess how much money the Fed printed during the last crypto bull market?

Nothing.

That’s right. During that period, the Fed did not add a dime to its balance sheet assets.

Fourth, big institutions are starting to buy in. In the last bull market cycle, they had virtually zero interest in cryptocurrencies. They thought Bitcoin was useless, worthless or even less than worthless.

Warren Buffett even declared to the world that Bitcoin is “rat poison squared.”

But in this bull market, the big players are starting to jump in. That includes Tesla Inc., (Nasdaq: TSLA), Fidelity, The Goldman Sachs Group (NYSE: GS), Morgan Stanley (NYSE: MS), PayPal Holdings, Inc. (Nasdaq: PYPL), Mastercard Inc. (NYSE: MA), Visa Inc. (NYSE: V) and several others.

Fifth, blockchain technology has come a long way in the last few years. The last time around, it was still in its infancy, with a lot of false starts and even fake projects.

It was reminiscent of the early dot-com days when no one could figure out how to make real money with the internet.

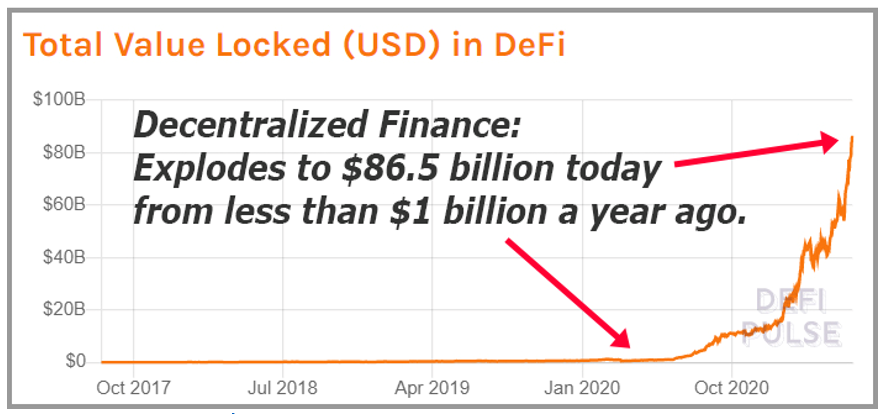

Now, blockchain has far broader and bigger practical applications, including decentralized finance (DeFi), which is creating a brand new financial system on the blockchain, and which has grown more than 86 times in just one year:

|

|

Data source: DeFi Pulse |

Sixth, it’s easier for individual investors to, well, invest. Last time around, it was very hard for individuals to get into crypto. Just opening a crypto exchange account was a royal pain in the butt.

Today, it’s far easier. And when crypto exchange-traded funds (ETFs) become available, you can expect another big flood of money into cryptocurrencies.

Which cryptos will ultimately be the biggest winners?

So far, we see a pattern that’s similar to the last bull market. Our highest-rated cryptos are among the few that are truly leading the pack. I highly suggest you head over to our sister site, Weiss Crypto Ratings, to view all the Weiss-rated cryptos for yourself.

Good luck and God bless!

Martin