Everything is Big in China – Including the Profit Potential!

I lived in Texas for eight wonderful years and as many of my friends there repeatedly told me, “EVERYTHING is big in Texas!”

It’s true: Texans do everything in a big way. But the same is true — maybe even more so — of China.

China is BIG in many ways — such as its 1.4 billion people and the third-largest geographical area in the world. But most Americans truly don’t understand how “big” China really is.

Get this: There are dozens of Chinese cities that most people have never heard of, yet they each hold millions of people and have an economic output comparable to entire nations elsewhere in the world.

|

Everybody has heard of Shanghai, Beijing, and Hong Kong. But have you heard of cities like Shijiazhuang, Wuxi, Changsha, Suzhou, Ningbo, Foshan, or Yantai? To see a list of 35 of them, the size of their local economy, and a comparably sized national economy, go to http://www.visualcapitalist.com/31-chinese-cities-economies-big-countries/

Big cities need big buildings — and China also has built some of the most amazing structures the world has ever seen. There are few signs of a slowdown, either. Just last year, China completed 77 of the world’s 144 new tallest buildings in 36 different Chinese cities.

|

These buildings aren’t just tall. They are amazing engineering feats. I’m talking about buildings like the CCTV headquarters and the Ring of Life building shown here.

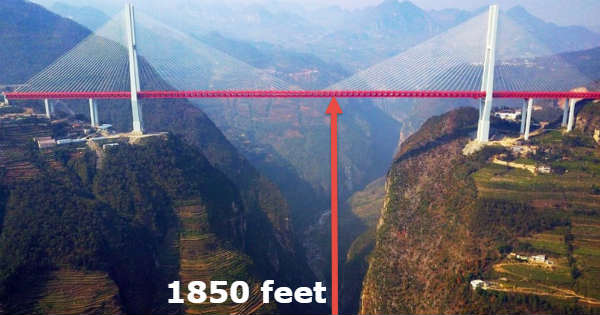

Yet the newest, biggest engineering marvel isn’t a building; it is a bridge. The Beipanjiang Bridge is the world's highest bridge, standing 1,854 feet over the Beipan River. That’s equivalent to a 200-story building and a true engineering marvel.

|

The Beipanjian Bridge isn’t the only jaw-dropping bridge in China, though. The Sidu River Bridge and the Puli Bridge are the second- and third-highest bridges in the world.

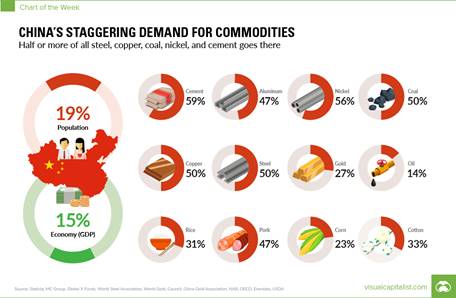

The impact of all that constructions on the Chinese economy and on commodities is significant. Just look at what percentage China consumes of the most important commodities in the world:

|

| Click here for larger image. |

- Cement — 59%: Cement is the most used building material in the world and is needed for roads, buildings, bridges, dam, foundations.

- Nickel — 57%: Nickel’s primary use is in making stainless steel.

- Steel — 50%: Steel is widely used everywhere, but it is especially important for construction, machinery, and automotive sectors.

- Copper — 50%: Copper is the cornerstone of anything electronic.

- Coal — 50%: Coal is China primary power source and generates 65% of China’s electricity.

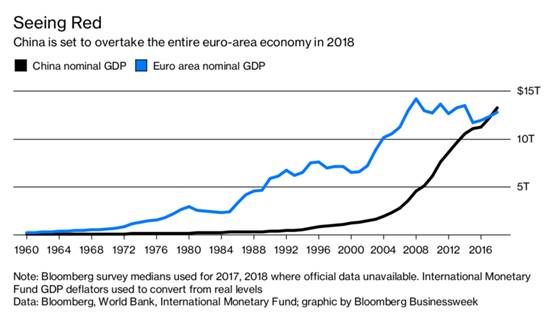

However, I think the most impressive “big” thing about China is its economy, which is now larger than all of Europe combined.

|

| Click here for larger image. |

According to Bloomberg, China’s gross domestic product will hit $13.2 trillion this year, easily surpassing the $12.8 trillion of the 19 combined Eurozone countries.

What all this means is that every investor — yes, that includes YOU — needs to have a significant dose of China in your portfolio. And I say that regardless of the recent flare up of trade tensions between us and them. The big-picture trends over there are just too “big” to ignore!

Unfortunately, almost all the investors I talk to have little to no exposure to China in their portfolio. And that’s a shame, because there are DOZENS of Chinese stocks listed on the NYSE and Nasdaq that you can easily trade in your own account.

|

Some of the BUY-rated names in the Weiss Ratings coverage universe include Alibaba Group (BABA, Rated “B”), Himax Technologies (HIMX, Rated “B-”), and New Oriental Education & Technology (EDU, Rated “B”).

Of course, the easiest way for most investors to get China exposure is with Exchange Traded Funds, or ETFs. But there are 46 China-focused ETFs to choose from, and not all of them get our top grades. So, here is a list of the Top 10 rated China-focused ETFs; it should get you pointed in the right direction!

Don’t forget my standard caveat: High ratings don’t mean you should rush out and buy all of these ETFs tomorrow morning. As always, timing is everything, so I recommend that you wait for my buy signal.

Do NOT make the mistake, however, of overlooking the tremendous profit opportunities of China.

Best wishes,

Tony Sagami