|

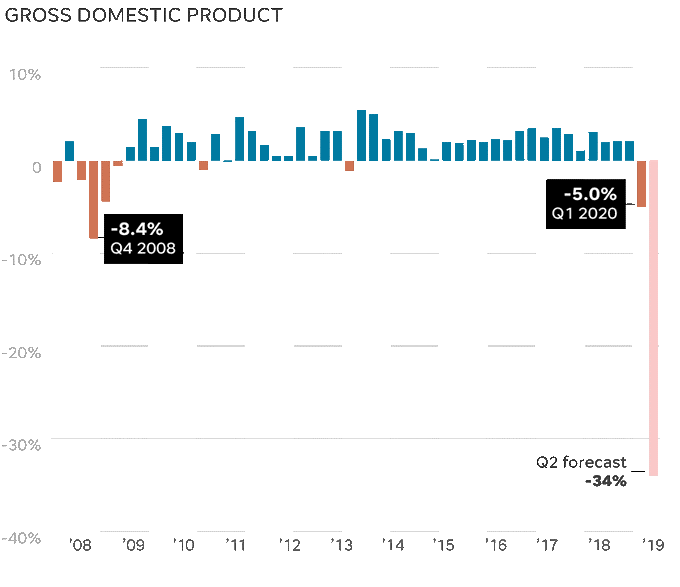

A “V”-shaped recovery? That’s what Wall Street keeps telling us is coming.

So how come governments around the world keep coming up with multi-trillion-currency stimulus plans?

Last week, the European Union approved an unprecedented stimulus plan equivalent to $2.1 trillion. Unprecedented how?

- The money is going to be raised by selling government bonds collectively rather than individually.

- Most of the money will be distributed to countries that have been hit the hardest by coronavirus.

- Most of the money raised will be given to member states not as loans but as grants ... meaning they do not need to be paid back.

- $630 billion was earmarked for climate change initiatives and nothing to do with fighting coronavirus.

This new spending spree is on top of the previous emergency packages that individual European countries launched earlier this year.

Here in the U.S., Congress is rushing to come up with a second emergency stimulus plan as the $600 weekly Federal unemployment checks and foreclosure/eviction moratoriums expire.

The details are yet to be determined, but it will likely cost upward of another TRILLION dollars. Remember, the CARE Act passed in March cost $2.3 trillion.

With our national debt at $26.5 trillion (and growing), we already owe 132% of GDP. As I said at the beginning, why are governments spending trillions they do NOT have if they believe the economy is ready to take off in a “V”-shaped fashion?

|

| Source: Pbs.twimg |

The truth is that a “V”-shaped recovery is not coming.

Here in the U.S., our government is spending money it has no chance of ever repaying, businesses are falling like dominoes, the unemployed are staying unemployed, we are on the brink of a new Cold War with China and large parts of the country are getting hammered by a second deadly wave of coronavirus infections.

What should investors be doing?

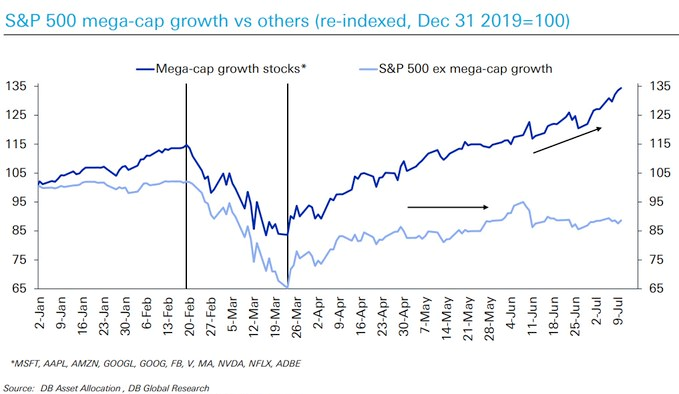

What I see are two completely different markets: one extremely healthy and one extremely sick.

The investments that are doing the best are the ones that are immune to an overload of debt: precious metals, cryptocurrencies, government bonds, utilities and companies that are flush with huge hordes of cash. Those companies are typically tech stocks, which is why the Nasdaq and cash-rich tech behemoths are doing so well.

For example, if you strip out the 10 largest mega-cap stocks out of the S&P 500, the stock market looks quite sickly.

|

The investments that are doing the worst are the ones that will get squashed by the burden of debt. For example, financial stocks (banks, insurance companies, credit cards), consumer discretionary, retail, and transportation stocks that have borrowed billions to buy planes and boats, will all be hit very hard.

The strategy is simple: Anything anti-debt looks strong, and industries that rely on debt look to be headed for an uphill battle.

The Weiss Ratings can help you pick out the strongest of the former, and avoid the weakest of the latter.

Best wishes,

Tony Sagami