Berkshire Hathaway (BRKA) is a stock for aspiring investors to covert. Not because Warren Buffett reports that on average he has added 19.2% to the per-share book value of Berkshire Hathaway over the past 51 years (he also freely admits that he has made “some dumb purchases”) but because the successes far outweigh the failures and Buffett continues to learn. He employs and partners with smart people and they help him make smarter decisions.

Weiss Ratings has analyzed Berkshire Hathaway’s holdings and can say that not all of the companies are recommended by us, with some “SELL” and others a “HOLD” but 47% have a “BUY” rating from Weiss. Of course we would not presume to suggest that our seal of approval is going to be high on Warren Buffett’s list of things to check but we believe that these “BUY” rated stocks have a lot going for them at the moment. Take a look at them, some you will have heard of, others maybe not.

With its diverse holdings Berkshire Hathaway could reasonably be considered to be a mutual fund pretending to be a stock. Although BRKA may be out of reach for most of us at over $205,000 per share we can still benefit from the vast expertise that has led to the company being considered as so desirable by buying the 1/1,500th priced BRKB stock. And you could do worse than to look at it in conjunction with your financial advisor. Of course the fees associated with a mutual fund would be missing and you would have to consider tax implications, but that is what advisors are for.

Weiss BUY Rated Berkshire Hathaway Holdings

Company |

Ticker Symbol | Weiss Stock Rating as of 03/04/2016 |

| Verisign, Inc. | VRSN | A |

| Mondelez International Inc | MDLZ | A- |

| Costco Wholesale Corporation | COST | B+ |

| Mastercard Inc | MA | B+ |

| Visa Inc | V | B+ |

| AT&T Inc. | T | B |

| Johnson & Johnson | JNJ | B |

| Moody's Corporation | MCO | B |

| Phillips 66 | PSX | B |

| Torchmark Corporation | TMK | B |

| United Parcel Service, Inc. | UPS | B |

| Verisk Analytics, Inc. | VRSK | B |

| Bank of New York Mellon Corp | BK | B- |

| General Motors Company | GM | B- |

| M&T Bank Corporation | MTB | B- |

| Procter & Gamble Co | PG | B- |

| The Coca-Cola Co | KO | B- |

| U.S. Bancorp | USB | B- |

| Verizon Communications Inc. | VZ | B- |

| WABCO Holdings Inc. | WBC | B- |

| Wells Fargo & Co | WFC | B- |

ETFs

According to Weiss Ratings, the top 10 ETF performers for 2016 have shown some positive year-to-date returns, but only one of them is a “BUY”, one - a “HOLD” and the other eight are a “SELL”. Almost all of them showed negative one-year and three-year results.

ProShares UltraShort Bloomberg Natural Gas (KOLD) was the only “BUY” on the list with some of the highest returns. Click here to see all Weiss rated ETFs.

Mutual Funds

Fees – most mutual funds have them but some investors may overlook them while trying to find a fund with the highest return.

Whether you’re an individual investor or have a 401k plan with your employer, you should consider expense ratio as one of the criteria for your mutual fund selection. The smallest difference in expense ratio may have a considerable impact on your nest egg in the long run.

Based on Weiss Investment Ratings, there are over 200 mutual funds in the “BUY” universe (rated A or B) with an expense ratio of 0.25 percent or less. To compare funds side by side, simply select any mutual fund and use the comparison tool to analyze them.

Banks

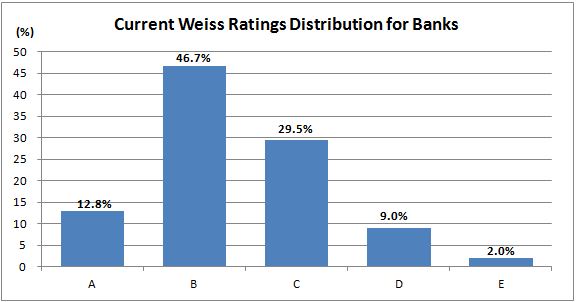

Weiss Ratings upgraded the safety ratings of 658 banks and downgraded 332 based on its analysis of fourth quarter 2015 results. Weiss, the nation’s leading independent provider of bank, credit union and insurance company ratings, analyzed over 6,100 banks.

Weiss Ratings recommends that consumers do business with institutions rated B+ or better. Currently, 1,541 banks, or 25.2 percent, are rated B+ or better, meriting inclusion on the Weiss Recommended List.

Credit Unions

Unlike many banks, credit unions have a defined field of membership, meaning that only certain groups of people may join certain credit unions. Some offer membership to people who live or work in specific cities or counties, others determine eligibility by employer, and some are based on the place of worship or education.

Although with certain limitations, the U.S. credit union industry saw a year-over-year increase in its membership in Q3, 2015 by 4.2 million or 4.3 percent. It has grown by 1.4 million or 1.3 percent since the prior quarter.

Weiss Ratings provides you with safety ratings on over 6,100 credit unions. By using our credit union screener you can select your state, type in your city and can even narrow down your search by Weiss rating. Once you’ve found a credit union in your area, be sure to contact them to confirm your eligibility. Credit union contact info is located on the summary tab under “Corporate Info”.

Insurance

On March 2, 2016, The House Financial Services Committee approved a proposal that intends to enable private insurers to sell flood coverage to homeowners with federally backed mortgages (FHA or VA loans) offering an alternative to the lender preferred National Flood Insurance Program (NFIP).

Supporters of the proposal believe that it will create more competition in the flood insurance market providing consumers with access to additional options and pricing. This might be good news for you, as you may have more, and possibly cheaper, future flood insurance options.

Visit Weiss Ratings to view safety ratings on over 2,700 property and casualty insurers. You may find out if an insurer is planning to offer flood coverage by contacting the company.

Add any insurer to your Watchlist and receive an alert whenever a rating changes.

Failures

Institution Name |

Industry |

State |

Total Assets in Millions |

| Greater Abyssinia FCU | Credit Union | OH | 0.4 |