Florida Insurers in Much Better Shape This Hurricane Season

The eye of the hurricane – a period of calmness and false sense of security. Is this what Florida homeowner’s insurers are currently enjoying?

The chaos began with the 2004 hurricane season, and did not let up for two years. A number of major hurricanes made landfall on the U.S. coast, Florida specifically. Because of large losses, property and casualty insurers began to withdraw from the Florida market.

Citizens Property Insurance Corporation stepped in to provide coverage, with the backing of the state of Florida and the taxpayers.

But now, with all the turmoil in the past, Citizens is trying to reduce its own market exposure and to boost the private mortgage insurance market by handing out policies to other insurers. These companies are known as the “Takeout insurers” and they increase their books by assuming Citizens policies.

After a number of years without a major hurricane, Florida based homeowner’s insurance companies increased in numbers, and are claiming they can withstand a major storm. But how safe are these private insurers? And do they have enough cash on hand to pay up if a natural disaster hits?

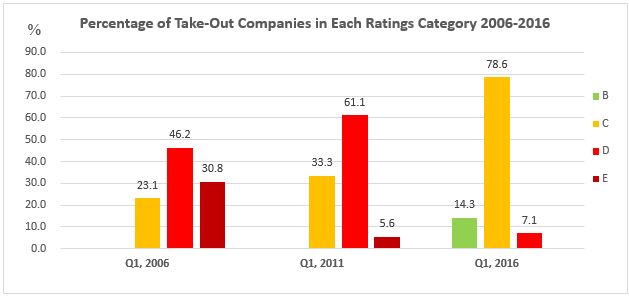

Our analysis of thousands of property and casualty insurers indicates the companies on the Citizens’ take-out list have significantly improved their Weiss Safety Ratings over the last 10 years.

Weiss Ratings Scale: A=Excellent, B=Good, C=Fair, D=Weak, E=Very Weak

Ten years ago, in Q1, 2006, the picture looked way different for the same group of insurers than it does now. Only 23.1 percent of them had a Weiss Safety Rating of C, 46.2 percent held a D rating, and 30.8 percent were E’s. There were no A’s or B’s.

The ratings breakdown looked a bit different five years later in Q1, 2011. At that point, 33.3 percent were C rated, 61.1 percent of insurers had a D rating, and 5.6 percent were rated E. There were no A or B rated companies from the take-out list during that period.

First quarter 2016 ratings indicate the most improved ratings with 78.6 percent of take-out companies falling within the C rating, 14.3 percent within B and 7.1 percent within D. No A’s or E’s in this quarter.

Currently there are 28 property and casualty insurers on the take-out list.

So our ratings do show increasing strength in the take-out companies. But the real test will be when Florida is hit again by a major storm or series of storms.

And if the dire climate change predictions are true, what will happen to properties in low lying areas? Who will insure them?

Click here to see Weiss ratings of all Florida based companies that write homeowners insurance. If you live outside of Florida and want to know which companies write homeowners insurance in your state, you have a dropdown box in this screener from which you can choose a different domicile state.