Four Strategies for Investing During Near-Zero Rates

|

Today I’m writing to you from an airplane.

It feels as surreal to type those words as it is to look around and see that we’re getting back to some semblance of normalcy.

But when it comes to interest rates, normalcy is missing in action. We’re about as far from normal as we’ve ever been!

Think about this:

• Checking accounts mostly pay 0%.

• Bank savings accounts pay a couple of basis points, if that.

• One-year CDs pay an average of around 0.17%.

• Ten-year Treasurys? Just over 1.3%.

• Even high-risk “junk” bonds are sporting yields of only 4%.

But again, those are NOMINAL yields. As in, not inflation-adjusted. Those are even more depressing.

Factor in the 5.4% Consumer Price Index (CPI) reading for July, and you see REAL yields are solidly in negative territory.

• That means when you stash money in most bank accounts, bonds or bond funds, you actually LOSE purchasing power week by week.

It’s not just the LEVEL of yields that’s so astonishing, especially relative to inflation. It’s the attitude and approach of policymakers.

You’d think they might try to adjust their course …

That they’d recognize and appreciate the negative side effects of flooding the economy and the markets with so much funny money …

And that they’d start “normalizing” things considering how far we’ve come from the depths of last year’s pandemic-driven, albeit short-lived, market collapse.

• Yet, nothing is changing.

NOTHING.

Federal Reserve Chair Jay Powell all but confirmed that in his recent speech at the Jackson Hole Economic Symposium.

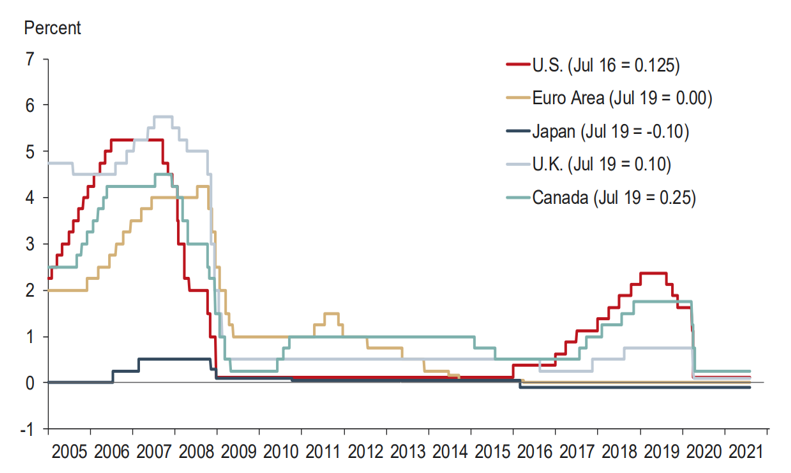

Of course, it’s not just the U.S. mired in low/zero/negative interest rates (LIRP/ZIRP/NIRP). The entire developed market world is in the same boat:

|

| Source: Dallas Fed |

It’s entirely possible that some central banks will try to keep rates pegged here even LONGER than they did after the Great Recession, too. Only time will tell.

• That brings me back to the reason I’m on this flight.

I’m going to be sharing the details of my four primary strategies for generating more income and sustainable gains in this rock bottom-rate environment with attendees at the MoneyShow Las Vegas. It runs from Sept. 12-14 and I hope to see you there. (Registration is available here.)

But in case you can’t make it in person … or if you’re thinking about signing up to attend virtually … I will give you a sneak peek of the basics behind this game plan:

Strategy 1: Focus on higher-income, higher-rated stocks and exchange-traded funds (ETFs) that help you beat inflation and generate SUSTAINABLE gains for your core portfolio ...

Strategy 2: Target companies that will get a share of the cheap, easy money D.C. keeps doling out (Examples: infrastructure, materials, construction, cyclicals) ...

Strategy 3: Boost your allocation to precious metals and mining shares amid dollar debasement, “Money Flood” policymaking ...

Strategy 4: Use tactics like SELLING (rather than buying) options for greater income and higher odds of success.

If you at least put these four strategies to work in your portfolio, I’m confident you’ll have a much better chance of success — low rates be darned.

Best of all, these strategies work even when yields and interest rates eventually take flight. So, start putting them to work now!

Until next time,

Mike Larson