|

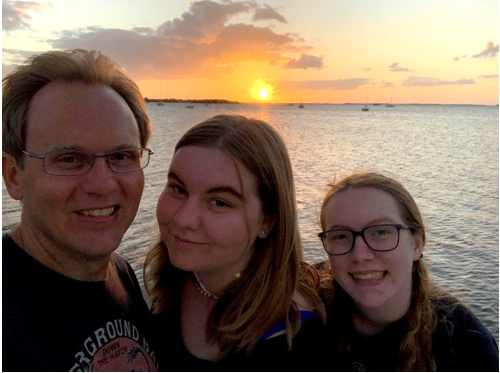

It’s hard for this father to believe. But, next week, my older daughter Maya will graduate from high school. Then, a few months later, she’ll head off to Washington D.C. for college.

If you’re a parent or grandparent, you know these milestone moments come with a mix of emotions. Pride ... hope ... excitement ... overriding love.

There’s also a tinge of sadness, because your first-born is leaving home to make her mark on the world.

Naturally, I’ve been reflecting on what I’ve tried to teach my kids over the years.

|

And, of course, for a guy who does what I do, many of those lessons have focused on investing, saving, borrowing and spending money wisely.

If you look at what’s going on in the city Maya will soon call home, you have to wonder if those lessons have been forgotten — or simply ignored — by just about everyone.

No one is talking about fiscal or monetary discipline down by the Potomac.

Instead, we’re in the midst of the biggest borrowing, spending and printing boom in history. And it’s created an unprecedented — and volatile — “Prosper Now, Pay Later” market environment.

It’s also creating fresh challenges for investors and everyday Americans — challenges like staying ahead of inflation.

In case you missed the figures from a few days ago ...

- The Consumer Price Index (CPI) surged 0.8% last month, four times the 0.2% gain forecast by economists.

- The “core” CPI that strips out food and energy jumped 0.9%. Not only was that triple the 0.3% rise expected, it was also the biggest monthly gain going all the way back to 1981.

- The year-over-year data wasn’t any better. Headline inflation rose 4.2%, the biggest annual gain since 2008. Core CPI jumped 3%, the largest rise in 26 years.

This, like last year’s, has to rank among the most fraught graduation seasons in living memory.

Indeed, though it seems we’re on the downside when it comes to the pandemic, there’s just enough agita out there — at large, in markets — that I’m reminded of core investing lessons I’ve shared with my own family. Perhaps you’ll take them to heart as well.

First, use “safe money” strategies that generate consistent income and solid gains. (Here’s a bit more information on these strategies.) It’s never been more important to focus on yield, safety and resiliency, especially with inflation accelerating.

Second, maintain a sizable allocation to gold, silver, cryptocurrency and/or mining shares. This is about protection against monetary debasement, which all of Washington seems bent on pursuing.

Third, keep a reserve of cash to take advantage of selloffs and new opportunities amid rising volatility.

Fourth, avoid reckless speculation in junky, overhyped stocks. They’re more and more treacherous because momentum is clearly waning in those kinds of names.

Finally, permit me a hearty “Congratulations!” to Maya and the members of the Class of 2021. I can’t wait to see what you accomplish over the next chapters in your lives.

Until next time,

Mike Larson

P.S. I’m excited to share some great news: Next month, I’m participating in the MoneyShow Orlando!

The conference is scheduled to run from June 10 through June 12 at the Omni Orlando Resort at ChampionsGate. You can catch my presentation “Prosper Now, Pay Later: Windfall Strategies for a World Gone Mad” on Friday, June 11, from 2:30 p.m. to 3:15 p.m. EDT.

For more details, including a complete list of speakers, full agenda and a registration form, just click here. I look forward to seeing you there!