As Government Piles on Debt, Servicing Costs Will Soar! What to Do ...

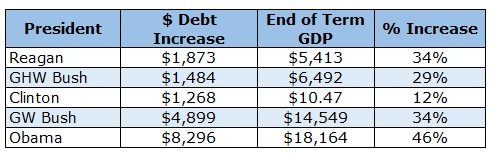

"President Obama has 'the worst record of any president when it comes to putting America deeper in debt.'" — Reince Priebus, chairman of the Republican National Committee, December 2014

|

Prior to 2016, one of the most enthusiastic talking points of the Republican Party was the deficit and the national debt. Nowadays, however, you seldom hear about our mountain of debt from either major political party.

I haven't voted for a Democrat since 1980 (at the time I was a liberal 24-year-old). But I was very disappointed in how much our national debt ballooned under President G.W. Bush, and I am just as disappointed that it has hit $21 trillion under President Trump.

Doesn't matter to me whether the President is a Democrat or Republican; I am intensely against silly spending and dangerous debt accumulation. Sadly, our national debt is growing at an alarming pace.

|

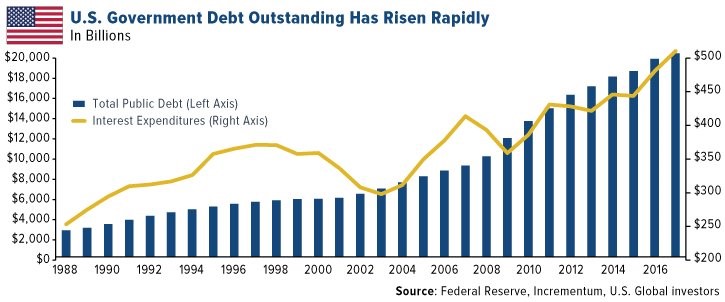

These days, politicians throw about the word "trillion" like it is no big deal. Get this: It took 193 years for our country to accumulate its first trillion dollars of federal debt. But we are going to add another trillion to our national debt in just this current fiscal year alone.

All told, the government owes $21.5 trillion, give or take a few couple tens of billions of dollars — which works out to $65,885 for each American.

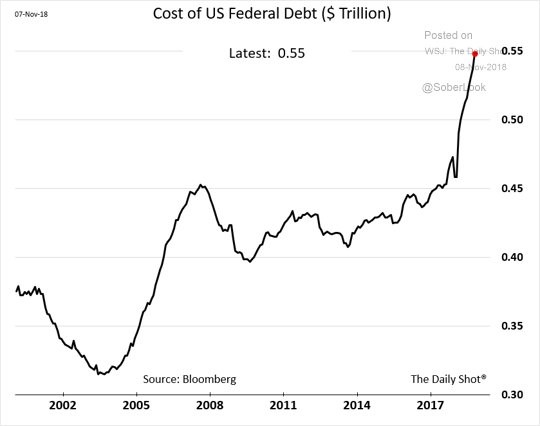

Here's the problem: The cost of servicing that mountain of debt is getting higher now that the Federal Reserve is on a rate-hiking warpath. The interest rate on 10-year Treasury notes is 3.2%,up from 2.9% at the end of August and from 2.4% one year ago. The interest rate on 1-year Treasury bills is now 2.7%, up from just 0.8% in January 2017. The yield on 30-year Treasury bonds is now 3.4%, up from 2.9% one year ago.

In fact, the fastest growing item in the budget is interest payments, which were up 19% in the last 12 months.

|

We are currently spending $1.43 billion each and every day to service that $21 trillion national debt.

What will happen to the cost of servicing that debt when Fed Chairman Jerome Powell "normalizes" interest rates to an even higher level?

Well, according to the Congressional Budget Office, we will spend $318 billion in 2018 for that. However, the CBO calculates that cost will triple in size to nearly $1 trillion by 2028 based on the assumption that interest rates rise to 3.7% and 2.8% for 10-year bonds and 90-day T-bills, respectively.

It won't be long before interest payments become the third-biggest item on the budget after Social Security and Medicare, surpassing even military spending. And if interest rates rise faster than the CBO expects, the picture would be worse.

|

Historically, the cost of servicing the national debt has been about 3% to 4% above the Fed Funds rate. So, when the Fed Funds rate hits 3%, debt service will hit $1 trillion.

What's this mean for investors?

- First, you need to get your head examined if you own long-term government bonds. If you own bond funds or bond ETFs that have an average maturity of 10 year or longer ... SELL THEM!

- Second, stick to stocks that have low debt-to-equity ratios. The less debt, the better when interest rates are rising. You can and should use our Weiss Ratings to screen for top-rated companies with strong balance sheets and low debt.

- Lastly, hold a bunch of cash. On Aug. 22, I boosted the cash position of my retirement account to roughly 36%. In retrospect, that was a month early and not enough. But I got to tell you, sitting on a 36% cash position in the last month has been very comforting -- not because cash doesn't go down in value with inflation, but because I have purchasing power to buy into what is now a much cheaper stock market.

I don't know when the stock market will bottom, but I am of the mind that bear markets are born out of recessions. And since our economy is getting stronger, not weaker, the right move is to treat this decline as a correction and not the start of a bear market.

Best wishes,

Tony